[ad_1]

[ad_1]

WEPOWER It is a Lithuanian startup that aims to change the way in which renewable energy projects are paid. The government-guaranteed prices that pushed the growth of wind and solar energy worldwide have been reduced, says Nick Martyniuk, the founder of WePower. So his company wants to help developers of renewable sources to raise money by selling the electricity rights that their plants will produce once built. Customers will now purchase an intelligent contract, executed on the Ethereum blockchain, which will provide them with power at a later time.

The use of a blockchain offers several advantages, says Martyniuk, who worked as an energy trader. Large energy users such as foundries and aluminum smelters already negotiate these contracts with power plants, but they are often complex and time-consuming. Contracts on a blockchain could be offered on the shelf, allowing smaller companies, and perhaps, one day, individuals to use them too. Such contracts would be easily negotiable like any other crypto-activity, creating a secondary market in power agreements.

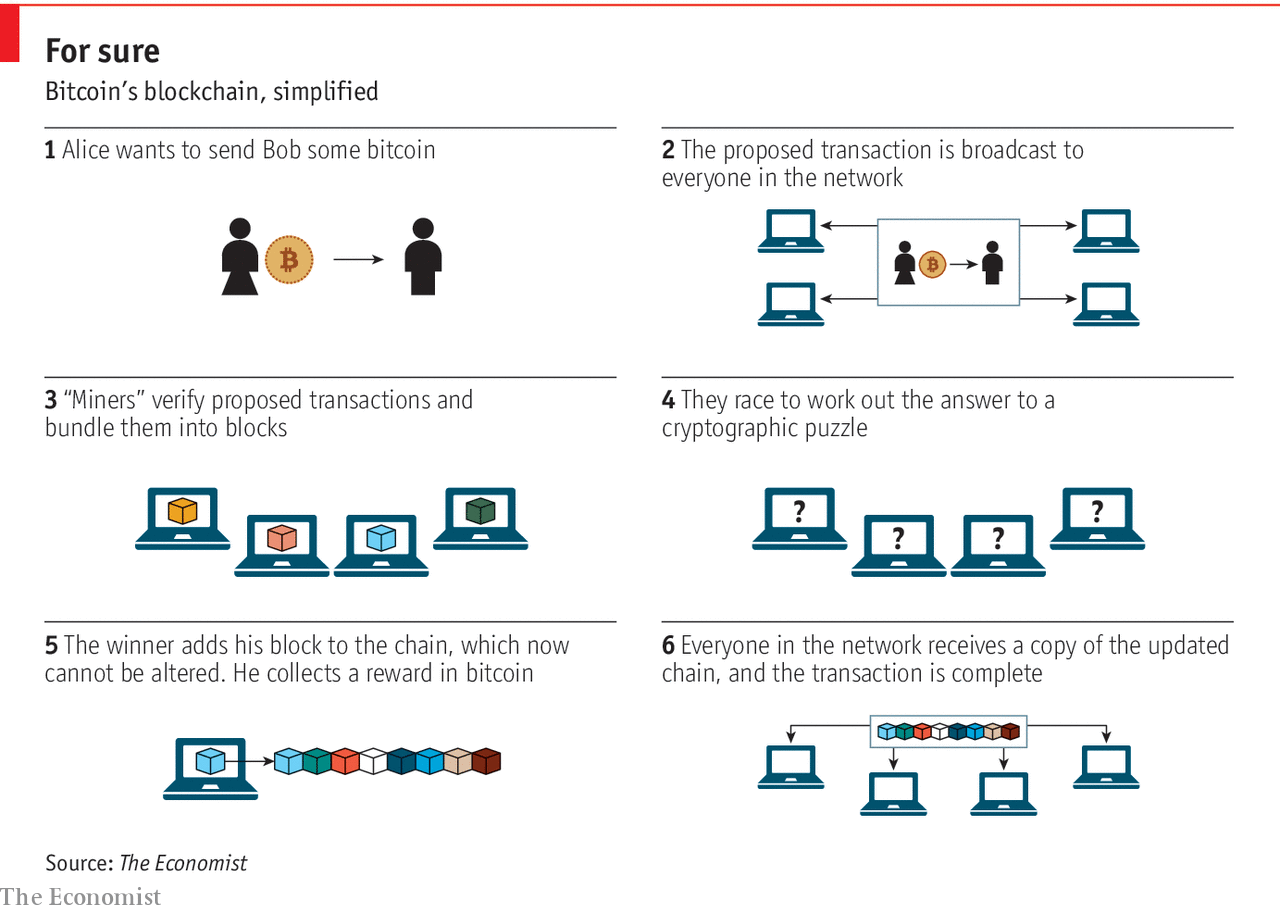

Blockchains that perform cryptocurrencies (see the diagram below) may have much larger applications than monitoring the history of electronic money transactions. Investors have taken note. Crunchbase, a corporate information company, believes that in the first five months of 2018 blockchain startups have raised more than $ 1.3 billion from venture capital companies, compared to about $ 950 million in all of 2017. Cloud computing platforms Amazon, IBM, Microsoft, Oracle and others allow users to experiment with the use of blockchain in their activities. Professional service companies such as Accenture and PricewaterhouseCoopers are lining up to advise customers on the new technology.

The idea is that because blockchains use distributed rather than centralized documents and are more tamper-proof than other databases, they can be applied to tasks by simplifying the archiving of medical records or commercial finance to ensure that diamonds and other minerals are ethically purchased. Santander, a bank, said the adoption of blockchain could save the financial industry $ 20 billion a year in back-office costs. Creative minds are already turning to exotic applications. LegalThings, a Dutch company, announced in April that it wanted to put sexual consent on a blockchain; the lovers would sign an unalterable electronic contract before going further and send copies to thousands of strangers for security.

The feature that most business blockchains share with the original bitcoin is that the information stored in a blockchain is retained by system users, not by a central authority, and that each entry is cryptographically linked to the previous ones and later. But companies do not share the ideological motivations of the bitcoin creators, so they can eliminate bits of bitcoin technology they do not need. For example, both Ethcoum bitcoins and blockchains are public and open to anyone, so a formal verification process is required for all transactions. But few companies are eager to put their back-office functions naked in the world, so most corporate blockchains are both private and "authorized", which means that access is limited to trusted users. Rope, a finance-focused blockchain developed by r3, a consortium of banks, and Hyperledger Fabric, originally developed by IBM and a company called Digital Asset, work this way. Allow only trusted participants to remove the need to waste the work trial systems used by many cryptocurrencies to update their records.

Most attempts to use blockchains remain temporary

Other vendors weaken cryptography that makes bitcoin transactions immutable. One reason for this is that European data protection law gives individuals the right to request that their data be removed from a company's servers and imposes severe penalties for non-compliance. Similar rules apply to medical data in America. But the entries in a standard blockchain, once created, can not be changed. Accenture has developed a changeable blockchain in which the content of individual blocks can be modified, leaving a digital "scar" to indicate that they have been modified.

Some business users prefer not to use the term "blockchain" at all, perhaps because they want to dissociate themselves from cryptocurrencies and their sometimes obscure reputation. Corda, Digital Asset and a number of other companies like to call it "distributed LED technology". But whatever the name of the game, there are plenty of uses proposed.

All together now

One common is to facilitate business transactions by allowing the various entities involved to tap into the same records. Simon Whitehouse, CEO of Accenture's financial services, believes that blockchains could help simplify supply chains by allowing records to be shared by suppliers, shipping companies, import agents, customs officials, and so on. This would also make it easier to resolve disputes where supply chains cross international borders, he says. At the moment all the parties involved in a supply chain use their own proprietary systems to track shipments, so the same data are used in different formats and places and must be transferred from one database to another. Replacing all of this with a single distributed database for everyone's use could offer great savings. Accenture is already driving such a scheme with a large technology company.

The financial industry is also experimenting with technology. Fusion LenderComm, developed by a company called Finastra, is running on the r3 blockchain. It aims to rationalize syndicated loan activities, in which groups of banks jointly provide large loans for infrastructure projects, linking individual banking systems to provide a coherent view of these loans between agents and lenders.

The Bank of Canada and the Singapore Monetary Authority are working together to investigate blockchain as a means of improving international payments. Banks from different countries often manage IT systems that can not easily communicate with each other, which makes payments slow and expensive. A single shared ledger could alleviate much of the administrative burden. Santander has launched a smartphone app called One Pay FX that allows customers to send international payments within seconds and tells them when they will arrive. Instead of the international financial standard, One Pay FX uses a closed, authorized, quasi-blockchain system operated by Ripple, an American company.

Encryption that protects entries in a blockchain from tampering could also be used to create solid logs of everything from property deeds to corporate accounts. Several countries, the most famous of Honduras, flirted with the idea of putting their land records on blockchain to protect themselves from fraud. DHL, a large logistics company, is testing if the technology could be applied to drug shipments. Everledger, which raised $ 10.4 million in funding in March, aims, among other things, to use blockchains to trace the origin of diamonds, from the mine to the wearer's finger.

Not so fast

Despite all the potential of technology, most attempts to use it remain uncertain. The blockchain owned by Honduras, originally announced in 2015, was finally abandoned in the face of official indifference. And some alleged successes are wildly exaggerated. At the start of this year, a wave of news that Sierra Leone had conducted the world's first blockchain elections, using software from a Swiss startup called Agora, had to be corrected on Twitter from the country's National Electoral Commission. He emphasized that the election had been counted in its database, which "does not use Blockchain in any way". Agora, it seemed, was simply observing the elections, and his blockchain counts did not correspond to the official ones.

The advantages of blockchain are often oversold. Because of the overheads involved in shuffling data among all participants, blockchains are less efficient than centralized databases, a problem that gets worse with an increase in the number of users. When the Bank of Canada tried to use blockchains to process domestic payments, which are already quite efficient, it found that they did not offer any benefits. Stripe, a large digital payments company, has abandoned its blockchain experiments after three years of attempts, describing technology as "slow and overwhelmed".

Talking about blockchain as "machines of truth" is particularly useless, says Kai Stinchcombe, who runs True Link, a financial services company for retired people. Many products, such as diamonds or luxury bags, already come with certificates of authenticity. A blockchain could reassure buyers that those certificates have not been tampered with. But it is not the same thing to show that they are true. "If you put the trash on a blockchain, all you get is distributed, encrypted trash," he points out.

One example is the case of Verisart, a company that hopes to reduce artistic fraud by providing certificates based on the blockchain of the provenance of an art work. Armed with an image of Wikipedia and a humorous sense of humor, Terence Eden, a developer of the digital service of the British government, has convinced the company to have painted a work titled "The Gioconda ". This information has been added to the Verisart blockchain, where it has been widely distributed and cryptographically protected. But this did not do well. The painting is better known as "Mona Lisa", created by Leonardo da Vinci in 1503. Similarly, says Mr. Stinchcombe, a blockchain can facilitate the verification of paperwork that purport to demonstrate that a diamond is ethically purchased, but can not prevent miners from falsely claiming that their products are legitimate.

The obvious way to think about blockchain is like a sort of database, even if it is difficult to find a more precise definition that commands the general agreement. The original blockchain, invented to power bitcoins, was designed to solve a specific problem, says Richard Brown, chief technology officer of r3, a blockchain company: "How can I build an electronic money system resistant to official censorship and confiscation?" Bitcoin carries out the work in a passive but extremely inefficient way.

Enthusiasts also begin to realize that even when a blockchain could be a suitable tool for work at hand, they will still have to solve the same problems as any other big IT project. Proposing a new standard is the easy part. The point is to convince everyone, including competitors with little mutual love, to agree on important details such as who will be responsible, how the system will be built, how data formats will work and what would happen if someone wanted to leave. As David Gerard, skeptic of the blockchain, says: "The blockchains do not solve the basic problem of agreeing what you want to do and how." The application of blockchain to highly regulated industries such as finance, says Brown at r3, means reassuring regulators that systems can function as planned and that systemic risks can be minimized.

The informatics emphasize that the ideas behind the blockchain are not new at all. For example, cryptographic links that protect entries in a block, known as Merkle trees, were first proposed in 1979. However, the impression of novelty can be useful. Sam Chadwick of Thomson Reuters notes that the word "blockchain" can help arouse interest among senior managers in the kind of back office enhancements they would normally consider boring. And once competitors are seated around a table, they find it easier to put aside their differences and find more efficient ways of doing business. Mike Pisa, of the center for global development, a charity, has studied possible uses of blockchain in poor countries and has discovered that "it is a word that can draw attention to things we could have done before. . "

Tim Swanson, at Post Oak Labs, thinks the blockchains are entering the "trough of disappointment" in the "hype cycle" proposed by Gartner, a technology consulting firm. At this point, after a first wave of excitement, reality reaffirms itself when the limits of a technology become evident. The key to making blockchain useful will be to manage expectations. And sometimes it is better to grant defeat. When Ujo Music tried to block the notoriously messy business of arranging payments to artists in the music industry, it was not successful. The musicians were fascinated by the technobabble; the technicians who had been called did not understand the industry they were promising to revolutionize. They concluded: "We are just some bright-eyed technologists with a special hammer, looking for the right nail".

Continue reading: from a cryptocurrency to thousands >>