[ad_1]

Boeing (BA) and Airbus (OTCPK: EADSF) (OTCPK: EADSY) are seeing a recovery of the outlook for the commercial aircraft sector, which also affects order inflows where the focus has shifted from finding who can book the most orders in a year to containing the order book. At the onset of the pandemic, our monthly coverage for order inflows and deliveries showed us that, while deliveries stopped, jet manufacturers were still experiencing higher order inflows, mainly driven by a good start to the business. year for Airbus, but we expected that, along the way, we would see a decrease in advantage as airlines and lessors slowed new orders and canceled orders, aligning with an extended market recovery requiring fewer aircraft in the near future.

Source: PR Daily

In this report, we will take a look at orders and deliveries, as well as cancellation activity for Boeing during the month of October. Although the report appears to be a simple summary piece, it took me a significant amount of time to get all the data right and present it in a useful way, including charts, and we uniquely provide market value estimates contrary to list prices. . Subscribers of The Aerospace Forum have access to a fully interactive infographic built on Airbus and Boeing order and delivery data, but presented in an interactive and more useful way. If you’re interested in reading Boeing’s monthly overview for September, you can check it out here.

Boeing October Commercial Airplane Orders

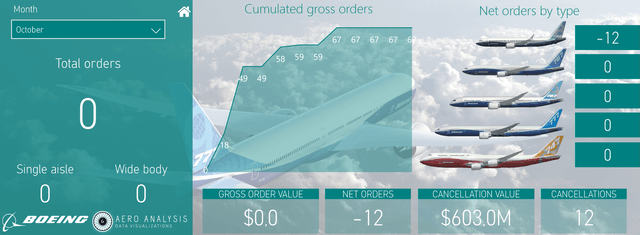

Figure 1: Boeing orders October 2020 (Source: The Aerospace Forum)

Just like in September, Boeing did not book orders in October. It should come as no surprise that no orders were guaranteed given the current state of the industry.

The changes to the order book in October were as follows:

- An order for two Boeing 787-9s has been transferred from Boeing Capital Corporation to the unidentified customer category.

- China Development Bank Financial Leasing has canceled orders for four Boeing 737 MAXs.

- Oman Air has canceled orders for three Boeing 737 MAXs.

- Smartwings has canceled orders for a Boeing 737 MAX.

- An unidentified customer canceled orders for four Boeing 737 MAXs.

- China Cargo Airlines was revealed as the customer of two Boeing 777Fs.

As expected, orders remain absent as there is currently no clear path forward as the recovery in demand profile remains highly uncertain and the Boeing 737 MAX continues to see orders eliminated. What we have observed is that cancellations for the Boeing 737 MAX have increased to 12 units but cancellations are modest at this point and many cancellations had already been planned. We can’t say that this marks the end of big backlog reductions for Boeing, as we’ll likely see customers face a renewed look at growth in the future, but the relatively low cancellation numbers are a positive low, in my opinion.

However, we are seeing continued pressure, and overall, it’s a net negative as Boeing hasn’t booked orders but had to scrape $ 603 million off the order book which means net orders are slipping further.

Year-over-year, the inflow of gross orders shrank by 10 units and, on a net basis, the inflow of orders during the month was -12 units compared to -11 units in October 2019. So actually we are not seeing a huge difference between this year and last year for the month of October. Part of the explanation is that Boeing was already facing the 737 MAX crisis around this time last year, so its order inflow had already been significantly reduced.

In any case, all cancellations, even if small, begin to add up. For the first 10 months of the year, our cancellation monitor shows 460 cancellations compared to 135 cancellations in the same period a year ago.

The result is also visible by looking at the long-term averages. The three and five-year averages for October are 54 and 49 sales, respectively, so Boeing’s order inflow was far below the moving averages. Also comparing the numbers from the beginning of the year to those of last year, we observed a decrease of 116 units in gross orders and 441 units in net orders.

ASC 606 mutations, which generally prelude to contractual cancellation, have increased by 25, all for the Boeing 737. When all ASC 606 mutations for the year turn into contractual terminations, Boeing’s net order count stands at – 1,020 units.

Boeing commercial aircraft deliveries October

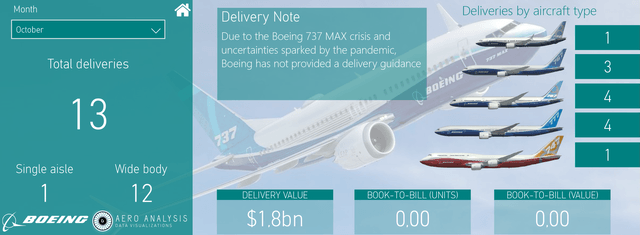

Figure 2: Boeing deliveries October 2020 (Source: The Aerospace Forum)

For 2020, Boeing has not provided any detailed guidance, nor do we expect the company to provide any guidance.

In October, Boeing delivered 13 aircraft, an increase of two units from last month:

- Boeing has delivered a Boeing P-8 Poseidon, a military aircraft based on the Boeing 737.

- Boeing has delivered a Boeing 767-300F and 2 Boeing 767-2C aircraft used as base aircraft for the Boeing KC-46A tanker.

- Boeing has delivered four Boeing 787s; one -8, one -9 and 2-10.

- Boeing delivered 3 Boeing 777Fs and one Boeing 777-300ER.

- Boeing has delivered a Boeing 747-8F.

What we are seeing is the delivery profile of a company that is currently facing incredibly great pressure from predominantly COVID-19 and the Boeing 737 MAX crisis. We are seeing that, even with assembly lines in operation, the delivery flow does not reflect that customers are currently lining up to accept delivery of new aircraft. This should come as no surprise, since there are limited routes that airlines can currently deploy their existing aircraft on. So accepting new planes at this stage doesn’t make much sense. Obviously what strikes Boeing is that for the moment it depends on deliveries of wide-body aircraft and the demand for these aircraft is extremely low at the moment.

Book-invoice relationship

For 2020, there are likely no order targets for Boeing as the Boeing 737 MAX remains on the ground, perhaps until the end of 2020, and due to the COVID-19 impact. Boeing recorded no orders during the month compared to 13 deliveries, resulting in a book-to-bill ratio of zero in terms of units and obviously zero in terms of value. We are currently in a phase where delivery volumes are low, so book-to-bill ratios, even when they are greater than one, are not a true reflection of performance. Furthermore, the industry practice of measuring in terms of gross ratios between books and invoices is also insufficient as the gross figures do not capture the impact of cancellations. For the first eight months of 2020, Boeing booked negative orders (more cancellations than order influx), which means the net book-to-bill would also be negative, not a strong sign.

Conclusion

Currently, the influx of orders is not that attractive as we are more interested in determining the shape and pace of recovery. So what matters most are the delivery numbers. Delivery numbers showed a slight increase of two units, but with 13 aircraft delivered during the month things are still not great for Boeing and this truly reflects the company’s current reliance on wide-body aircraft deliveries.

Regarding cancellations, we have seen a slight increase in cancellation activity and I expect cancellations will continue over the next 1-2 years for Boeing. The least important at this stage for me are the orders, we expect them to continue to be low, but interestingly, although the aircraft need to be remarketing, Boeing is not booking any orders at the moment to sell those jets. Perhaps when there is more clarity on the Boeing 737 MAX timeline and overall recovery of the demand profile, we will see an increase in activity there.

* Join the Aerospace Forum today and get a 35% discount *

The Aerospace Forum is the most subscribed service focused on investments in the aerospace sphere, but we also share our holdings and activities outside the aerospace sector. As a member, you will receive high-level analytics to gain a better understanding of the industry and make more rewarding investment decisions.

The Aerospace Forum is the most subscribed service focused on investments in the aerospace sphere, but we also share our holdings and activities outside the aerospace sector. As a member, you will receive high-level analytics to gain a better understanding of the industry and make more rewarding investment decisions.

Disclosure: They are / we are long BA, EADSF. I wrote this article myself and express my views. I don’t get any compensation for this (other than Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

[ad_2]

Source link