[ad_1]

[ad_1]

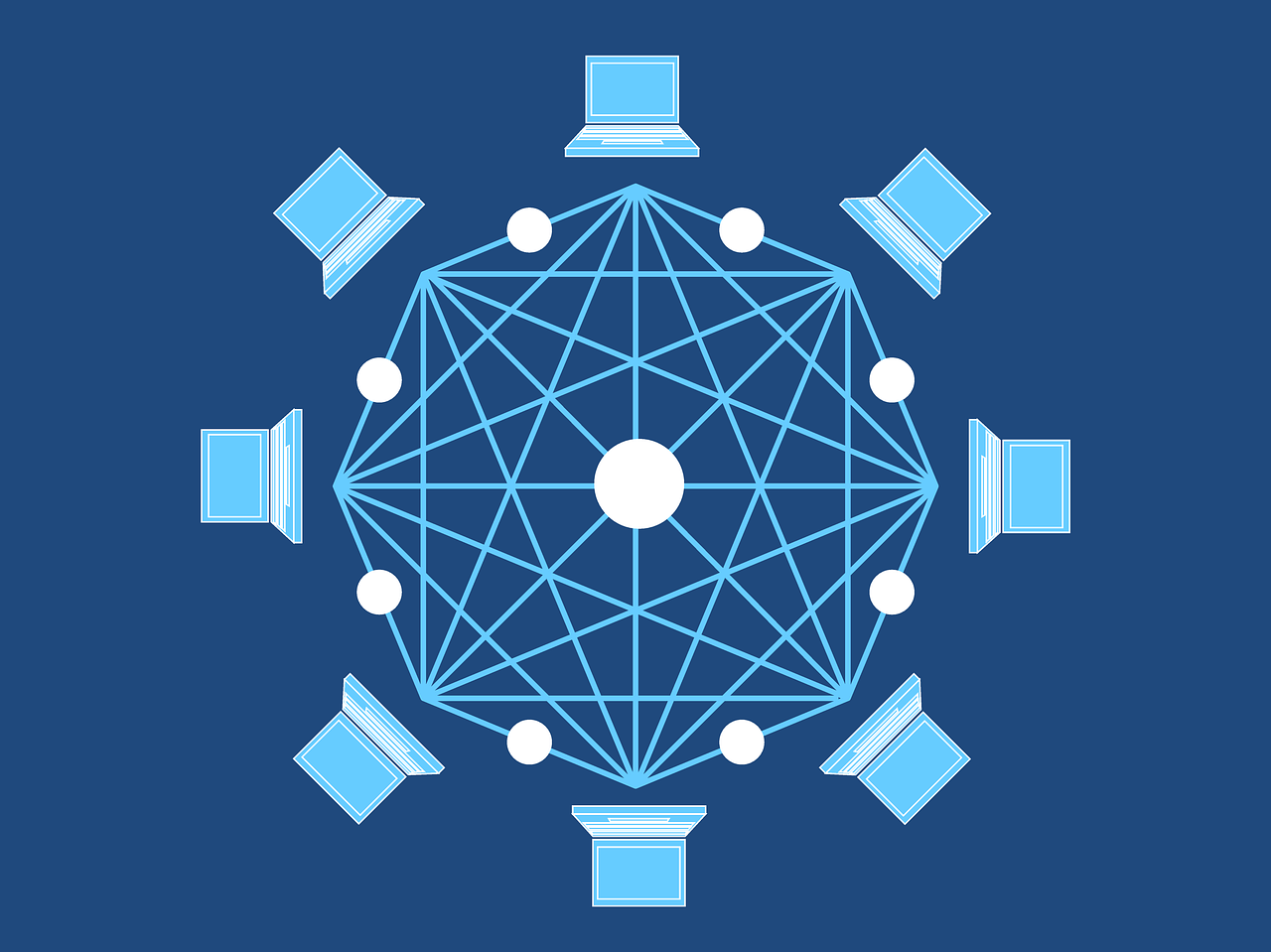

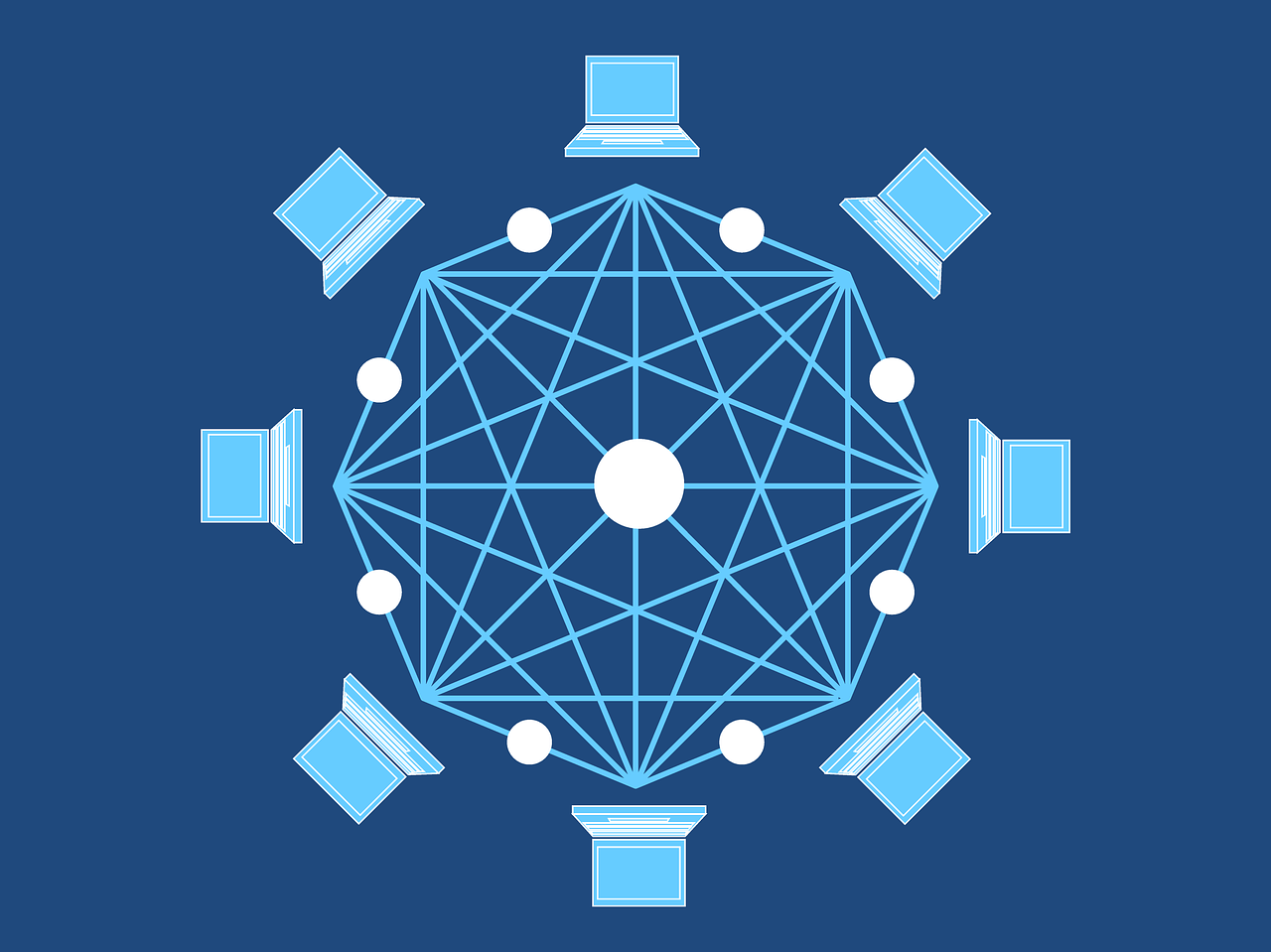

Many technological people have defined 2018 "Year of the Blockchain" and, given the permanent and transparent nature of the platform, many of these advances have been in the field of financial technology. For those who are new to the blockchain, the basic essentials to understand are:

- It is a transactional database in which it is possible to record records of any kind.

- Blockchain data is never deleted, because each record (block) is explicitly linked to the other (chain).

- Data is constantly monitored on an encrypted network. Since multiple systems are examining the same data, it is easy to confirm data and detect / correct anomalies.

These benefits have emerged as exciting new ideas for finance in various ways, from new paths to investment and fundraising for companies to new forms of currency.

However, innovations that are not so compelling actually feed some of the biggest advances in the financial sector. This means that while things like Initial Coin Offeringings and Stablecoin currency feel new and exciting, the real power of the blockchain could be greater in securing the logistics of existing transactions.

How Blockchain affects credit unions

Since credit unions operate differently than commercial banks and Stablecoin initiatives, blockchain will not give credit unions its cryptocurrency at any time. However, consider the logistics that occurs with the transactions. Resources must be monitored, titles must change hands and records must be checked. Blockchain is a perfect platform for this because of the following traits:

- Permanence: establishing a permanent and immutable registration means that no data will be questioned by the opposing parties. This will accelerate any kind of dispute or record control.

- Publicly accessible: Blockchain's intrinsic designs utilize a public network (albeit in a secure encrypted form used only for auditing and auditing). This means that records can be shared between different parts, creating a database with a single supplier. For example, this allows a credit union to transmit a security using the same data asset with a securities company rather than two individual records.

- Hackproof: any type of vital transaction for legal, financial or governmental purposes must be secure. Because of the blockchain protocol for continuous public record control, records are much safer than databases currently used by the financial sector.

The most important thing to know is that blockchain can feed any type of data transaction securely and securely. That's why people imagine it as a means of feeding many types of logistic data in the future as the world moves towards being connected and intelligent. In particular, for credit unions, blockchain can simplify and streamline processes such as identity authentication, cross-border transactions and registries.

Naturally, in order for this to succeed, it requires supervision and regulation. It does not matter which type of data model uses a platform if it is not regulated, particularly when records and finance are involved. Privacy, security and infrastructure are the main concerns: in fact, the blockchain had to face an infrastructural crisis at the end of 2017, when digital cats managed to destroy the Ethereum network (seriously, this happened).

As this technology is at the forefront, there will always be a learning curve. This is why so many steps in government and financial spaces imply pilot programs and small steps forward. There's just too much at stake to hurry up.

The cryptocurrency enigma

Cryptocurrency like Bitcoin is money free of nationality that allows you to process transactions through a blockchain network: the blocks in the chain are essentially dollars. Like dollars, there are serial numbers, limited quantities and traceability. The attraction of cryptocurrency implies a decentralized source: it removes the theoretical intermediaries and removes the geopolitical links to the currency value. Cryptocurrency banks are looming on the horizon, but most likely they will be a step back from traditional credit unions. Because these banks act as a bridge between traditional banking and cryptocurrency, they provide a buffer against the volatility and the wild-western atmosphere of Bitcoin and other cryptocurrencies.

However, there is a push for the gradual and traditional acceptance of Bitcoin. The SEC has initiated a procedure to discuss the approval of Bitcoin's ETF. If approved, Bitcoin will become much easier to buy and will most likely be seen as a mass-accessible currency. Keep in mind that while things like Apple Pay and PayPal allow electronic payments, they still do it with their native currency; the difference here is that Bitcoin exists as its own currency, like a precious digital metal. The SEC approval of Bitcoin will legitimize this currency substantially.

If and when this happens, the union credit industry will have to evaluate exactly how this type of transaction can be used as an acceptable currency for savings and investment. The industry is currently evaluating these possibilities for the future, but for now, any blockchain involvement will remain strictly at the process level.

It does not seem as sexy as the rise of a new currency. But even in the "boring" world of records and transactions, blockchain can make things safer and safer. For credit unions, simple old stability could be the most exciting in the world.

Summary

Item name

Will cryptocurrencies interrupt the credit industry?

Description

Many technological people have defined 2018 "Year of the Blockchain" and, given the permanent and transparent nature of the platform, many of these advances have been in the field of financial technology.

Author

Jeff Falk

Publisher name

PaymentsJournal

Publisher logo