[ad_1]

After seeing the highest domestic market rate, the president of the Central Bank of the Republic of Turkey of all time (CBT) focused on the message to be given to the year-end inflation report Murat Uysal.

On October 28, CBRT Governor Uysal will present the latest inflation report of the year.

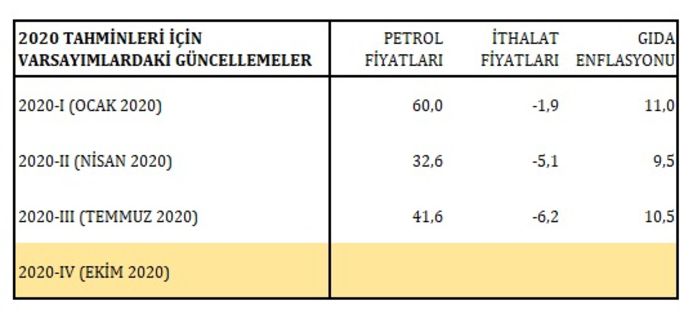

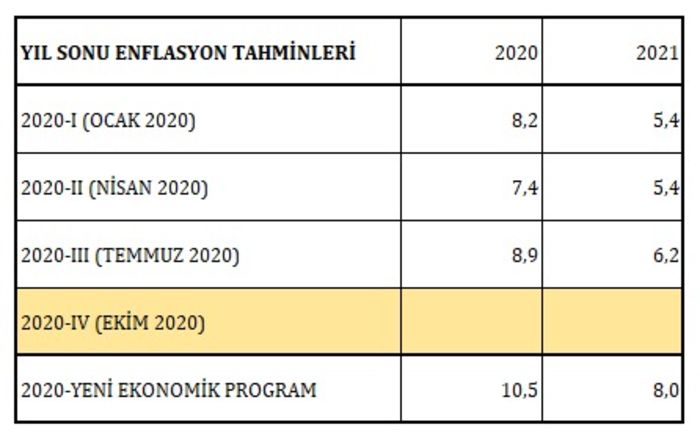

In the presentation of the inflation report in July, the bank’s inflation expectations for 2020 were raised to 8.9%. In his presentation, Uysal stressed that the disinflationary effects on the demand side would become more pronounced in the second half of the year.

Although the exchange rate increased in the period following the previous inflation report, inflation expectations also deteriorated. Here’s what you need to know before the latest inflation report of the year …

1- The rise of Kurds has accelerated

The depreciation of the Turkish lira against the dollar gained momentum compared to the previous inflation report. Since the end of July, the dollar / TL rate has entered an upward momentum with the effect of prices in global markets and geopolitical developments. While the rise in the exchange rate accelerated in late October, the dollar / TL rate broke through level 8 and hit an all-time high.

2- Horizontal trend of inflation

While the rise in the exchange rate accelerated, the annual rise in the consumer price index was observed to follow a horizontal pattern after July. According to data from the Turkey Statistical Institute, while annual inflation of 11.76% in July, August stood at 11.77% and 11.75% in September, respectively.

3- Inflation expectations worsen

Although inflation is flat, inflation expectations have been seen to deteriorate. The Central Bank of the Republic of Turkey held last year and its expectations survey in July, reflecting market expectations of 10.22%, while inflation expectations, those in October, 11.76% of production in the survey.

4- Interest rate increase after 2 years

Before the inflation report published in July, interest rate cuts were followed in monetary policy, after this period several monetary policy decisions were made. In September, the Central Bank raised the policy rate after 2 years. The bank raised the official rate by 200 basis points to 10.25%. In October, while maintaining the policy rate constant, the late liquidity window, which determines the upper limit of the liquidity tightening phases, increased by 150 basis points to 14.75 per cent. As a result of these moves, the weighted cost of financing reached the 13% limit.

[ad_2]

Source link