[ad_1]

Photos = News 1

Woori Bank plans to reduce 1,000 employees over the next three years. This is because if the company does not change its cumbersome branch-centric organization, it will inevitably lag behind in competition with Internet banks and big techs (large information technology companies). Starting with Woori Bank, there is the prospect that a wind of workforce restructuring will blow across the entire banking sector.

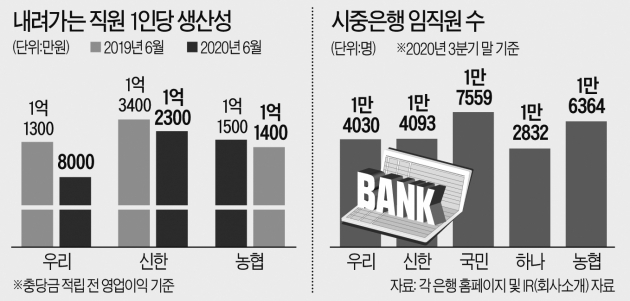

According to the financial sector on the 25th, Woori Bank is carrying out a plan to reduce the number of managers and employees, from about 14,000 to 13,000 by 2022. Assuming that the number of new hires is maintained as usual (2,000 in the last three years) , means that around 3,000 of the existing staff are expected to be reduced.

Woori Bank will work to group 676 general branches into 117 regional branches starting next year to improve the efficiency of manpower management. Next month, the number of executive positions with vice president or above in executive staff will be reduced from 22 to 20 or fewer. A senior Woori Bank official said: “The proportion of labor costs to net income is too large to be competitive with the current staff structure.”

The high-cost structure is the same for other commercial banks. This is why the prospect exists that restructuring the banking sector’s workforce may begin in earnest. A commercial bank official said, “As the number of people using digital and non-face-to-face banking has increased rapidly, the need for offline stores and human resources has declined relatively significantly.” Sara.”

Starting with Woori Bank, there is the prospect that the movement to restructure the banking sector’s workforce will begin in earnest next year. It’s an analysis that “ improving the constitution ” has emerged as a survival task as digital and non-face-to-face finance has become the trend with the Corona 19 incident. There is also a growing awakening that is needed. a radical reorganization focused on digital talent to tackle big technologies like Kakao Bank, which is growing rapidly without stores, and Naver, which is destroying the financial sector with big data as a weapon.

“If you can’t reduce labor costs, there is no future”

Major domestic banks are struggling to reduce their operating income expense ratio (CIR). CIR is the part of the SG&A expenses in the operating profit. It is mainly used to evaluate the business efficiency of a bank. In banks, 50-70% of SG&A expenses are personnel expenses. It is a representative indicator to see how efficiently banks are making profits relative to their workforce.

The reason why Woori Bank plans to cut its jobs is because this percentage is higher than that of other banks. Woori Bank’s CIR in the third quarter was 53.7%, higher than Shinhan Bank (44.2%), Kookmin Bank (48.6%) and Hana Bank (43.7%).

The growth of Kakao Bank, which went black this year, is also a factor that has raised the sense of crisis. The CIR is still higher than that of commercial banks due to the small size of profits, but experts predict it could be lowered to 30% sooner or later. A commercial bank official said: “Since Internet banks have no stores, fixed costs such as labor and rent can be drastically reduced. I will do it.”

Considering the symbolism of hiring in the financial sector, it is analyzed that reducing hiring will not be easy. A bank executive said: “Reducing new hires is the most obvious way to cut staff, but we have no choice but to see the financial authorities.” . This year, the number of new employees in six major banks, including Shinhan Kookmin, Woori Hana Nonghyup Corporation, was around 2,000, down 30% from last year (2,779).

Accelerate the recruitment of digital talent

Major banks agree that they can only survive when they break away from the existing financial sector and transform into an information technology (IT) company. Most banks are already consolidating existing stores and reorganizing them around basic stores. In addition, face-to-face and non-face-to-face convergence services are introduced one after the other.

Talent-driven digital recruiting is also expected to accelerate. Banks are dedicating their life and death to recruiting science and engineering students in the fields of artificial intelligence (AI), big data, blockchain, and software by creating a special digital master’s and doctoral program. Kookmin and Woori Bank strengthened their digital and IT workforce by 40 and 70 people respectively through frequent hires in the first half. Shinhan Bank partnered with Samsung Electronics to prepare a special recruiting screening for IT talent, and Hana Bank began “coding training” for all employees.

A commercial bank executive said: “In the future, the digital and IT workforce will no longer be called the ‘professional workforce’. The time has come when every employee of the bank must have the same knowledge and competitiveness as company employees. IT “.

Reporter Jeong So-ram / Kim Dae-hoon / Oh Hyun-ah [email protected]

Source link