[ad_1]

Santiment, a platform that focuses primarily on sharing cryptocurrency information, accessing data and learning about cryptographic markets for smarter investments, recently partnered with Cyber • Drop.

The partnership aims to create customized metrics related to the mining sector functional to the Ethereum network. To start the development phase of the project, an accurate and complete overview of the ETH mining ecosystem was required.

The analysis of the many complexities of the mining pools of Ethereum was carried out by the developers of • cyber drop. They also searched for mining transactions, distribution of prizes and other closely related topics.

The results are important as they will work as a basis for the next mining metrics on Santiment. Here are some of the most crucial insights.

Analysis of mining pools of etereum

The period of time focused on the analysis began with the launch of the ETH network which rose to the block of 6,781,512 which was created on 27 November 2018.

Mining pools received a cumulative lifetime total of ETH 0,4 million in transaction fees and ETH 31 million in premiums during that period. A total of 4,700 addresses received a mineral reward in the entire life-long ethereal life focused.

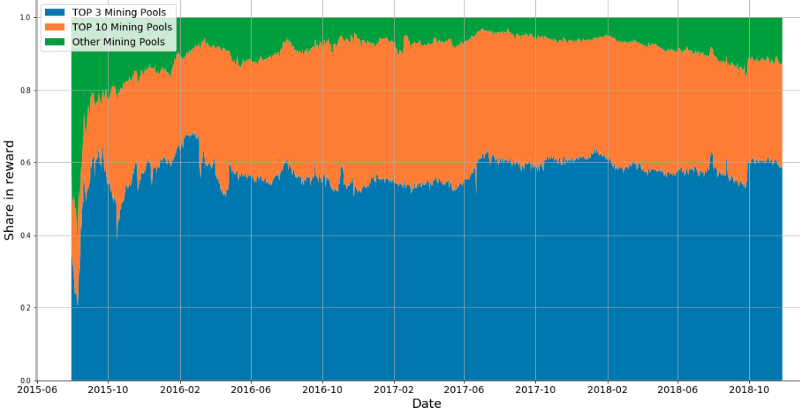

However, not all mineral pools are evenly developed. The reward inequality exists with the 3 best pools that collect over 50% of all available mining prizes.

Some pools remain largely unchanged for the equal months after settling early in the launch of the network. It is interesting to note that mining premiums are the main sources of inflow for balances of mineral scales.

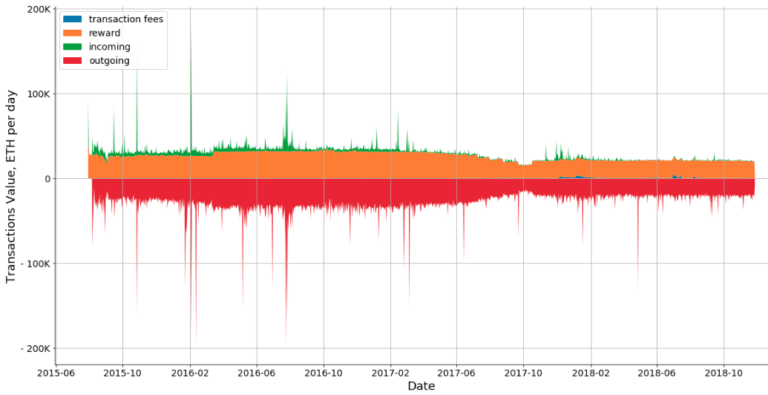

However, non-remunerative transactions in these pools are also a ceiling of around 4 M ETHs on the entire network. Most of the incoming transactions reflect the outflows with the cumulative pool balance that has recently suffered a steady decline just like the ETH market capitalization.

The total balance of all mining pools decreased from the 1M ETH peaks at the start of 2016 to only 0.2 M ETH at the time. However, most of these pools control a considerable amount of funds in their hot and cold portfolios.

Data mining pools can also be divided into two unique groups based on the average value of their outgoing transactions.

Those with less than 10 ETHs represent 82% of lifetime mining premiums and a total of 91% in the last year. Pools with more than 100ETH represent 11% of all lifetime mining premiums and only 8% in the last year. The recent cyber • Drop focuses on the group with less than 10ETH.

Analysis of miners etereum

The volume of miners' transactions remains significantly stable over a long period with an average tx volume between 15K and 20K ETH / day.

On the other hand, outgoing transactions have strong anomalous values. The maximum output output volume was recorded as 125K ETH on July 19, 2016. Mineral balances are steadily increasing contrary to the balances of mining pools.

Their 1M ETH balance amounts to around 5% of all life's mining premiums. Hodls represent only 2% of all mining premiums, but claim up to 40% of their total balance.

The DAO's attack of 20 July 2016 had a considerable impact on the overall budget of the Minereum miners.

The 2017 Bull Run has organized a "balance rally" that has lasted until today despite the recent downward correction.

The new Ethereum mining metrics will be incorporated into Santiment's platform based on many results from previous research conducted by Cyber • Drop.

It is expected that the new mining metrics of Ethereum will become part of the "ETH Gas Used" dashboard launched by Santiment.

Follow us on Facebook , chirping is Telegram

[ad_2]

Source link