[ad_1]

| After | Price | Modify |

|---|---|---|

| 1 day | $ 113.0129 | 0.90% |

| 1 week | $ 112.7545 | 0.66% |

| 1 month | $ 112.9482 | 0.84% |

| 6 months | $ 186.1069 | 66.15% |

| 1 years | $ 392.9381 | 250.81% |

| 5 years | $ 1,485.9177 | 1,226.59% |

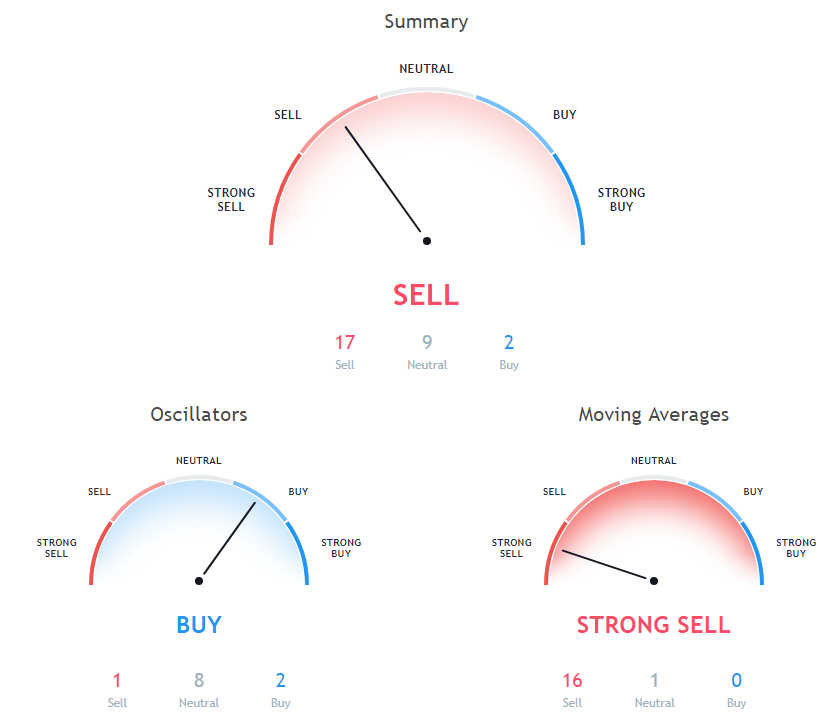

The stochastic oscillator is a momentary oscillator. The stochastic oscillator indicates the Buy action, with a value of 19.98.

The Relative Strength Index (RSI) is an important indicator for measuring the speed and variation of price movements. Its value ranges from zero to 100. The value around 30 and below is considered an oversold region and over 70 as oversold regions. Relative Strength Index is showing the Neutral signal, with value at 30.69.

The Commodity Channel Index (CCI) is a momentum oscillator used in technical analysis to measure the deviation of an instrument from its statistical average. Index of the goods channel shows a neutral signal, with a value of -64.58.

The 50-day moving average is at 177.39, showing the sales signal, Ethereum is trading below this at $ 112.01. 10-day exponential moving average is at 119.23, showing the sales signal, Ethereum is trading below this at $ 112.01. The 200-day exponential moving average indicates a sales share with a value of 307.82, while Ethereum is trading below it at $ 112.01.

5 days Exponential moving average means Sell since Ethereum is trading at $ 112.01, below the MA value of 114.33. 20 days of exponential moving average indicates a sales share with value at 134.44, Ethereum is trading below this at $ 112.01. 9 days Ichimoku Cloud Base Line is at 159.82, showing the Neutral signal, Ethereum is trading under it at $ 112.01.

10-day moving average indicates the sale share with value at 115.64, Ethereum is trading below this at $ 112.01. 100 days of simple moving average means a sales share with value at 203.83, Ethereum is trading below this at $ 112.01. The moving average of the 9-day hull indicates the stock Buy with value at 112.96, while Ethereum is trading below it at $ 112.01.

The 20-day weighted moving average is at 130.08, showing the sales signal, Ethereum is trading below this at $ 112.01. 30-day exponential moving average means a sales share with value at 147.85, Ethereum is trading below this at $ 112.01. The 5-day moving average is at 114.53, showing the sales signal, Ethereum is trading below this at $ 112.01.

50 days of exponential moving average indicates Sell since Ethereum is trading at $ 112.01, under the MA value of 168.67. 100 days of exponential moving average indicates Sell since Ethereum is trading at $ 112.01, below the MA value of 218.28. 20 days of simple moving average means Sell since Ethereum is trading at $ 112.01, under the MA value of 133.08.

Read also: 5 best exchanges of Altcoin and trading platforms of 2018

30 days moving average at 159.07, which shows the sales signal, Ethereum is trading below this at $ 112.01. The 200-day moving average is at 333.27, showing the sales signal, Ethereum is trading below this at $ 112.01.

Other technical analysis of prices for today:

The price of Bitcoin (BTC) decreased compared to the level of $ 3,750 – Bitcoin price analysis – December 4, 2018

Ripple (XRP) Price is in a bearish zone – Price trend analysis – December 4, 2018

Source link