[ad_1]

As financial investments lead to industrial direction, the industry expects there will be changes in the industry in general if the financial group preemptively goes green.

Shinhan Finance declares the first “Zero Carbon Drive” in East Asia

On the 13th, Shinhan Financial held the Social Responsibility Management Committee under the board of directors and declared “Zero Carbon Drive” for the first time in the East Asian Financial Group.

On the day, Yong-byeong Cho, president of Shinhan Finance, said: “The expansion of ecological finance is an essential role of finance for future generations. We will do our best to spread Shinhan’s good influence within the mission. of the group to help the world with finance “.

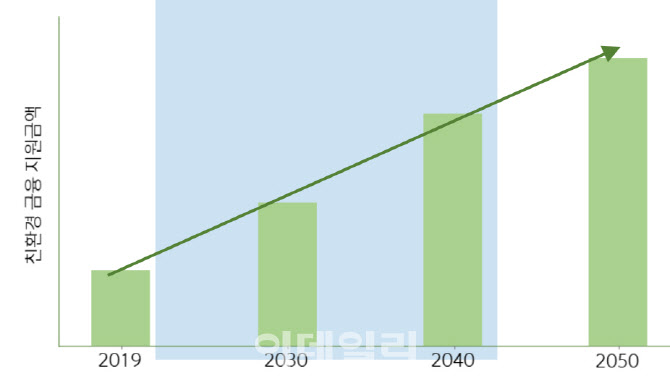

“Zero Carbon Drive” contains the contents of the reduction of loans and investments to companies and industries that emit a lot of carbon and the expansion of eco-friendly financial support by accurately measuring and systematically managing the carbon emissions of investment assets.

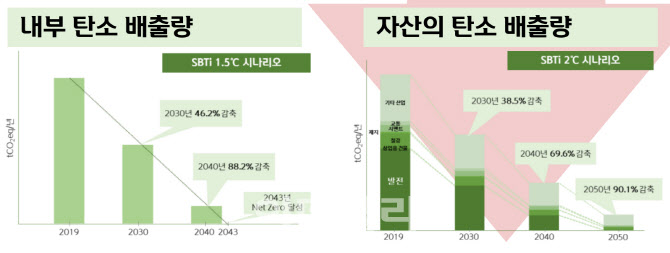

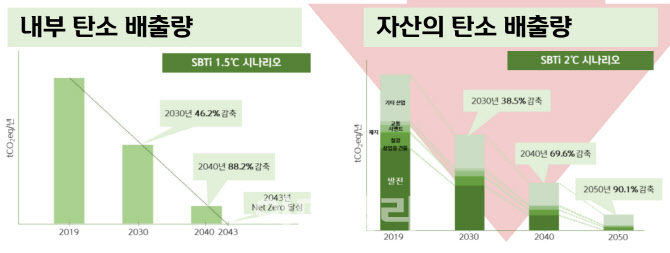

First, Shinhan Financial Group plans to reduce its carbon emissions by 46% in 2030 and by 88% in 2040 and by 100% in 2043. The group’s business portfolio also plans to reduce carbon emissions by 38%. % in 2030, 69% in 2040 and 90.1% in 2050. Instead, it replaces the carbon-emitting industry with loans to green tech companies or financial support for renewable energy.

|

Shinhan Finance has already created a database that calculates and manages carbon emissions for 1042 national companies, but to further improve the measurement of carbon emissions, the science-based reduction target (SBTi) has also decided to promote membership .

Shinhan Finance was the fastest way to present an eco-friendly topic in the domestic finance sector. In 2018, led by President Cho, he introduced the eco-friendly management vision “ECO Transformation 20 and 20”. It was an attempt to invest and support 20 trillion won in green industry by 2030 and reduce greenhouse gas emissions by 20% by establishing a social responsibility management committee under the board. The following year, Shinhan Bank began establishing an “equator principle” process that does not support environmental damage projects and, in September, was the first commercial bank in Korea to successfully join.

|

The Joe Biden era has opened … ‘Green is profit’

The reason why Shinhan Finance is accelerating climate finance is simple. This is because we believe that zero carbon emissions and the elimination of coal are now carrying risks. In the past, eco-compatibility was achieved at the level of companies’ “social contribution”, but the situation has changed as the global society pays attention to eco-compatibility since Corona 19.

The time for the Paris climate agreement to enter into force is approaching next January. Countries should reduce their carbon emissions to meet their target values. Korea alone has stated that it will reduce its carbon emissions by 37% by 2030. The European Union (EU) has proposed a 40% reduction by 2030. China has also announced that it will achieve carbon neutrality by 2030. 2060.

Furthermore, President-elect Joe Biden, who has become the new president of the United States, announced that he would join the Paris Agreement early next year. If the US and China-led leadership, the global G2, recovers in the climate domain, the global movement to minimize carbon emissions should accelerate further.

Therefore, when countries regulate carbon-emitting companies and focus on promoting eco-friendly technologies to deliver on their promises, the value of the high-carbon industry will naturally decline and the value of investments will inevitably decline.

Already overseas, Hong Kong and Shanghai Bank (HSBC), Barclays and the Australian ANZ have declared carbon neutrality by 2050 and are reflecting it in their business.

Not only Shinhan Finance, but also the entire national financial sector is strengthening its eco-friendly and coal-free movement. KB Finance has declared its coal financing and has decided not to take over domestic and foreign coal-fired power plants, related project financing (PF) and bonds. Samsung finance companies, such as Samsung Life Insurance and Samsung Fire & Marine Insurance, have also announced that they will stop investing in corporate bonds and direct investments related to coal-fired energy.

Korea Development Bank President Dong-geol Lee also said in a state audit that he will stop investing in coal and will not make new investments unless the government exports overseas. The Export-Import Bank also announced that it will further tighten its review of coal-related investments to minimize them.

An official from the financial authorities said: “The financial sector recognizes the importance of green investments and is accepting it more quickly. It will be.”

.

[ad_2]

Source link