[ad_1]

[ad_1]

Bull & Bear Trading wants to recognize the significant contributions of Keith Taub for the origin and development of this article. The market experience and the analytical skills of Mr. Taub combine for a strong set of skills. These skills have proved invaluable in identifying winning operations. The short sale of Mr. Sears (OTCPK: SHLDQ) of Mr. Taub in the last year or so is just one example of his vision in seeing the likely results for the companies. Mr. Taub acquired the ability to thoroughly read company balance sheets. This vision helps him to accurately identify companies in difficulty, often before many other market participants. Bull & Bear is grateful for Mr. Taub's valuable contributions to this article. All opinions expressed belong to Bull & Bear Trading and do not reflect Mr. Taub's thoughts. This article does not provide any investment advice. Bull & Bear Trading discusses the trading ideas we may be involved in for our account, both long and short.

RIOT data of YCharts

RIOT data of YChartsAs the graph above illustrates, sometimes what happens must be discussed as was the case for the Riot Blockchain (RIOT) in nano-cap. The Securities Exchange Commission, SEC, took an investigative interest in RIOT and in the cast of characters who worked behind this company as disclosed on page 23 of the companies on March 31, 2018 10-Q.

Riot Blockchain is based in Castle Rock, CO, which is a rich suburb of Denver. For decades the Denver area has been a hotbed of equity assets where the creativity and mental gymnastics of local penny suppliers knows no boundaries. As a newly licensed stockbroker in 1986, I listened to disconcerting accounts from clients who had had bad experiences with Denver-based brokerage firms as described in this 1982 article. While there were dozens of nefarious companies Penny bail investors from the Denver area in the 80s and 90s, one of the biggest was Blinder, Robinson & Co. This company famously became known for the downturn of Blind's em, Rob & # 39; em & Co. The SEC eventually closed that company and sent prisoner Meyer Blinder to prison.

That was then, this is now. And maybe there's a clear connection between the thought and creativity outside the box of the old penny dealers and creative thinkers of today in Denver's public markets. Until August 2017, a stock of Castle Rock, a CO-based penny called Bioptix, fell 2.2% until it changed its name, you guessed it, Riot Blockchain in October of 2017. RIOT has risen above 600% to end the year as the highest percentage in Colorado. action. It seems that the individuals behind the name change into Riot Blockchain, finally, will hit the jackpot with their new corporate strategy given that the previous name of Bioptix was not good for the publicly traded company. Interestingly, the previous name of Bioptix was Venaxis. And the previous name of Venaxis was AspenBio Pharma, Inc. Do you get the picture? This entity had four different names including the current name of Riot Blockchain, which eventually captured the market's attention.

AspenBio Pharma changes the name of the company into Venaxis, Inc.

Venaxis reports the name change in Bioptics, Inc.

A biotech company has changed its name to Riot Blockchain

Source: Pixabay

Unfortunately for the people involved in this public market activity, RIOT drew the SEC's attention in two separate surveys. One of these two investigations was closed by the SEC, while the other survey associated with the citation from 9 April 2018 is currently active. An active SEC investigation can greatly complicate and even reduce the ability of a publicly traded company to raise capital. In fact, RIOT's 10-Q-201 dated October 10, 2010 revealed the withdrawal of their S-3 shelf registration for further sales of securities. This would imply that the ongoing investigation into the SEC would have a negative impact on their ability to increase equity. Without the SEC issuing an order of effectiveness, there would be no registration of securities. While the citation for April 9, 2018 is currently open during an active survey, there would be no issuance of approvals by the SEC for the acquisition of capital by the company. More threatening, as cited in 10Q, RIOT is in communication with the SEC enforcement division on various accounting issues related to a number of potential irregularities.

It is common practice that when the SEC spends considerable resources in an investigation, the commission would prefer to conclude expensive projects with results to show for their efforts. The higher the profile of the investigation, the more urgent the need for the SEC to appear productive becomes. When CNBC covers investigations for the entire international business community to see in plain sight, the SEC's highest level of motivation is recognized to examine their argument aggressively. The following is one of the CNBC investigations that appeared on the commercial channel:

CNBC investigates Riot Blockchain

Several key comments on 30 June 2018 10Q raise concerns. To paraphrase, the company recognizes in a comment that it is not able to determine the impact that an unfavorable SEC judgment might have on RIOT's ongoing operations. Given that RIOT's financial position could be within a few weeks of insolvency in its current conditions, the SEC may not have to take any action against this company. Due to unpaid invoices, it may be possible that RIOT simply ceases operations while the electrical service company interrupts the service to the energy-intensive cryptocurrency mining servers. Another possibility could be the issuance of a financial sanction of the SEC against RIOT. Any fine of any size could also force RIOT to default and a sharp decline in the price of publicly traded shares.

& # 39; Trader & # 39; s Idea Flow & # 39; he believes that in both cases, if the SEC simply decides to "run out of time" on RIOT or find just cause to impose a financial penalty, it is basically game over and goes off literally for RIOT.

The checkered history of the main actors behind the questionable activities of this publicly traded company has taken them to their current Waterloo. Perhaps the high-profile nature of the last move represented by these individuals in their risky RIOT venture was a too many questionable operation. The allegations of fraud alleged by the SEC for O & # 39; Rourke that are not related to its activities in RIOT led to his departure from the company and his resignation as CEO. This SEC complaint that appoints Honig, O & Rourke, Frost, Stetson and others has not only caused the departure of the RIOT CEO; but it also questioned the activities of RIOT's major shareholders. Andrew Kaplan, a newly released board member, has significant ties to Barry Honig and it has not yet been determined to what extent Andrew Kaplan was indeed an insider of RIOT. The federal government always prefers to have privileged witnesses to give independent testimony to confirm their committee's findings. Plea bargaining opportunities are often based on providing the government with cooperation and assistance in their investigations. It has been said that those who advance promptly to enter into an agreement with the authorities first are the most valuable and can therefore negotiate the best deal. Perhaps in the future we could learn of the cooperation given to the SEC by some former allies who built RIOT and other creative market schemes involving corporations.

At this point we have tried to communicate the seriousness of the RIOT situation in regards to the existing presence of the SEC in dismantling the main actors of the company and to make the company toxic for any serious new manager who joins the company. A significant number of people behind the scheme that has become RIOT are now subject to a SEC claim and have been dis-associated with the company. Furthermore, the company's S-3 company registration statement has been withdrawn indicating that there will be no capital increase. So without the previous management that drove this business, little chance of a capital increase, and with the SEC having the foot firmly on the throat of this expiring company, what remains to be determined? On 9/9/18 RIOT announced that the company's COO would now be CEO. It seems that the new responsibilities of CEOs can include the final closure of operations for RIOT.

This is where speculation about the financial condition of the company comes into play. It is possible that some kind of announcement by RIOT about their new dead status may be imminent. But when the market could expect such news, if it were to happen? This excellent article published on 11/9/18 on Seeking Alpha by The Stock Stooge has speculated that RIOT could remain without cash in the "next month or so". The financial results of RI3 of Q318 should be announced around 11 / 12/18 and could provide the company with an appropriate opportunity to make an announcement of insolvency or deceased status. Or maybe the company will extend its survival for a few more months, if they can avoid payments for their financial obligations.

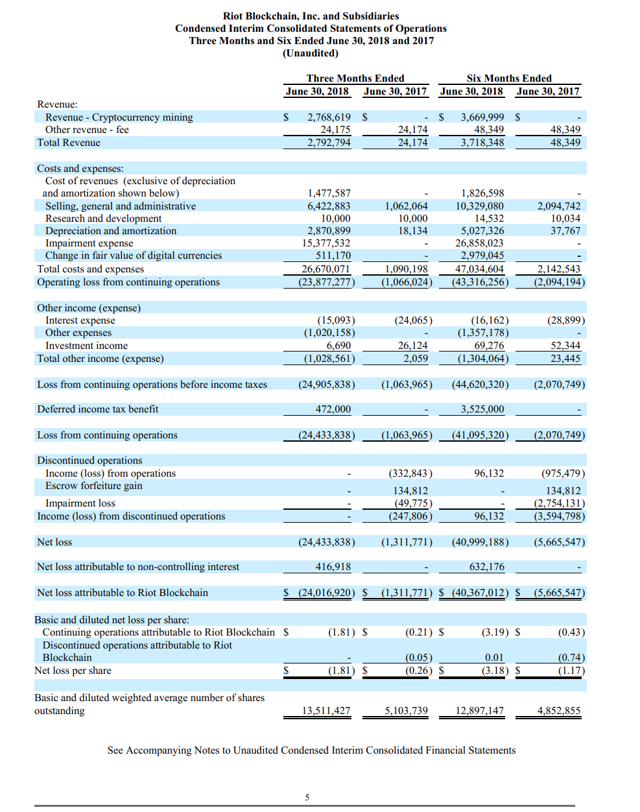

The results of Q218 indicate revenues for RIOT of only $ 2.77 million on mining production mainly of Bitcoin but also of Litecoin mine. However, Bitcoin reached $ 9,800 in the Q218 period and recorded an estimated price of about $ 8,000 per currency during the period. Today's Bitcoin price of 11/4/18 is about 20% lower. In this way reducing the value of such Q2 revenues by a similar percentage.

Source: Coinbase

The real problem with RIOT's failed business model is that the company continues to spend more on Bitcoin extraction than it does in terms of revenue. The result, which is based on the extrapolation of RIOT's revenue and expenses through the third quarter of 2008, shows that RIOT will end the fund to fund operations in mid-November. Based on this analysis, RIOT would need the price of Bitcoin to be around $ 14,000 per currency just to equalize. Current accounts and accrued expenses continue to rise, which means that RIOT ages its debts in an effort to pay off cash losses. This allows RIOT to remain in business by not paying current expenses. This could ultimately result in an abrupt closure of the business, as the creditors, ie their landowner and utilities, stop supplying the AntMiners that generate revenue for RIOT.

Consolidated statements of operations for RIOT found on page five of 10Q are not a good image: Summary

Summary

The news of Riot Blockchain, CEO and President John O & # 39; Rourke who resigned following the allegations of SEC fraud, were another gem in the coffin of this company. While the company, RIOT, has not been charged in this particular SEC case against O & Rourke, the company remains the target of another ongoing SEC investigation that could involve separate charges. The former RIOT shareholder, the eldest, Barry Honig, was also accused by the SEC of fraud. Honig and O & Rourke were RIOT's main control groups. In addition, Harvey Kesner, who was RIOT and Honig's lawyer, recently left his company and was also removed as a partner of his company. As a company, RIOT is now more toxic than ever and is unable to attract the kind of new talent and capital needed to remain solvent. The kind of individuals who dance on this shady, penny-rich stage do not like to have the spotlight on them for the benefit of the SEC and the national media.

The current price of $ 6.400 of Bitcoin is far below its peak of 2017 above $ 19,000. The trading volume is very low at this time and does not indicate any higher imminent move in this cryptocurrency. Bitcoin's mining business has become progressively more difficult and decidedly more expensive. The break-even cost for RIOT would require Bitcoins to trade at around $ 14,000. This price moves higher in Bitcoin does not seem to be probable right now. It is questionable how long RIOT can incur Bitcoin mining money-losing operations at a higher cost than the benefit.

Due to the ongoing SEC investigation, RIOT will not be able to raise capital through public markets. The current investigation could result in an unfavorable decision by the SEC which results in negative consequences for the company. The range of punitive actions that could be adopted by the SEC range from criminal charges to the imposition of a financial penalty. It is arguable that RIOT can even afford the kind of ongoing expenses that any legal defense would require. And the weight of a financial penalty or SEC penalty could also force the company to default.

And then there are collective legal actions, which are backed by the SEC fraud charges against many of RIOT's former executives and financiers, and by the ongoing investigation into RIOT's irregular accounting. These collective lawsuits could be considered worthy and could go ahead in court. If this happens, then RIOT simply does not have the financial capacity to defend itself in court as the company can not afford the legal fees or any kind of settlement payment.

Certainly it seems to be a question of when and if not RIOT will announce the news of their imminent insolvency.

Conclusion

According to the analysis of the Q218 RIOT 10-Q it could be cashless by the middle of November. RIOT management may have extended its debts as far as possible during that period of time. The company could undergo an abrupt closure of cryptocurrency miners while the power goes out.

If RIOT is able to renegotiate the final payment date of $ 1.5M for the AntMiners, it does not change the inevitable, but only kicks the jar a month or two before their accounts pay and the expenses accumulated there. reach. They have 90 days to pay these expenses and that clock started the countdown about 30 days ago. Can Riot survive to see the new year? Possibly.

An announcement of news about the company's demise could bring the stock down to below $ 1 per share fairly quickly. Further price declines could follow the initial selloff as news spreads that mining operations have ceased and RIOT is now deceased. And if there is no plan to recapitalize the company or bring in competent management with a legitimate business plan, then the long journey for this entity that has been known as AspenBio Pharma, Venaxis, Bioptix and finally Riot Blockchain since October 2017 it could finally be in a dead end. Soon the market could say: "Rest in peace Riot Blockchain, we barely knew you".

RIOT data of YCharts

RIOT data of YCharts

The members of our Merchant Ideas Flow community always receive our trading ideas and updates first. Traders know that timing is everything. Receiving information in advance and preparing ahead of the competition is invaluable. Please feel free to try our marketplace service, Trader & # 39; s Idea Flow for free. A single successful trading idea can cover the cost of many years of the very affordable subscription price.

Revelation: I am / we are short RIOT.

I wrote this article alone, and expresses my opinions. I'm not getting any compensation for this (other than Seeking Alpha). I have no business relationship with any company whose actions are mentioned in this article.

Editor's Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

[ad_2]Source link