[ad_1]

[ad_1]

KARACHI / LONDON: Bitcoin, a cryptocurrency that people around the world invest in by buying and selling it online, rose 4.5% over Rs 2,982,510 ($ 18,600) on Friday to close at a three-year high of just under of $ 20,000.

Currently just under Rs3 million, Bitcoin has set its sights on its all-time high, having recorded a gain of more than 16% – the largest weekly gain since June 2019 – this week. It has also increased by over 160% this year.

What is really driving the cryptocurrency rally right now and bringing it back to the headlines? A hedge against inflation? Another currency? Or maybe another niche resource to focus on?

Just today, the chief investment officer of New York-based global investment management firm BlackRock, Inc., Rick Rieder, hinted that Bitcoin could replace gold.

Check out today’s gold prices in Pakistan here

Second CNN Business, Rieder said CNBC who believed that Bitcoin was “a durable mechanism that could take the place of gold to a great extent”.

This, he reasoned, is “because it is much more functional than passing a gold bar around”, validating the role of cryptocurrency in the mainstream financial world.

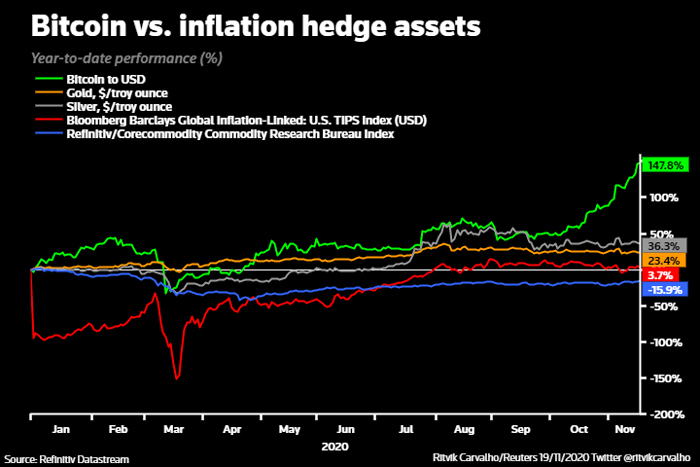

Bitcoin was “outperforming almost all assets considered its rivals this year”, Market Watch noticed.

Furthermore, Cointelegraph reported Thursday that two capital and investment management firms, Morgan Creek and Exos Financial, filed a new Bitcoin (BTC) fund with the US Securities and Exchange Commission (SEC), which, if approved, “will offer institutional investors another way to long flagship cryptocurrency without the volatility of owning it outright. “

During today’s trading, other major cryptocurrencies, including Ripple’s Ethereum and XRP, which often move in tandem with bitcoin, were up 7.2% to $ 505.2 and 3% to $ 0.31, respectively.

Trade risk

With governments and central banks around the world pouring cash out of money printing presses and stealing spending to fight the damage caused by the coronavirus pandemic, the resulting liquidity ends up lifting assets from emerging currencies and junk bonds to bitcoin and actions.

At the world’s largest digital currency manager, Grayscale, assets under management (AUM) rose to a record $ 10.4 billion – up more than 75% from September 2020 – while its bitcoin fund is increased by 85%. CoinShares, a smaller rival, said its assets under management increased more than 150% this year alone to $ 1.3 billion.

In general, higher savings rates have flooded investment funds with money, potentially sparking greater interest in bitcoin as a portfolio diversifier.

According to JPMorgan analyst Nikolaos Panigirtzoglou, there are signs of family offices – which handle money for wealthy people – turning to cryptocurrency.

Security against inflation?

Similarly, while governments and central banks have raised defensive walls in the battle against the coronavirus and plunged into full-fledged stimulus mode, some market observers and analysts think Bitcoin is useful in protecting themselves from inflation, especially considering its supply is limited to 21 million, which provides it with innate value.

JPM’s Panigirtozoglou said that some of the people who previously bought gold as an inflation risk hedge may now turn to cryptocurrency.

“There is a revaluation of Bitcoin on its value here as an alternative currency, as an alternative to gold,” he said.

However, Bitcoin’s earnings outstrip gold’s – around 20% – while an inflation-linked government bond index is up 4%.

Furthermore, its rally has accelerated in recent weeks, even as gold has stabilized and the resurgence of the pandemic has made the rise and resumption of inflation a distant prospect.

Convenience in terms of volatility

Interestingly, however, some of Bitcoin’s gain may be due to the fact that it is becoming more and more accepted around the world, both as a payment system and by a wider range of investors.

Celsius Network cryptocurrency lending platform CEO Alex Mashinsky said Bitcoin “has come to a point where institutional investors, banks and family offices are legitimately pondering involvement as a defense against currency devaluation.”

Since last month, when PayPal said it would open its network to cryptocurrencies, meaning users could spend bitcoin at its 26 million merchants, Bitcoin has jumped in half, hoping it can catch on as a way to pay. .

Mashinsky noted that the 2017 Bitcoin rally was led by retail investors who were early adopters, but now that major players like LINE Corp and PayPal are involved this time around, “we can expect more stability than the 2017 bubble. “.

“This is no longer a gold rush,” he added.

Additionally, traders who believe larger investors participated more are aiming for lower volatility levels than the 2017 bubble. During the period between late June and mid-November, a time when bitcoin prices are nearly doubled, 10-day price swings against the dollar were well below historical averages.

In this regard, Andrea Leccese – associated with the cryptocurrency fund Bluesky Capital – said: “It is still largely retail but it is becoming more efficient. [and] mature and I see more professional participants “.

The end, according to many, doesn’t seem to be in sight as cryptocurrency fans see Bitcoin firing over the $ 20,000 mark.

“There is little to suggest that this rally is over and all signs point to an all-time high in the near future,” said Denis Vinokourov, head of research at Bequant in London, according to Bloomberg.

The chief boss of Bitcoin’s largest exchange-traded product explained that, given new entrants and larger market players turning their attention to cryptocurrencies, “it may further expand the investor base participating in this asset class. “.

“We are very, very encouraged by the prospects for this space in general,” said Michael Sonnenshein, chief executive officer of Grayscale Investments, according to the publication.

($ 1 = Rs160.35)

–Further input from Reuters

.[ad_2]Source link