[ad_1]

The plot

I do not normally write about the news, because I usually feel that it is overwritten (click-bait), already covered, or does not really matter in the long run. This morning I read something that stopped me in my tracks and I could not let it rest.

The story is quite long, so I want to summarize the main points below and then give you my perspective on what I think means for Bitcoin (BTC-USD) (COIN) (OTCQX: GBTC) now, and in the future.

- The ICE owner has partnered with Starbucks (SBUX), Microsoft (MSFT) and the Boston Consulting Group in an effort to "fix" Bitcoin and make it a "reliable global currency with wide use". – Fortune Magazine

- The company they founded is called Bakkt and their main goal is to create a fast, secure and efficient global market for digital resources. From their website:

Supported by Infrastructure and technology of the proven financial market of Intercontinental Exchange Bakkt's global secure platform will connect investors, merchants and consumers, making it easier, faster and more convenient 39; access, trade and use digital resources. The open-source neutral Bakkt platform will be designed to meet applicable regulatory requirements and to support innovation in relation to digital resources and blockchain applications. – Bakkt.com

- Aiming at the world's largest financial institutions, Bakkt says its goal is to "pave the way for important money managers to offer mutual funds, pension funds and ETFs as highly regulated mainstream investments". – Fortune Magazine

- If this were not enough, they also plan to hire outlets and payments:

The next step could be the use of Bitcoin to replace the credit card.

"Bakkt is designed to serve as a scalable ladder for institutional, commercial, and consumer participation in digital goods promoting greater efficiency, security, and utility," said Kelly Loeffler, ICE digital asset manager, who will serve as CEO of Bakkt, in the press release announcing the launch. "We are working together to create an open platform to help unlock the potential for transforming digital assets through global markets and trade."

…

Use of Bitcoin to simplify and interrupt the world of retail payments by moving consumers from swiping credit cards to scan their Bitcoin apps. The market opportunities are gigantic: consumers all over the world pay a high credit card or online shopping fees for 25 trillion dollars a year in annual purchases. – Fortune Magazine

- CNBC is already reporting that Starbucks will allow customers to pay for Frappuccino with Bitcoin.

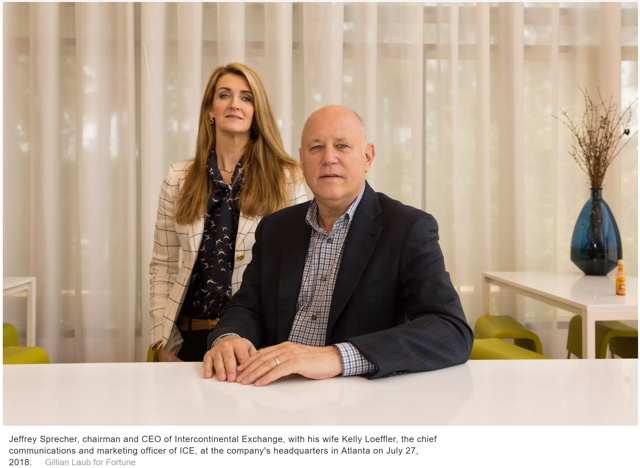

- Jeff Sprecher, founder and CEO of ICE (who owns the NYSE) has turned $ 1 into $ 44 billion over the past 25 years, revolving around a lack of electricity and reaching the world's second largest stock exchange, behind CME. Bakkt was the idea of Sprecher, but his wife (Kelly Loeffler), who is currently a manager at ICE, will be the CEO of the new company.

– Fortune Magazine

– Fortune Magazine

- ICE has been planning Bakkt for a while now and they admit that their participation in Coinbase was of a strategic nature:

To study how digital currencies work, ICE at the beginning of 2015 took a minority stake in the largest US market for digital currencies, Coinbase. "Coinbase has twice as many customers as Charles Schwab," says Loeffler. "Many of the people who have opened accounts on Coinbase are millennials who use it to make small investments in crypto-currencies." – Fortune Magazine

- According to the article, hedge funds own 80% of digital currencies (what?!)

Cryptocurrencies today serve mainly as a vehicle for speculation by daring traders and from hedge funds that own 80% of the approximately $ 300 billion in digital currencies worldwide. – Fortune Magazine

- To enable clearing and archiving, Bakkt will build an integrated solution that will store digital resources such as Bitcoins in cold storage (where private keys are disconnected from the Internet).

- Currently the ICE has six warehouses and vertically integrated compensation structures with future ICEs. Using this experience, Bakkt will provide the first regulated exchange that also has clearing and filing as part of the package.

- Bakkt's proceeds will derive from trading commissions and Bitcoin storage fees.

- Pending approval, Bakkt will launch "One Day Futures", settled in actual Bitcoin, not cash.

The broker-dealer would click on a price published at any time during the day of trading on behalf of a money manager customer. At the close of the market, the ICE clearing house would have organized the transfer of cash from the buyer's account to the seller's bank account, and the Bitcoin tokens would have been en route to the Bakkt digital warehouse. – Fortune Magazine

- Bakkt plans to use an open source system similar to the Lightning network to keep most of the daily transactions off-line. This will allow for a huge scalability with the transmission of only occasional transactions to the main network to update the total value in their system (as when people sign up for the first time or when they leave, instead of any transaction between people or institutions that they already use their own system). [19659020] Once Wall Street gets buzzing flywheel, Bitcoin would get cash to become a bona fide currency. Sprecher and Loeffler expect the multinationals would adopt Bitcoin for international payments. "Banks control international payments and the system is very expensive," emphasizes Sprecher. – Fortune Magazine

The article continues to provide a long background of almost biographical nature about Jeffery Sprecher.

Bitcoin VS Wall Street?

I think many people have the impression that Bitcoin is either anti-establishment, or that it is under the control of the old system it was supposed to replace. They seem to think that it is a winner to take all kind of game, with zero sum at the end. I suggest that this is not correct, please allow me to explain why.

Bitcoin is like an onion

In my opinion, the Bitcoin as it is today will begin to become known as the "base layer". The interesting thing about technology with levels is that you can have your cake and eat it even if it is implemented correctly.

Here's how it works. On the first level, we have all the activities we see today, minus what is happening with the Lightning network. At the basic level, things are expensive, slow and seem to be "obsolete technology that is being replaced".

However, it turns out that the basic level (while still has to resize), does not need to be responsible for all the activities directly. This is because it is possible to build on Bitcoin, without doing everything directly on the chain (on the basic level).

Think about it this way. Go to Coinbase.com and decide to check the price of Bitcoin. Would you expect the web page you're viewing to be archived and uploaded by the blockchain itself? What about if you bought Bitcoins from Coinbase? Do you think it was a Bitcoin transaction?

Good, spoiler alert; everything that happened outside the chain. The only time you will create a real transaction on the basic level is if you sent Bitcoin to Coinbase, or picked up on another site or on your personal wallet (cold storage, etc.)

See, we are already using systems that touch the blockchain only if necessary, the network of lightning and the sounds of it, what Bakkt is building are just an extension of this.

In contrast to the lightning network, which is a trusted and decentralized network layer atop Bitcoin, the one built by Bakkt will be completely under their control (which is required for regulatory requirements) and limited by KYC / AML .

This means you can have them both! Yes, it is possible to have open, reliable networks and closed systems with reliable third parties. This means that no matter what builds Bakkt, I will always be able to interact with the basic level whenever I want. But it also means that investors and sellers can build on Bitcoin and create compliant systems that attract investors, traders and traders.

You can not build open and trustless systems on closed, trust-based systems. But you can build closed and trusted systems on an open system without trust, and that's what we're seeing happening right now!

This is a very exciting time, and I hope you have time to reflect on this for the future of our financial institutions and global trade; Change is coming.

What it means to you

Bitcoin today is a system run mainly by volunteers, but it is becoming the backbone of a new global financial system. Will Bitcoin be the last global reserve currency? Well, we do not know. Perhaps in the future, something better will come that can serve the same (or better) purpose. But, for now it is clear enough for me where the momentum is.

We live in a world that is upset by the new technology that is moving intermediaries, but that does not mean there will be no central power structures in the new world. It just means that things are changing. Some large players are moved, it's true, but it could only be the other big players moving them (like what Bakkt could do to Mastercard).

For me, it is no longer possible to doubt the potential of Bitcoin. If you think that the power of Bitcoin is only in its source code, then go make a copy now and see what happens. If that was enough, why did Mr. Sprecher not create his cryptocurrency instead of building on Bitcoin?

The reason is that you can not duplicate the community, you can not duplicate the miners, and you can not replace a nine-year blockchain with a scientific experiment and expect the same results. This is no longer just a crazy theory of a rogue software developer or an idea of "sky in heaven" that "might work one day", is happening right now and has the support of the crowd, nerds and more great financial institutions on the planet.

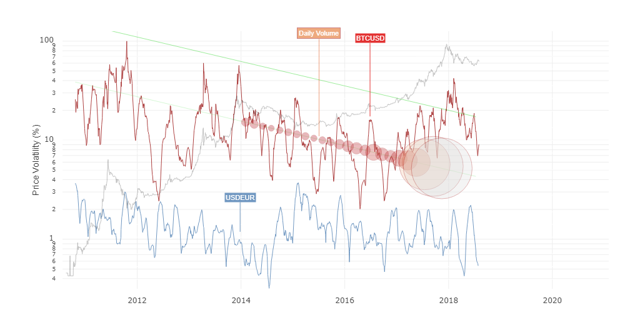

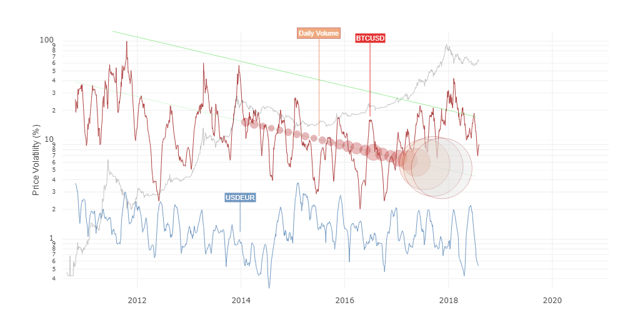

Over time, Bitcoin's volatility will continue to decline. In the end, Bitcoin can also be seen as boring. It's all a matter of perspective based on when you enter.

Image source: Woobull

Image source: Woobull Concluding thoughts

I would like to see some starting material that shows that hedge funds have 80% of all cryptocurrencies. This is the first time I've heard such a number, and it makes me doubt who exactly Bakkt wants to sell if the hedge funds are already inside. If you happen to have information on this, please post it in the comments section below.

Bakkt could be a turning point for Bitcoin, which could accelerate the adoption of many months, even years. It will be interesting to see how the regulators react, since all their plans will be based on their approval. Given what has happened so far with Bitcoin ETFs, this could prove to be a bigger challenge than expected. However, it is also possible that they worked behind the scenes and know things that we do not know. I guess we'll just have to keep them eye and see how it develops.

If Bakkt manages to keep a fraction of their promises, this article will be the best he has seen in the last year for Bitcoin. I'm not arguing that you go all-in on Bitcoin, but I think this is a blow to the fore that if you're looking at the market already, you may want to start paying more attention.

Have you heard about Crypto Blue Chips?

I am launching a market on September 1, called Crypto Blue Chips. I'd like you to join me while I launch my new private investment company that focuses exclusively on cryptocurrency. Get access to items that are not open to the public, look at our investment portfolio and much more. I hope to see you there.

Cheers,

Hans

Disclosure: We are / are long BTC-USD.

I wrote this article alone, and expresses my opinions. I'm not getting any compensation for this (other than Seeking Alpha). I have no business relationship with any company whose title is mentioned in this article.

[ad_2]

Source link