[ad_1]

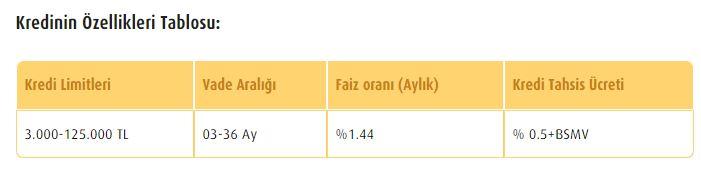

VakıfBank offers consumer loans with attractive interest rates and flexible payment options between 3,000 TL and 125,000 TL. As part of the loan offered for public employees, private sector employees and retirees, all customers are offered a maturity of up to 36 months at 1.44 interest. So what are the conditions for applying for the VakıfBank consumer loan? How to apply

HalkBank offers loans of up to 30,000 TL with an interest rate of 1.09! Loan Application Screen!

HalkBank offers loans of up to 30,000 TL with an interest rate of 1.09! Loan Application Screen!

Ziraat Bank grants a real estate loan with an interest rate of 0.99! Loan application terms!

Ziraat Bank grants a real estate loan with an interest rate of 0.99! Loan application terms!

HOW TO APPLY FOR VAKIFBANK NEEDS CREDIT?

You can easily apply for a VakıfBank consumer loan with your mobile phone. You can use the loan easily after writing your CREDIT, TR ID, Monthly Income and send an SMS to 5724 and then a confirmation message, with a space between them.

VAKIFBANK NEEDS SCREEN APPLICATION SCREEN

CALCULATION OF VAKIFBANK CREDIT

VAKIFBANK NEEDS CREDIT PAYMENT OPTIONS

VakıfBank meets its customers with 7 different payment options within the consumer loan. Here are the loan payment options;

-

In equal monthly installments,

-

Increasing installment

-

Descending installment

-

3 month grace period, equal monthly installments,

-

Equal installments every 3 months,

-

Payment by balloon on the last installment,

-

You can repay in variable installments

CREDIT APPLICATION TERMS

The conditions for applying for the VakıfBank consumer loan are as follows;

– VakıfBank has the right to freely evaluate requests as part of its lending policies.

– Duration of the VakıfBank campaign and during the campaign; reserves the right to change the fees and interest rates to be charged.

– Although a guarantee prerequisite is not required for applications, our branches can apply for a surety when necessary.

– You can get detailed information from all our branches.

– The increasing installments are evaluated by the Bank in the context of the customer’s income and information on the score.

– Our bank reserves the right to make changes to the terms of the loan when it deems it necessary.

* In accordance with the bank’s lending policies, information on the client’s monthly income, score, collateral, etc. reserves the right not to allow loan repayment options, taking into account the factors.

– VakıfBank can make changes to the campaign terms as part of the lending policies on a client basis.

.

[ad_2]

Source link