[ad_1]

Original title: What warning? The six major banks announced on the same day to suspend account opening for this business

Summary

[Quale avvertimento? Le sei principali banche hanno annunciato la sospensione dell’apertura del conto per questa attività lo stesso giorno]On November 27, many banks announced the suspension of the account opening for the precious metals business. According to Zhongzheng Jun statistics, as of press time, the five state-owned banks and the China Merchants Bank have all posted relevant announcements. (China Securities Journal)

November 27, multiplebankPost breakPrecious metalsOpening a company accountadAccording to Zhongzheng Jun statistics, at press time, the five state-owned banks andChina Merchants BankRelevant announcements have been made.

According to industry experts, in recent months, gold, silver, etc.priceIncreased volatility,bankAnd other institutions are guiding investors to avoidmarketVolatility risk. Looking to the future, before new stimulus policies are envisaged,Precious metalsThe overall price remained low and fluctuated weakly.

Multiplebanktime outPrecious metalsOpening a company account

On November 27, a number of banks ran announcements one after the other, stating that they would suspend opening accounts for precious metal assets.

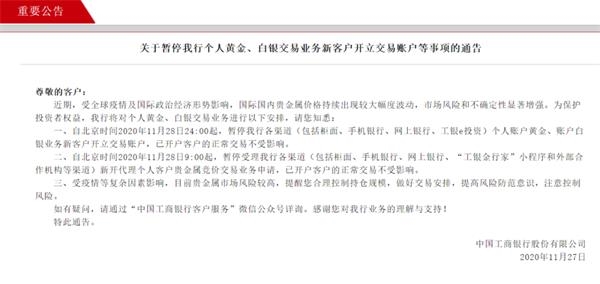

ICBC said that from 24:00 on November 28, 2020, Beijing time, all bank channels (personal account in gold, silver account new businesscustomerOpentransaction accountStarting at 9:00 am on November 28, 2020, Beijing time, the bank’s new channels will be suspendedproxyPersonal customer precious metal bid transaction trading application.

Source: ICBC website

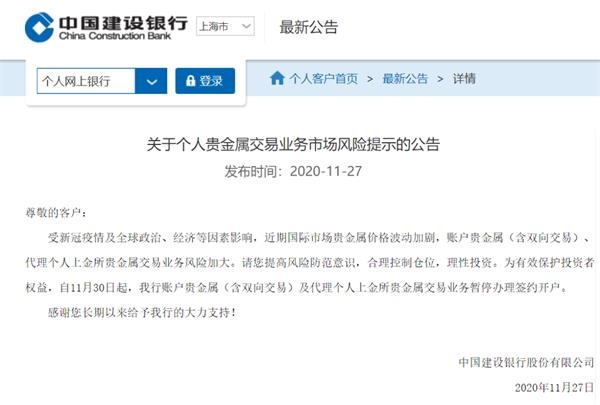

The CCB announced that as of November 30, the precious metals bank account (including two-way transactions) and the broker’s personal listing of precious metals trading assets on the gold exchange will suspend the signing of the opening of the bill.

Source: CCB website

According to the Bank of Communications, it will be suspended from 12 noon on November 28, 2020, Beijing timeCommunications bankAccounting posting precious metals, deferred transactions of personal precious metals agency and new customers of Jinbao business open accounts.

Source: Bank of Communications website

The Agricultural Bank of China further stated that it is expected to suspend the trading activity of precious metals of the bank account and to act as an agent for the signing and opening of accounts by personal clients of the precious metals trade of the Shanghai Gold Exchange.

Source: Agricultural Bank of China website

Except for large state-owned banks, joint-stock banksChina Merchants BankIt was also announced that, as of November 28, the bank’s channels for two-way paper gold and silver, solid paper gold and silver and Zhaocaijin (agent of the Shanghai Gold Exchange business) will be suspended for new clients for opening trading account applications.

Source: China Merchants Bank website

Furthermore,bank of ChinaAccording to the announcement, due to international holidays, bank account precious metals and two-way account precious metals activities will be suspended from 2:00 am Beijing time on November 28, 2020 (Saturday) and November 30, 2020 (Monday) Beijing time Quotes will resume at 7:00 am.

Precious metals have recently cooled

Why do many banks simultaneously announce the suspension of new trading accounts for precious metals activities? Judging from the announcement, various banks have said that due to the impact of complex factors such as the epidemic and changes in the global political and economic situation , the recent international market for precious metalsPrice fluctuationsIncrease, investment risks increase.

Everbright BankfinancialAnalystZhou Maohua told Zhongzheng Jun that international fluctuations in gold, silver and other prices have intensified in recent months and banks and other institutions have been guiding investors to avoid the risk of market fluctuations; from the point of view of trends, the global epidemic, the economy, vaccines and other factors will be complicated in the coming months. Overlap The current market is still racking up huge profits, especially towards the end of the year, the price of gold is still volatile and investors need to be alert to the risks of market fluctuations.

At press time November 27,London GoldIt was reported at US $ 1,807.54 per ounce, down 0.03%; COMEX gold reported at US $ 1811.9 per ounce, up 0.04%; London silver reported at US $ 23.225 per ounce, down 0.41%; COMEX silver reported at US $ 23.345 per ounce, down 0.43%.

Since the beginning of this year, hit by the epidemic, safe-haven assets such as precious metals have seen a notable increase. However, recently, driven by factors such as the expected improvement in the global economic recovery, precious metals have started to adjust.

Looking ahead, CITIC Futures said the currentGDPThe quarterly annualized rate was in line with expectations and durable goods orders in October were better than expected. Earlier last weekunemploymentThe gold number is higher than expected. November United StatesenterpriseThe businesses are expanding rapidly. News about vaccines and the improving US economy suppressed the demand for coverage. At the same time, the global economic outlook is further optimistic after widespread vaccination.US economic dataThe dollar index’s promotion has bottomed out and rebounded, which should further drive down precious metal prices.

Maike Futures said the negative sentiment in the early days of gold and silver stems mainly from the important news on vaccine progress and the expected economic recovery in the United States. These negative factors have not changed in the short term. We must pay attention to the US approval of the emergency use of vaccines on December 10th. The formation of gold and silver prices is further negative. Therefore, before the new stimulus policy is expected in the US, the price of precious metals as a whole remains low and fluctuates weakly.

There are precedents for preventing the risks of precious metals

This isn’t the first time this year that banks have imposed precious metals eitherForeign currencyProductMake changes to transactions, etc. The previous crude oil treasury incident also made banks more cautious in protecting the legitimate rights and interests of investors.

For example, on the eve of the US election, many banks issued risk warnings and temporary adjustment warnings for transactions.bank of ChinaThe announcement stated that the United States will hold a general election on November 3, 2020, local time, and precious metals, precious metals,Foreign exchange marketVolatility will increase dramatically, liquidity will be significantly reduced, and market risks may increase according toInternational practice, Make the following temporary changes:

The first is to adjust the quote spread level based on market conditions. At that time, the price spread of account precious metals, two-way account precious metals, accumulated profits, foreign exchange treasury, two-way foreign exchange treasury and personal options could be significantly higher of the normal level; second, if liquidity is exhausted.In extreme cases, it may be possible to temporarily suspend the quotations of the precious metals of the account, of the precious metals of the two-way account, of the accumulation funds, of the foreign currency treasury, of the foreign currency treasury two-way and personal options contracts; third, during the US general election, if liquidity is significantly reduced, it may be appropriate Account precious metals decrease, two-way account precious metals, accumulated profits, foreign exchange treasury, single two-way foreign exchange treasury transaction waysDealMaximum amount. These temporary adjustment measures will be canceled after the market stabilizes.

In July of this year, when the precious metals family’s businesses were in full bloom and international prices of gold, silver, palladium and platinum reached new highs, many banks announced the suspension of their precious metals accounts.Open a positiontransaction.

For example,Communications bankHaving said that given the currentInternational financeThe market turbulence has intensified. Platinum and palladium are products with less liquidity and higher volatility. From the perspective of risk prevention and investor rights protection, the bank will suspend accounting platinum starting at 9:00 am on July 22, 2020. And new palladium opening transactions with accounting entry, existing customersLiquidationThe transaction is not affected.

(Source: China Securities Journal)

(Responsible publisher: DF512)

Solemnly declares: The purpose of this information released by Oriental Fortune.com is to disseminate more information and has nothing to do with this booth.

.

[ad_2]

Source link