[ad_1]

Ethereum Price Elliott Wave Spots of discussion:

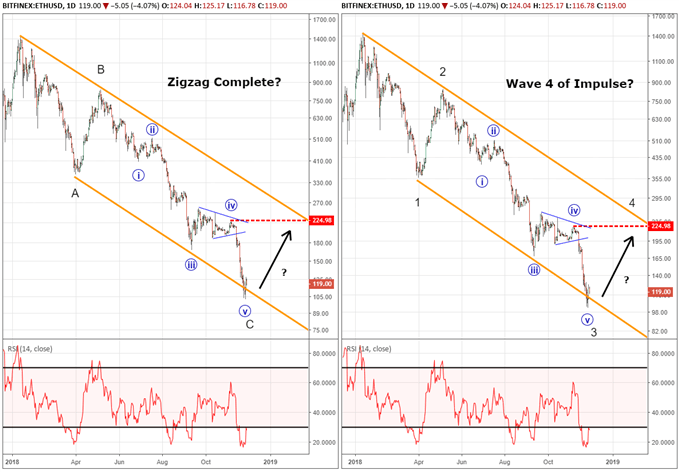

- The bearish wave of May 7, 2018 can be considered complete by opening the door for a big rally

- Elliott's wave pattern for this cryptocurrency implies a bullish break that could be in the horizon towards 225 and probably higher levels

- An immediate move below 102.20 does not nullify the long-term bullish forecast, but simply delays the bull's tendency

The price of Ethereum fell into a downward momentum from the May 7, 2018 high. Using Elliott Wave Theory as our guide, we can count the minimum waves in place to suggest that a large rally can be formed nearby if it has not already started. If the rally is successful in training, Ethereum could go back to 225 and possibly higher levels.

The current Elliott Wave for Ethereum

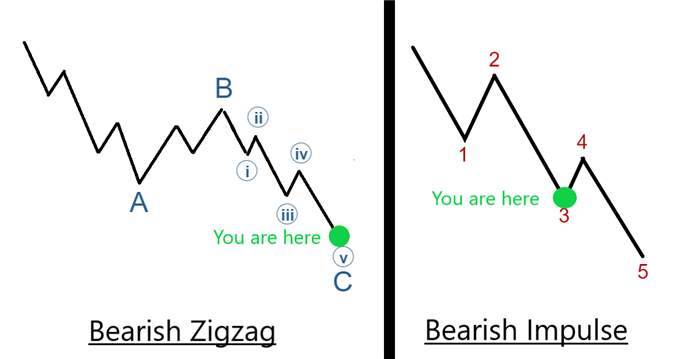

New for Elliott's corrective wave models? On page 5 of our Elliott wave advanced guide, we explain Zigzag and where they occur commonly.

The Ethereum price chart shows a wave of bearish impulse in effect since May 7, 2018. This downward impulse may be the wave 3 of a larger pulse or wave & # 39; C & # 39; of greater degree zig Zag. In both scenarios, a 225 rally would be considered normal. 225 is identified as the previous fourth wave of the bearish impulse.

At that point, the structure and form of the rally will help us determine if there is a potential greater than 225.

Can other coins give us a clue if the trend has moved higher?

Yes, we wrote at the beginning of this week Ripple plunges into the support while the bullish base develops.

We are uncertain if the rally has started to rise higher or if the rally starts from a last dive to below .33. In any case, we expect Ripple to keep above 0.25, which suggests that a manifestation of Ethereum looms nearby.

Frequently asked questions about Elliott Wave

What are the waves of Elliott Wave's impulse?

According to Elliott Wave Theory, the market shifts five waves in the direction of the short-term trend followed by a three-wave trend wave. An impulsive wave is one of two types of driving waves that denotes the direction of the trend. Therefore, if we see a downward pulse waveform, after a wave of the three wave counter trend, we can anticipate at least one other bearish driving wave. For Elliott Wave technicians who want more information, read our expert advice in our beginners and advanced trading guides.

Interested in cryptocurrency trading, but uncertain about Elliott Wave Theory? Read our guide to the day trading cryptocurrencies.

—Written by Jeremy Wagner, CEWA-M

Jeremy Wagner is a Certified Elliott Wave Analyst with the designation of a Master. These articles are designed to illustrate Elliott Wave applied to the current market. To see Bio page of Jeremy for the recent Elliott Wave articles to see Elliott Wave Theory in action.

Communicate with Jeremy and send your message below by posting in the comments area. Feel free to include your Elliott wave count as well.

Discuss this market with Jeremy in Monday US opening Webinar Bell.

Follow on Twitter @JWagnerFXTrader.

RECENT ELLIOTT WAVE ITEMS

S & P 500 Pattern Walks on the ledge like Dollar Steadies

Ripple Dips Into Support as a basic bullish build

NZDUSD Elliott wave analysis: the bullish momentum suggests to be more positive

[ad_2]

Source link