[ad_1]

[ad_1]

Cryptocurrency markets are still on the floor; Minor earnings for most of the altcoin, the dominant climbs of the BTC.

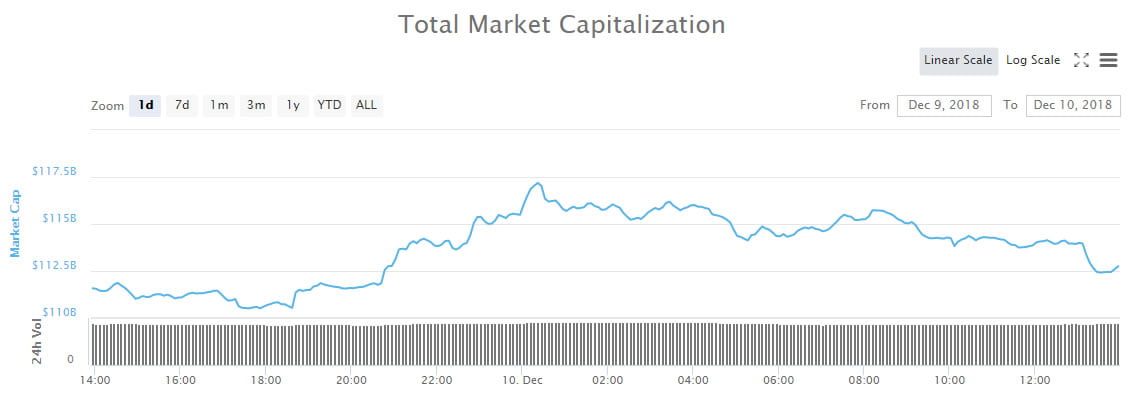

C & # 39; has been a bit of recovery from Saturday of all time for the year, but nothing significant. The total market capitalization is still bearish, hovering just above $ 110 billion at the time of writing. It could fall below this at any time, as the bears are still lurking.

Bitcoin has recovered almost 2% of the day to reach $ 3,570. It was up from its year low of $ 3,280 over the weekend, but the rebound was expected. BTC lost 11% from the same period last week when it was priced at $ 4,000.

Ethereum is still on the field with no earnings on the day, at the moment it is just over $ 90. At the time of writing, altcoins in the top ten are mixed, mostly green but earnings are minimal. EOS is leading the group with an increase of 8% to bring him to seventh place to just under $ 2. The rest is not moving much and, of course, Bitcoin's cash is falling again.

There is little movement in the first twenty during the Asian morning trading session. Dash is leading the pack with a 3% recovery on the day, Monero is not far behind.

The pumps operated by FOMO are happening at DEX, which has increased by over 30% during the day. Centrality and Aelf are both in double figures at the moment, but there is a lot more at the top end of the first hundred green. At the time of writing this article, there were no previous alt numbers that dropped two digits while the markets are fairly flat.

The total capitalization of the crypt is currently $ 112 billion, a marginal gain compared to yesterday's levels. Since the big dumps on Saturday have recovered 8.7% but are still on the floor. Since the same time last month, the capitalization of cryptocurrency has been reduced by half with a hundred billion dollars coming out of the digital gate. The bitcoin domain is the only thing on the rise when it comes to 55%.

FOMO Moments is a section that takes a daily look at the 20 best live shows during the current trading session and analyzes the best results, looking for trends and possible bases.