[ad_1]

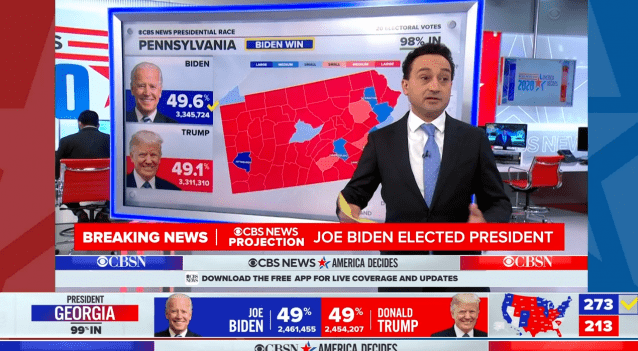

Candidate Joe Biden was elected in the US presidential election. North Korea’s trade, oil prices, exchange rates, industry and politics are expected to have a major impact in all directions of the Korean economy.

On the 8th, the Korean Chamber of Commerce and Industry summarized the opinions of experts by industry and sector and analyzed by route “the effects of the election of President Biden on the Korean economy”.

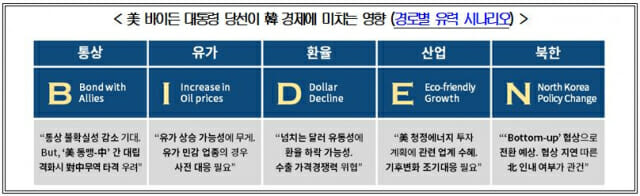

The Chamber of Commerce of Korea is the most promising scenario that can be triggered by the election of Biden ▲ “Ties with allies” ▲ “Rising oil prices” ▲ “Dollar decline” ▲ “Green growth” ▲ “Changing the North Korean policy “.

[Bond with Allies] Comparison between the “US-China Alliance” in a context of less commercial uncertainty

Due to the nature of the Korean economy, which is heavily dependent on trade, the industry focuses on Biden’s trade policy. The industry expected that the volume of global trade would increase if the uncertainty of trade friction was reduced relative to the Trump administration. Even if the free trade position is not revived immediately, it is public opinion that if an atmosphere of respect for the international trade order is created, it will also serve as a boon to the domestic export industry.

Experts focused on “Chinese pressure” and “multilateral negotiations” as Biden’s business strategy.

“With Biden’s election, the United States will return to human rights diplomacy and strategic engagement, and in solidarity with the alliance will pressure China in all directions, including politics and economics,” he said. said Chung Hyuk, advisory member of Korean Sang-Ang (Seoul National University Graduate School of International Studies). In the process, there is a high possibility of seeking active cooperation from Korea, and as a result, companies with a large percentage of trade with China may be interested. The need to diversify trade will become more urgent. “

Advisory board member Jung Hyuk added: “Even if the free trade position does not come to life as in the past, there is a high possibility that international trade will be revitalized as a whole, as the uncertainties that will cause unexpected variables in the international trade order will decrease. “

Hyung-gon Jung, advisory board member of the Korea Institute of Foreign Affairs, said: “Biden is expected to uphold the principle of US priority, but he is very likely to deviate from Trump’s protectionism and negotiation strategy. bilateral to transform itself into a multilateral system. If membership of the CPTPP is promoted, Korea may also be pressured to join. In this case, negotiations with Japan, an existing member of the CPTPP, will be an obstacle and, after joining. agreement, it is feared that the trade deficit due to tariff cuts in Japan will deepen “. She said.

In addition to this, advisory board member Jeong Hyeong-gon warned that “according to the position of the Democratic Party of the United States which traditionally values environmental and labor issues, if these issues are stipulated in trade negotiations, it could become another form of trade barrier for national companies “.

[Increase in oil prices] Weight on the possibility of raising oil prices… Industries with sensitive oil prices need to be responded to in advance

Experts also called for careful attention and a preventive response to the possibility of rising oil prices.

“As Biden has committed to regulating shale oil development and expanding investments in eco-friendly energy, there is a high possibility that the international oil price will rise in the short term as the supply of crude oil it will decrease, “said Song Eui-young, advisory board member of the Korea Awards (Professor of Economics at Sogang University). However, adviser Eui-young Song predicted that “if the supply of oil increases due to the resumption of nuclear negotiations between the United States and Iran and the large-scale implementation of the carbon neutral project, the prices of the oil could return to the downside in the medium and long term “.

Kim So-young, advisory board member of Seoul National University’s Department of Economics, said: “It is difficult to say whether the situation is good or bad because the contrast of each type of business can be changed depending on the increase. of the price of oil “. Efforts are needed and, at the national level, economic and diplomatic strategies need to be re-examined in preparation for the possibility that the economic power and status of the beneficiaries of rising oil prices such as Russia and Saudi Arabia will increase. “

[Dollar decline] Potential drop in exchange rate due to overflowing dollar liquidity … Threat of export price competitiveness

There were also concerns about the depreciation of the dollar. As Biden’s promised positive economic stimulus measures increase the supply of dollars in markets that are already rich in liquidity and the ability to raise tariffs between China and China, the preference for risky assets in financial and foreign exchange markets has increased. . The value of the currency is expected to be strong.

In fact, the won / dollar exchange rate, which was 1,190 won per dollar on Sept. 3, has fallen by more than 60 won in the two months that the chances of winning Biden’s election have increased dramatically and have fallen below. under 1130 won.

“The decline in the won / dollar exchange rate is a factor that weakens the price competitiveness of domestic export companies,” said Shin Hyun-han, advisory board member of the Korean Sang-Ang University (Yonsei University Business School). . “In view of this situation, we will establish next year’s management strategy and export and procurement strategy while improving design and quality. Efforts are also needed to improve competitiveness without price, such as the development of new technologies and new products. “.

[Eco-friendly growth] Benefits of the US clean energy industry … Need for a timely response to climate change

As the Biden government is expected to release $ 2 trillion in clean energy and infrastructure to respond to climate change over the past four years, eco-friendly energy industries such as wind and solar energy and electric vehicle battery industries are expected to they will benefit from it.

“As the US market expands in the energy and environment sector, business opportunities for domestic companies will increase as the US market expands,” said Hong Jong-ho, member of the University’s advisory board. Korean Sang-Ang. It is necessary to expand the support in relation to the internal policy of the Green New Deal so that these industries can increase their competitiveness. “

It also ordered a rapid response from the industry to respond to climate change. Advisory board member Hong Jong-ho said, “You need to prepare for domestic companies because RE100 (using 100% renewable energy) that companies voluntarily participate in becomes a new global normal and can act as a barrier to trade when the carbon border adjustment tax is introduced “.

The carbon border adjustment tax is a measure that imposes tariffs on products manufactured in countries with high carbon emissions. Biden has shown willingness to rejoin the Paris agreement on climate change, which President Trump withdrew, and said he will impose a carbon border tax on countries that fail to comply with environmental obligations.

[North Korea policy change] Should move to Bottom-up trading … North Korea’s patience

Finally, a radical change in US policy towards North Korea was expected. Yang Moon-soo, a member of the advisory board of Daehan Sang University (Professor of North Korea Graduate School), said: “The Trump administration will move to a ‘bottom-up’ method that discusses the details on a practical level rather than a direct negotiation of the ‘Top-down’ method, and ultimately agrees between the leaders “. Forecast.

Kim Byeong-yeon, a member of the advisory board of Seoul National University’s Department of Economics, said: “As it takes a long time to form the North Korean political line and prepare for negotiations, negotiations with North Korea could be possible only after a certain period of time after the inauguration of the Biden administration. ” It may differ from the desired negotiation timing.

Related articles

Biden opens the era of electric vehicles to install 500,000 charging stations in the United States

Joe Biden wins the US presidential election … Secures the majority of the electorate

Biden’s Strongest Election … Business World “We must clarify Korea’s principles in the US-China conflict”

If Biden is elected, the renewable energy and battery industries will increase.

There was also concern that North Korea’s dissatisfaction with the delay in negotiations could be expressed in provocation. Lee Jung-cheol, a member of the Korean Sang-in advisory board (professor in the Department of Political Science and Diplomacy at Soongsil University), said: “North Korea is raising tensions with dissatisfaction with the political divide that it will appear during the ignorance of good faith “until July next year, when the United States appoints a new political official and conducts a review of North Korea’s policy. “This can lead to turmoil in the Korean financial and currency markets and a decline in investment sentiment, so the Korean government needs to preemptively manage peace through the ROK-US summit.” .

Kim Moon-tae, head of the economic policy team of Korea’s Sang-Ang Sang, said: “The decline in trade uncertainty and the prospect of increasing global trade volume after Biden’s election is an opportunity factor for the Korean economy, which is heavily dependent on foreign countries, but the direction of oil prices and exchange rates will be another variable. ” Government and business should carefully analyze changes in US policy tone and trends in macro and financial indicators and prepare a response strategy in advance. “

Source link