[ad_1]

China Securities Network Lin Qian

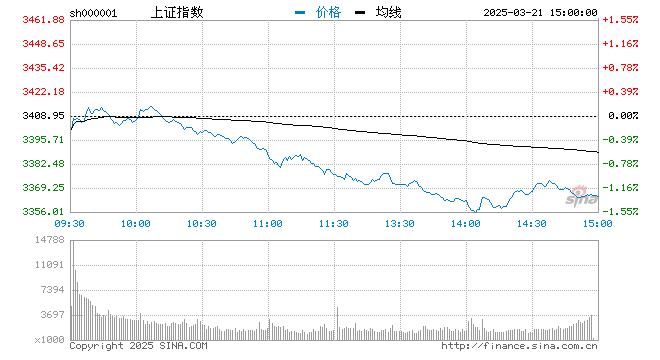

On the morning of November 24, the three major A stock indices fell collectively, with the home appliance sector leading the decline. According to Wind data, the Shanghai Composite index fell by 0.07% to 3412.08 points; the Shenzhen Component Index fell 0.17% to 13931.68 points; the ChiNext index fell by 0.17% to 2681.92 points. Half-day turnover of the Shanghai and Shenzhen stock markets was 519.69 billion yuan.

The 28 industrial sectors of Shenwan Grade 1 were mixed. Among them, the leisure services sector led the two cities’ earnings, with the defense and military, steel and communications industries leading the rise; appliances, building materials, the medical and biological sectors all decreased.

In the concepts industry, conceptual sectors such as rare earths, lithium mining, semiconductor and semiconductor packaging and testing ranked among the top earners; Conceptual sectors such as vaccines, gold jewelry, biological vaccines and innovative drugs have ranked the main declines.

Centaline titlesHe said investors are advised to pay close attention to investment opportunities in sectors such as wine, automobiles, chemicals, cement and building materials and non-ferrous metal automobiles in the short term. The middle line recommends continuing to pay attention to investment opportunities in some low valued blue chip stocks.

Sina Statement: This news is reprinted by the Sina Co-operative Media Posting this article on Sina.com for the purpose of providing more information does not mean that I agree with your views or confirm your description. The content of the article is for reference only and does not constitute investment advice. Investors therefore operate at their own risk.

Massive information, accurate interpretation, all in Sina Finance APP

Responsible editor: Ma Qiuju SF186

.

[ad_2]

Source link