[ad_1]

What is considered to be one of the biggest failures in the history of markets around the world is leaving many investors “hanging”. Suspension of the IPO (Ant’s initial public offering, which would have been the largest ever, lost a lot of money for many people, as, for example, one fifth of the entire Hong Kong population had invested in this stock market entry.One example of these losers is Chen Wu, a 35-year-old computer scientist, who confessed to Bloomberg “not knowing what to say” after this cancellation. “Yesterday I was imagining a trip with my wife somewhere next year thanks to the IPO earnings. Now I’m calculating how much I’ll lose,” he confesses. This is because yesterday, in an unexpected decision, Chinese regulators prevented the IPO of Ant Group, which intended to sell $ 35 billion worth of shares, in what would become the largest transaction of its kind in history. The Shanghai Stock Exchange announced that the suspension was due to regulatory issues. After this announcement, the Ant Group reported that the Hong Kong Stock Exchange listing has also been suspended, so the fintech debut, scheduled for Thursday, will no longer take place.

In the Hong Kong session, Alibaba slipped 9.3%, as it holds a third of Ant’s capital.

“This is all very unfair. The deal hasn’t even been closed, why should I give the brokers any money?” Asks Lu. But this computer case is not unique, with more than 19,000 comments to be made at one of the companies. brokerage, Fuju Holdings.

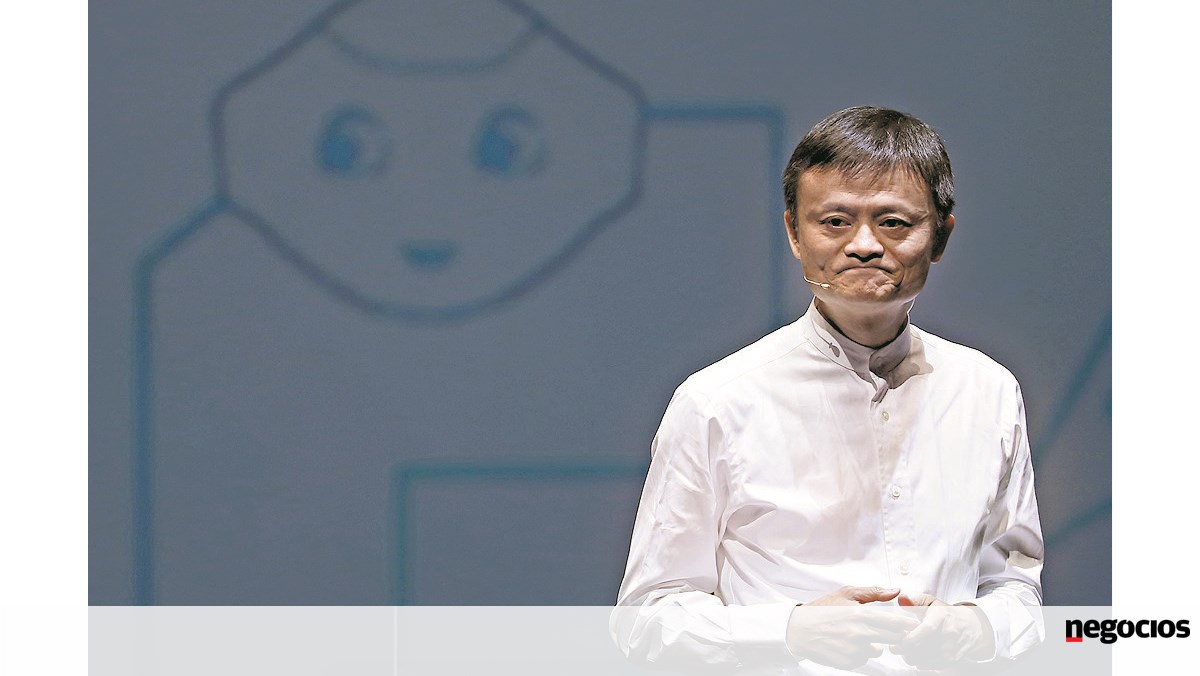

Ant, one of the jewels of Jack Ma’s tech empire, intended to raise at least $ 35 billion, the equivalent of € 29.7 billion. To materialize exceeds the entry on the stock exchange of the oil company Saudi Aramco, in December of last year (25.6 billion).

Jack Ma intended to go public with his company in China and Hong Kong. On the Chinese stock exchange in Shanghai, the shares would trade at 68.8 yuan, while in Hong Kong each bond would cost 80 local dollars (about 10 US dollars in both cases). In terms of comparison, Ant will have a stock market value four times higher than North American Goldman Sachs.

China’s “fintech” could now be valued at over $ 316 billion after the deal.

.

[ad_2]

Source link