[ad_1]

[ad_1]

The volatile nature of the cryptocurrency market needs no introduction after its staggering gains in 2017 and subsequent losses in 2018. Looking at the market as a whole, however, it gives us a bigger picture of who the biggest were losers and what were the coins

Total Market Cap still 11 times bigger than in 2017

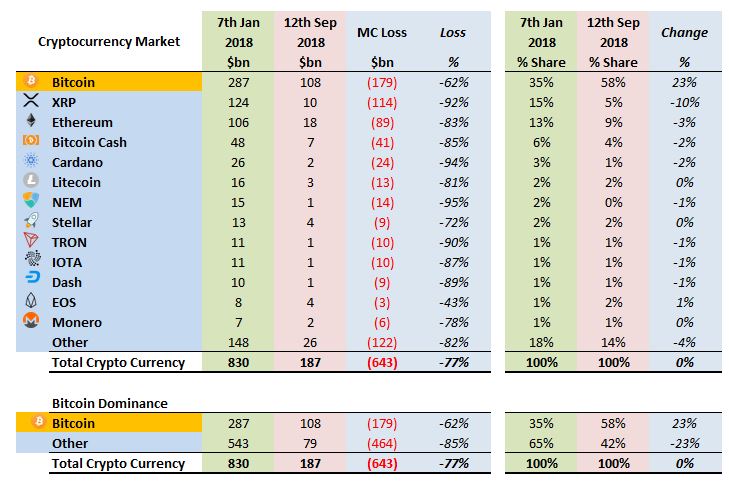

The total market capitalization of the cryptocurrency has reached a peak of $ 830 billion in the week starting from January 7, 2018, about $ 813 billion – or almost fifty for the week of 2017 which amounted to $ 17 billion, with Bitcoin 0 0 representing 35% of the total market share.

Nine months and the euphoria that took hold at the end of 2017 was replaced by desperation and total capitulation of many investors. The total market capitalization now amounts to $ 187 billion; a staggering $ 643bn or 77% lower than the previous highs in 2018.

It is important to note that while the 2017 hype cycle has somewhat reversed, total capitalization is still 11 times compared to the beginning of 2017. [19659007] While some of the latecomers to the 2017 market are the biggest losers, many investors in space are still in gain.

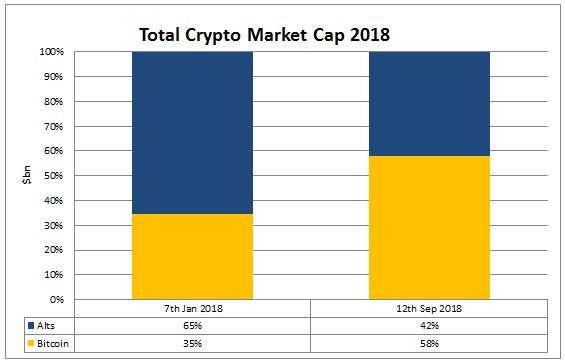

Total Market Cap 2018

Bitcoin 0 0 [19659006] lost the highest total value of $ 179 billion, representing a reduction of "only" 62% compared to the peaks observed at the • beginning of the year, however, compared to a reduction of 85% in that of the altcoins, which lost $ 464bn.

Having spectacularly inflated and subsequently deflated, we can take a closer look at the biggest losers in the market:

Ripple 0 0 NEM 0 [19659005] 0 Cardano 0 0 and TRON 0 0 have lost more than 90% of their value with the most other coins at the top are behind.

Ripple, Ethereum 0 0 and Bitcoin Cash 0 0 lost an amazing $ 244 billion; more than double the current total market capitalization of Bitcoin and almost the total value of Bitcoin at its top.

The only best currency to "outperform" Bitcoin is EOS 0 0 which lost only 43% of its value at the beginning of January 2018 and doubled its market share, according to data from Coinmarketcap.com .

Bitcoin Dominance

While the rest of the market seems to continue to fall, Bitcoin has represented a relative flight to security for many investors.

Bitcoin repurchased about 23% of altcoins' total market share, striking a dominant position of 58%, with no sign of slowing down.

So questions remain from where the fund for each cryptocurrency will be found, Bitcoin has stubbornly kept its market lows at around $ 100 billion as others have "decoupled".