[ad_1]

Key points

- The ETH price remained in a solid uptrend and could be traded above $ 170 and $ 180 against the US dollar.

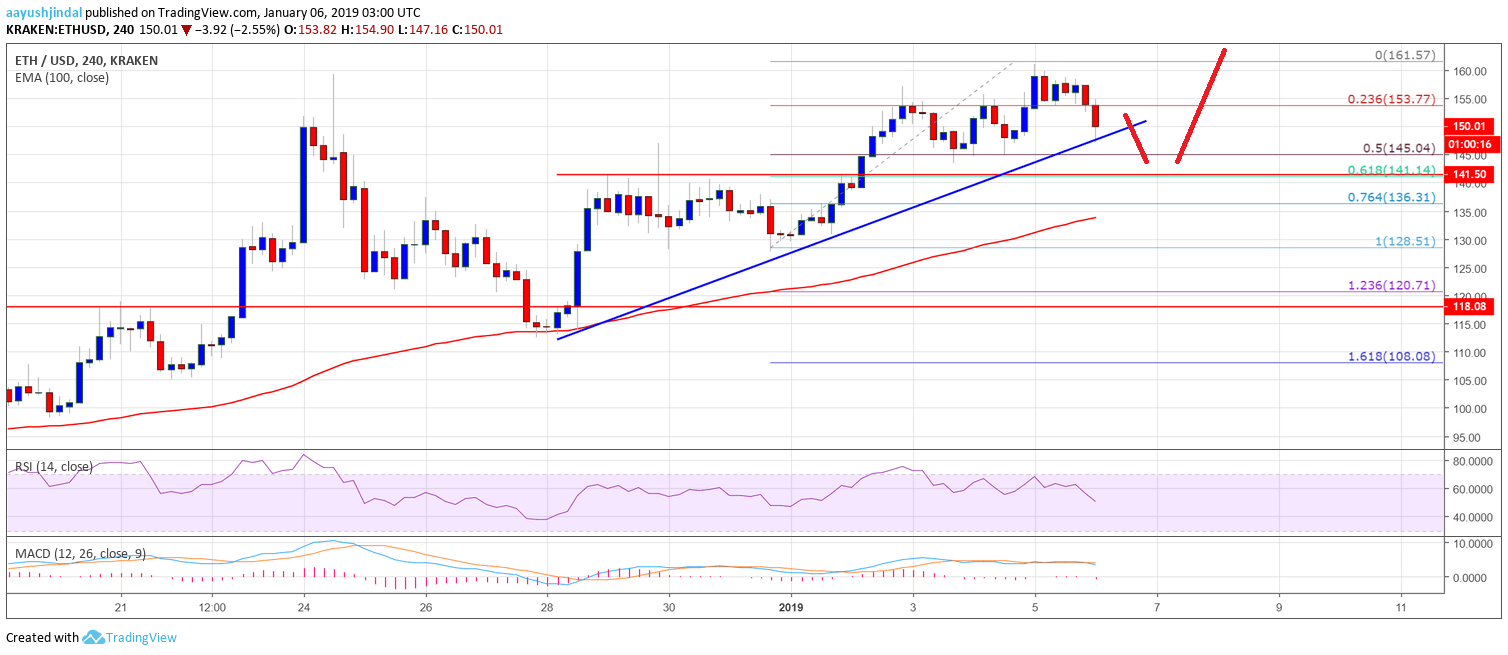

- C & # 39; is a crucial bullish trend line formed with support for $ 148 on the 4-hour chart of Eth / USD (data feed via Kraken).

- The pair may resume its move upwards and may soon cancel the $ 162 and $ 170 resistors.

The price of Ethereum is slowly gaining ground against the US dollar and Bitcoin. The ETH / USD could correct lower in the short term, but the dives remain supported.

Price analysis of Ethereum

Last week, the ETH price followed a solid bullish path over the pivotal area of $ 120 against the US dollar. The ETH / USD broke the resistance area by $ 142 and settled above the simple moving average at 100 (4 hours). Subsequently, buyers gained bullish momentum and broke resistance levels $ 150 and $ 154. The price even broke the $ 160 level and traded towards the $ 162 level.

A high was formed at $ 161.57 and thereafter the price started a downward correction. It fell below the $ 154 support to move into a short-term bearish zone. The sellers pushed the price below the Fib retracement level of 23.6% from the recent wave, from a minimum of $ 128 to $ 150 swing. However, there are many supports on the negative side close to $ 150 and $ 142 levels. In addition, there is a crucial bullish trend line formed with support for $ 148 on the 4-hour chart of Eth / USD. Below the trendline, the 50% retracement level of recent wave fiber from the low of $ 128 to $ 150 is $ 145. Thus, the disadvantages near the $ 150 and $ 145 levels are susceptible. to find a strong buying interest.

The chart above indicates that the ETH price remains in a fair upward trend above the $ 142 support. On the upside, a break above the $ 162 swing can open the doors for $ 170 and $ 180.

4-hour MACD: the MACD is slightly positioned in the bearish zone.

4-hour RSI – The RSI is moving down to level 50.

Main support level: $ 142

Main resistance level: $ 162

Source link