[ad_1]

Original title: After the battle for the home robbery, the “egg shell” broke. . .

Recently, on the platform of long-term rental apartmentsEggshell ApartmentsThe news continues.The chain of capital is broken,I love my homeRumors like the acquisitions pushed Eggshell’s share price upPiombinoAlthough Eggshell has released a statement that he will not run away, many landlords and tenants still have a hard time keeping quiet. At present, the conflict between owners, tenants, financial institutions and eggshells continues.

Long-term rental apartment “eggshell” capital chain turmoil attracts attention

Eggshell ApartmentsTenant:The owner posted a notice on the door saying we should move in within a time limit.serviceThey are all finished and our commissions are still paid.

It is not only the tenant who is anxious, but also the landlord of the eggshell.Eggshell is supposed to pay their rent quarterly, but recently many landlords haven’t received the money。

Eggshell Apartmentsowner:I didn’t pay my rent last month, so I went to them and couldn’t find anyone on every call. Either I couldn’t get through, or everyone who talked on the phone stopped talking.

However,Eggshell flatworksThe staff said,the companyStill running。

Eggshell Apartment Staff:Our company is not like some companies, low-rent high-income companies run away, the company is still actively responding.

The black cat complaint platform shows,There have been more than 30,000 complaints related to Eggshell Apartments. The complaints mainly concerned “eggshell apartment arrears with deposit and non-refundable”, “normally withdrawing the rent, the deposit cannot be withdrawn from the account for a long time”, etc.However,What bothers some tenants even more is that even if they lose the deposit and rent they have already paid, they still have to continue paying the “rental loan” every month in the future, otherwise it could affect.Credit。

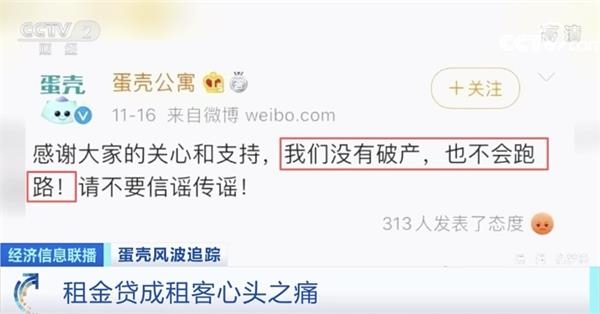

November 16Eggshell flat passSinaBo’s Official Rumor: Eggshell Apartment hasn’t failed, nor has it run awayOn the other hand, Weizhong, which has a rental loan cooperation with Eggshell Apartmentsbankmake a statement,At least before March 31, 2021, those who applied for a consumer loan for the rental of the housecustomerCredit reporting won’t be affected.And after that, where tenants should go, WeizhongbankNo further explanations were provided.

Eggshell apartments are just a microcosm of the long-term rental apartment industry. Since September this year, Aizu Apartment, Mercure Apartment, Kitty Apartment in Shenzhen,LejuThe apartment and five other rental apartment parent companies have complained about “lack of space to live in,” and some of them have stopped working and are included in the abnormal operations list.

Illegal and leveraged “rental loans” were breaking the standard

The house is no longer rented, but people are still repaying the “rental loan” loan.Rental loan means that while the tenant signs a lease with a long-term rental apartment platform, he signs a loan agreement with a financial institution that works with the platform. The financial institution pays the rent for the whole year and the tenant pays the financial institution monthly Pay the rent and the mortgage With long-term rental apartmentsCrisis eventThe “rental loan” business model has also been tortured.

the end of last year,Six departments, including the Ministry of Housing and Urban-Rural Development, have issued documents to rectify rental housingmarket, Clear real estate leaseenterpriseIn rental income, the amount of “rental loans” cannot exceed 30%.According to the Eggshell Apartments prospectus, in the first three quarters of 2019, Eggshell Apartments received pre-paymentIt is 790 million yuan, and the advance payment by financial institutions is up to 3.16 billion yuan, and the leverage ratio exceeds 80%.Significantly exceeded the 30% ratio requirement. This rent-collecting method has amassed a large amount of rainfall funds for eggshells to increase the number of homes and capture the size of the market.

Beijing YuechenglawyerLawyer Yue Dishan of the firm:The use of third party rental loans and leveraged models such as eggshells presents many uncertainties and extremely high risks. The main reason for the “explosion” of long-term rental apartments may be due to this reason: once the capital chain breaks down, the owner’s rent cannot be paid and there may also be problems with normal functioning. of the company.

Since its founding in 2015, Eggshell has grown from more than 2,000 rooms to more than 400,000 rooms. Under massive expansion, it increases year on year.LostThe financial report shows that from 2017 to 2019, the loss of egg shells increased from over 270 million yuan to 3.435 billion yuan. In the first quarter of this year, the company lost another 1.23 billion yuan, setting a record loss for just one quarter.

ExcludingcostThe home theft war has also paved the way for future crises.According to industry experts, the cost of renting long-term apartmentsRepayment periodLonger. The ideal rent level is usually around 90% -95%. When homes are vacant for a long time, the pressure on the company’s revenues will increase. Data visualization,In February of this year, the Chinese New Year was superimposed by the epidemic and the vacancy rate of the eggshell apartments reached 20%.Based on the average rent of about 2200 yuan per eggshell house, 20% are vacantRate itIt means a rent loss of around 200 million yuan per month. In the list of “killed” long-term rental apartments, many companies have vacancy rates of even more than 50%.

Yang Xianling, dean of the Blank Research Institute:Long-term rental apartments are a low-margin industry for people’s livelihoods, which is unlikelyProfitIndustry, it is unlikely to have a largeprofitThere is room for growth, so it has to work constantly and improve efficiency little by little.

Where is the long-term rental apartment?

In order to prevent risks, measures are now being introduced in many places to strengthen oversight of housing leasing companies, requiring housing leasing companies not to adopt the “high-in-low-out” and “high-in-low-out” business methods. long-term income and short-term payment “. This fast-paced, quick-profit approach harms the health of the industry. Development has sounded the alarm for the entire industry.

According to incomplete statistics on public information,Invest inNearly 70% of long-term rental apartment companies with broken gold chains, business disputes or bankruptcies are based on the business model of “high income and low production” and “long income and short payments”.

Long-term rental apartments, which originally had a long cost recovery period, have worsened their losses under the epidemic this year. On the one hand, the number of vacancies in long-term rental apartments has increased, on the other hand rents have generally fallen in many cities across the country.

China’s fluctuating population accounts for nearly 20%, and long-term rental apartments meet the high demand for white-collar workers in many cities.qualityThe demand for housing, the development and profitability of the concept a few years before the birth proved that the demand exists How the industry drives rentersloanLoan, use the rental time difference to doubleinvestment, It inevitably increases the company’s risk.

Zhang Cuixia, Chief Investment Adviser of Jufeng Investment:In fact, the real profit model for long-term rental apartments is not to engage in rent spreads or lease loans, but in real asset upgrades and service premiums. Long-term apartment rental is an emerging sector, coupled with the backdrop of the overlapping epidemic in 2020, which has led to weak rental demand.Business managementIn other words, we must learn to turn crisis into opportunity.

(Source: CCTV Finance)

(Responsible publisher: DF524)

Solemnly declares: The purpose of this information released by Oriental Fortune.com is to disseminate more information and has nothing to do with this booth.

.

[ad_2]

Source link