[ad_1]

[ad_1]

Hi everyone,

Last night we saw a potentially innovative title …

Unfortunately, this is not an official declaration of the Russian Federation, but of an economist named Vladislav Ginko, who is part of a group of state experts. However, the idea seems tempting.

Following my recent discussions with Professor Ginko and other members of the Russian government, it seems that there are several possible ways to put them into practice. Obviously, given the current regulatory and infrastructural context, they can not simply open an account in an encrypted exchange or even get it on the OTC market.

More likely, they will need to set up a brokerage service, possibly by introducing a new cryptographic currency, possibly through an already established financial institution, to help facilitate.

Even if we understand that Russia and some other countries are very interested in the desponization, we can only assume how close they are to replacing it with bitcoins.

However, I can easily predict a future in which governments and central banks of the world hold large amounts of bitcoins in their national reserves similar to the way they hold gold today.

@MatiGreenspan – eToro, senior market analyst

Today's highlights

- Turn off: day 19

- KodakCoin Anniversary

- Coming out of their shorts

Note that: All data, figures and graphics are valid from January 9th. All trading involves risks. Only risk capital that you can afford to lose.

Today's highlights

The stocks are in the green today. Continued progress in the US-China trade talks and a more subdued position by the US President regarding the southern border wall, seems to be generating a risk appetite among global investors.

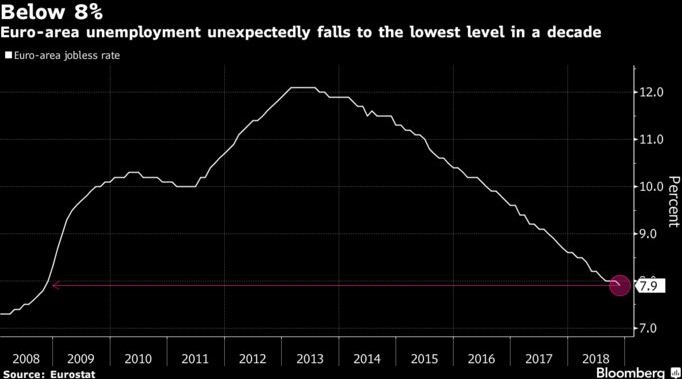

Accompanying this positive atmosphere, data on unemployment in Europe fresh from the press they came out much lower than expected and now shine with the best level from the crisis.

The oil broke $ 50 on the upside and even the gold is shrinking a bit.

Kodak Coin (No Joke)

Exactly one year ago, photography giant Kodak announced that they were launching an ICO with its own token, designed to track ownership of images on the Internet.

Of course, at the moment there were a lot of startups who collected a lot of capital announcing new coins, so the market was a little skeptical about this.

So, it was a nice surprise to see this story reported by The Block today on the success of the Kodak beta test. Apparently, they have already been able to generate over $ 1 million in license credits.

What we have here is an excellent example of an old-world society subjected to a serious financial burden that manages to take a huge step forward towards blockchain innovation that, hopefully, will change the world for the better.

The courts are coming down

The cryptographic markets are consolidating the gains at the moment and it seems that once again prices have stabilized. Bitcoin remained stable at $ 4020 at the time of writing this article.

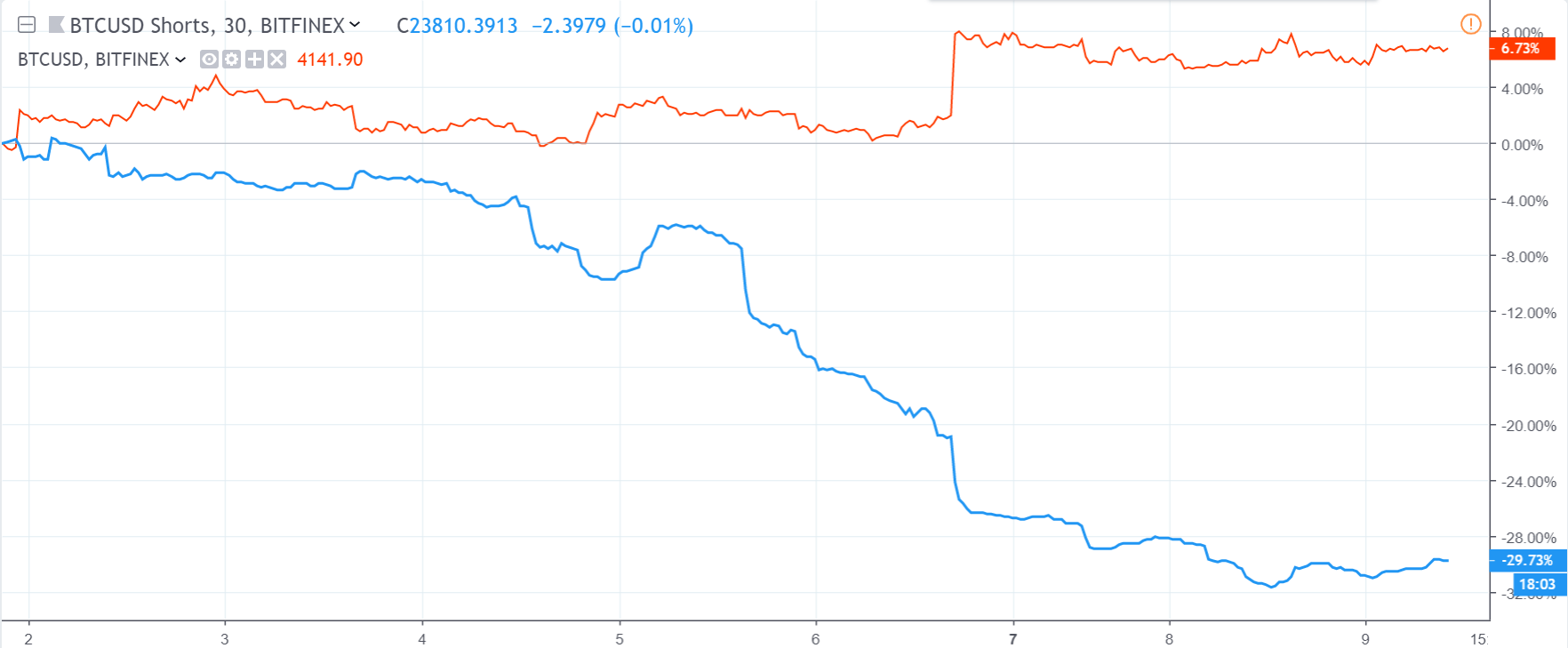

One thing we wanted to highlight is a small chart here from tradingview.com that shows the short selling volume of the bitfinex encrypted platform.

The red line is the price of Bitcoin. The blue line is the level of short sales, which fell nearly 30% from its January 1 peak.

In case you missed it, here is the recording of yesterday's webcast session where we reviewed the highlights of 2018 and provided a forecast for the following year.

In the presentation, we discussed what the markets are driving at the moment and some of the best trading opportunities for the new year.

https://event.on24.com/wcc/r/1898448/749D6E1B25C37A26F7D812867EE138FC?partnerref=Mdaily

I wish you a fantastic day!

This content is provided for informational and educational purposes only and should not be considered as an investment advice or recommendation.

Past performance is not indicative of future results. All trading involves risks; only venture capital you are willing to lose.

The presented perspective is a personal opinion of the analyst and does not represent an official position of eToro.

eToro is a multi-asset platform that offers both investment in stocks and cryptocurrencies, as well as CFD asset trading.

Please note that CFDs are complex instruments and present a high risk of losing money quickly due to leverage. 65% of retail investor accounts lose money when they exchange CFDs with this supplier. You should consider if you understand how CFDs work and if you can afford to take the high risk of losing your money.

Cryptocurrencies can fluctuate widely in prices and are not appropriate for all investors. Cryptocurrency trading is not controlled by any regulatory framework of the EU.

About the author: Mati Greenspan is eToro Senior Market Analyst Connect with Mati on .... eToro: http://etoro.tw/Mati Twitter: https://twitter.com/matigreenspan LinkedIn: https://www.linkedin.com/in/matisyahu/ Telegram: https://t.me/MatiGreenspan Telephone of the office: + 44-203-1500308 (ext: 311)

Disclaimer: The opinions expressed in this article do not represent the opinions of NewsBTC or some of his team members. NewsBTC is not responsible for or responsible for the accuracy of any information provided in Sponsored Articles / Press Releases like this.

[ad_2]Source link