[ad_1]

- The cryptocurrencies are stabilizing over the weekend after the SEC has sucked them into life earlier.

- Each cryptocurrency is in a different state.

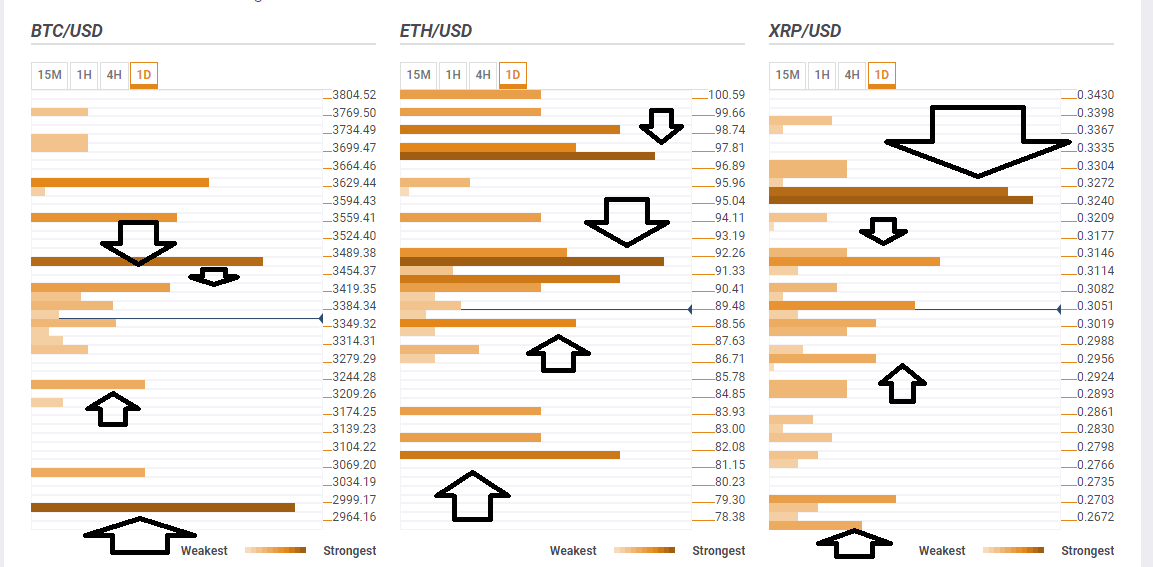

- Here are the levels to be observed based on our proprietary technical tool.

After the US Securities and Exchange Commission (SEC) decided to postpone the decision on the SolidX / Van Eck Bitcoin ETF decision in February, the grandfather of digital coins fell below the previous $ 3,466 minimum, Ripple it slipped below $ 0.30 and Ethereum entered double -Digit territory.

However, after the fall of late Thursday / early Friday, we see some stability over the weekend. In recent months, these periods of stability were only temporary calm before the subsequent storms and scrambled have suffered further accidents.

However, some suspect that the accumulation of whales is close. After the big players have downloaded the scrambled to lower the price, they will begin to gradually buy at lower levels. This is the theory. Is the route close?

Here are the levels to watch on Bitcoin, Ethereum and Ripple.

BTC / USD needs to exceed $ 3,489 to escape $ 3,000

Bitcoin has stabilized at $ 3,300 and is looking for the next move. Some resistance awaits for $3,419 that is the convergence of Simple Moving Average 5-4h, SMA 50-1h, SMA 200-15m and Fibonacci 61.8% of a day.

The most significant obstacle is $3,489 where we see the confluence of the Fibonacci 23.6%, the minimum of the previous month and the Bollinger Band 1h-Upper.

On the negative side, we see support for $3,209 with the meeting point of the One Day Pivot Point 1 support and yesterday's low.

However, the real bearing for BTC / USD is only less than $ 3,000 to $2,980 which is the minimum of last year and the Pivot Point 1 month of support 1, both powerful lines.

The ETH / USD must first exceed $ 92 before thinking of $ 100

Ethereum has a more complicated technical picture, with some dense upward resistance groups.

About $ninety two for an Ether, we see the confluence of the Fibonacci 23.6% per week, SMA 100-15m, Bollinger Band 1h-Middle, the Fibonacci 38.2% a day, and the Simple Moving Average 5-4h.

Higher, $97.50 sees the Fibonacci concentration of 38.2% at one week, the Bollinger Band 1h-Upper, the day before the maximum and the SMA 100-1h.

Looking down, a support waits for $88 where we see 61.8% of Fibonacci one day, the previous hourly minimum and the 50-1h SMA converge.

The downside target is $81.50 which is the meeting point of two levels of Bollinger Band: the 4h-Lower and the one-day Lower.

The prospects for the idea of Vitalik Buterin remain sad.

XRP / USD only observes an obstacle: $ 0.3250

Ripple has not reached its annual lows but it is not too far. His hope is a specific level.

A $.3250 we see a dense and explosive cluster that includes the Fibonacci 38.2% per week, the Simple Moving Average 100-1h, the Pivot Point R2 of one day and the minimum of last month.

A lower resistance a little lower waits for $.3133 that is the confluence of the Fibonacci 23.6% per week, the PP one day R1 and the maximum of the previous day.

Support waits for $.2956 with the BB one hour less, the previous 4h at the bottom and the Fibonacci at 23.6% in one day.

The bearish bearish target is $ 0.2703 that is the meeting point of the PP a month S1 and of the PP a month S1.

Source link