[ad_1]

Credit Loan Regulation … Banknote “Hitting Homeless Home Purchases”

“Athletes” who seem to be crowded before the regulation on 30

(Seoul = Yonhap News) Banking Team = When a household loan management plan came out that “tweezers” high-income loans of high-income people, the bank note estimated that the way to buy a house was stuck with “‘young drag’ (which means to attract the soul as well)”.

Since the 30th of this month, if a high-income worker with an annual salary of 80 million won or more receives more than 100 million won in credit loans, the regulation of the total debt principal and the interest repayment ratio ( DSR) is applied on an individual basis and if a loan exceeds 100 million won and you buy a home in a regulated area within one year, the loan.The key to this plan is to get back the product within two weeks.

In particular, in the banking sector, common concerns have been raised that “it has become more difficult for homeless people to buy homes”.

After the financial authorities have decided to strengthen the standards for the “high DSR lending ratio” per bank and to check whether commercial banks meet the credit lending targets, the credit limit will apply to all borrowers as well as to those earning a high income. It is noted that it can be reduced to.

[연합뉴스 자료사진]

◇ Banknote “It becomes more difficult to buy a house with a young couple ‘Young Klo’ …

On the 15th, the banking sector showed a common reaction to the government’s announcement on the 13th on handling loans to households, saying: “It has become impossible to buy a house through credit loans.”

After receiving a loan of over 100 million won as of 30, if you bought a house in a regulated area like Seoul (speculation area, overheated speculation area, adjustment area) within one year, you will have to pay the loan within 2 weeks. Failure to repay the loan will result in arrears and may be registered as a default. However, the collection target is the amount of the new loan received after 30 days.

A banking official said: “There are estimates that a 40% DSR for those with an annual salary of 80 million won and a credit loan of more than 100 million won will have a significant impact.” It can be said that buying a house making billions of dollars is now impossible “.

A senior bank official said: “In a situation where it is difficult for ordinary people to buy a home without a mortgage in a situation where house prices are soaring, in addition to the DSR regulation, the fact that credit and Mortgage loans cannot be duplicated is even more so for homeless people who want to buy a real home. “I’m worried it will make buying a home difficult.”

Other bank officials also said, “I agree with the policy, but it is said to be too much to block the way even homeless people use loans to buy homes for a high house price. In the end, this one. measure is summed up in one word: “Don’t buy a house.” There is also a saying: “You need to come up with a plan to make exceptions in the event that a homeless person becomes a homeowner.”

If a credit loan exceeding 100 million won has already been received before the 30th of this month, it is excluded from the regulation. For this reason, there are observations that loan consumers may rush before 30 days, the effective date of the measures, to board the “last train” before the regulatory tightening. This countermeasure also includes content that requires the entire limit to be treated as the loan amount, not the amount actually used in connection with the “passbook”, a type of credit loan.

Financial authorities set the execution time at the end of this month in view of the need for time to reorganize each bank’s IT system. “We will seek cooperation so that financial institutions can independently apply the DSR for each borrower even before the system is implemented so that no prerequisite claims occur.” She said.

![[그래픽] Main contents of the credit loan management plan](https://img8.yna.co.kr/etc/graphic/YH/2020/11/13/GYH2020111300170004400_P4.jpg)

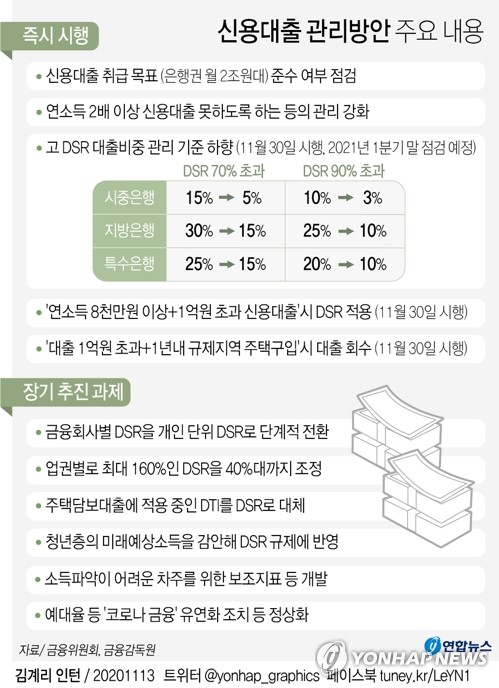

(Seoul = Yonhap News) Reporter Kim Young-eun = As of the 30th of this month, if the total amount of credit loans received by high income people exceeding 80 million won per year exceeds 100 million won, 40% of the total debt repayment ratio (DSR) regulation per borrower (non-bank sector 60%) Apply.

If a borrower who has received a credit loan of over 100 million won buys a home in a regulated area within one year, the loan is repaid.

On the 13th, the Financial Services Commission and the Financial Supervisory Service announced plans to manage loans to households.

[email protected]

Facebook tuney.kr/LeYN1 Twitter @yonhap_graphics

◇ Strengthen the bank’s high DSR lending rate … “The overall impact of lending to households is inevitable”

Through this measure, the financial authorities have decided to tighten the regulation of the “high DSR loan share” by banks and it is noted that the overall effect of loans to households will be inevitable in the future.

Commercial banks accept loans above 70% DSR from “15% or less” to “5%” of the total amount of loans and loans above SDR 90% from “10% or less” to “3%” Each should be lowered to. The deadline set by the financial authorities to reach the target number is until the first quarter of next year. DSR is the repayment of principal and interest for all loans due, divided by the annual income.

A commercial bank official said: “The government is willing to limit household debt. This measure will inevitably reduce not only personal loans, but also household loans such as mortgages” and said: ” The bank has managed to manage its high DSR. So, eventually, it will affect the entire family loan. ”

Another commercial bank official pointed out: “If the borrower has already received all the loans, and if the total amount of the high DSR is adjusted, there is a risk that the general public who has to receive the loan from the bank until at the limit at the end suffer a major blow “.

Some banking sectors have also expressed concern that the DSR regulations for the second financial sector are not clear to this extent, which could lead to the balloon effect of the shift in demand to the second financial sector.

Furthermore, in connection with the decision to check whether financial authorities are meeting the objectives for the bank’s handling of bank loans, it is noted that the credit limit can be reduced not only for high-income workers, but overall.

Banks will reduce their credit limit first, focusing on high-income workers, but if they fail to meet the goals set by the authorities, they will reduce the overall limit and affect some low-income people.

[연합뉴스TV 제공]

◇ Banks “I have to admit insurance fee for proof of income” … “Review” authority

Prior to the implementation of the new system on the 30th of this month, a common request emerged in the banking sector to add a “health insurance premium” as a document to determine an annual income of 80 million won when examining credit loans for the employees.

In this regard, on the 13th, in a meeting attended by the Financial Supervision Service and leading banking professionals, a number of banks suggested this issue and the FSS replied “I will see it again”.

A bank official said: “At first, the FSS only accepted two types of proof of income and withholding tax receipts for earned income when handling loans. However, if participants only provide proof of income for two types, loan advice, especially non-face-to-face loans Since the difficulty is great, it has been suggested that the amount paid for health insurance could be converted into income for employees, “he said.

In the case of health insurance, the insurance premiums are calculated based on the amount of income, so the banks explain that it is not unreasonable to prove the annual income.

Furthermore, the banks have pointed out that if a person with credit of more than 100 million won buys a house in a regulated area within a year, it seems difficult to manage the loan in practical terms in terms of IT application and individual management, and A system must be in place to confirm this. done.

In this regard, the financial authorities state, “banks will be able to share lists of people with credits exceeding 100 million won through the system and connect them to the computer registration system to select those who are subject to regulation”. He is said to have explained to banking operators that “it will be checked every six months”.

All rights reserved

2020/11/15 06:03 sent

Source link