[ad_1]

[ad_1]

Bitcoin mining operations in the United States and China are facing closures after the bitcoin downtrend means they may no longer be profitable.

The most precious cryptocurrency in the world is currently trading at around $ 4,500, having lost almost a third of its value within a week.

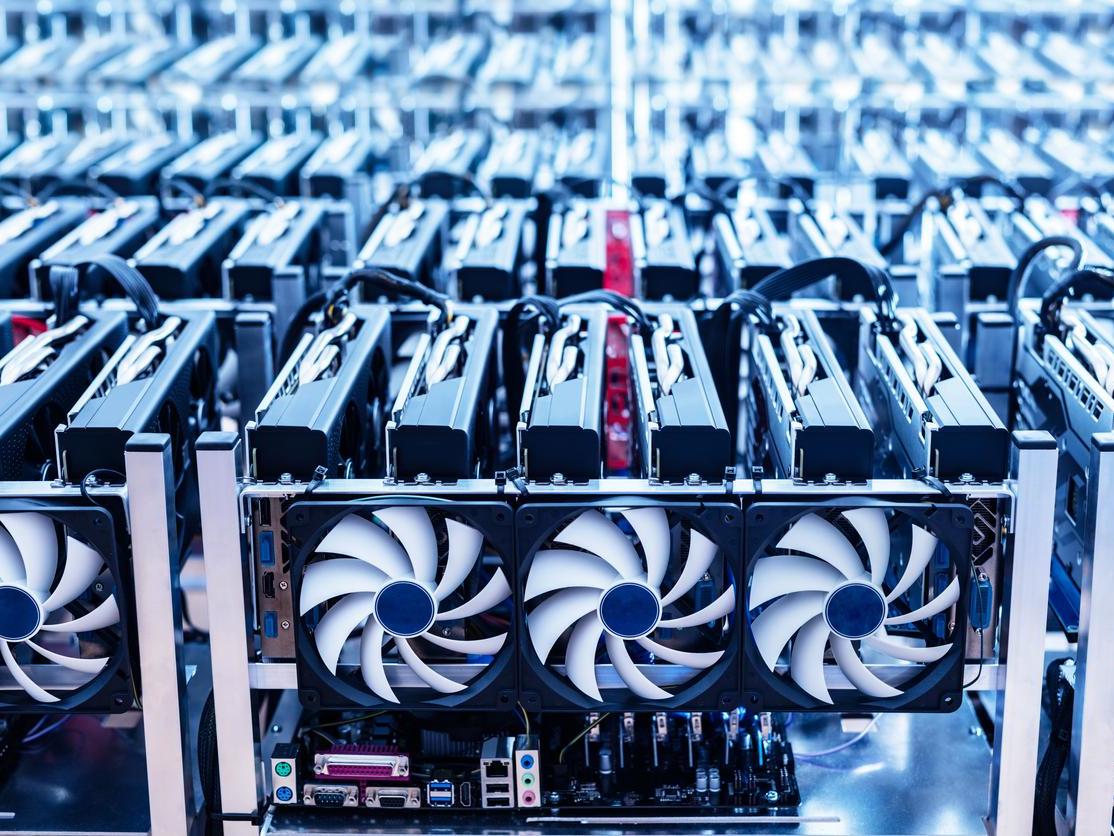

Bitcoin mining – the process of generating new cryptocurrency units by solving complex puzzles – requires huge amounts of electricity to power the computers that perform the calculations.

This means that the profitability of mining decreases when the price of bitcoin decreases and, if the price goes down too much, the operations may no longer be economically viable.

1/8 Satoshi Nakamoto creates the first bitcoin block in 2009

On January 3, 2009 the bitcoin genesis block appeared. It was less than a year after the pseudonym creator Satoshi Nakamoto described the cryptocurrency in a document titled "Bitcoin: a peer-to-peer electronic payment system"

Reuters

2/8 Bitcoin is used as currency for the first time

On May 22, 2010 the first bitcoin transaction took place in the real world. Lazlo Hanyecz bought two pizzas for 10,000 bitcoins – the equivalent of $ 90 million at today's prices

Lazlo Hanyecz

3/8 Silk Road opens to business

Bitcoin soon gained notoriety for its use on the obscure web. The Silk Road market, established in 2011, was the first of hundreds of sites to offer illegal drugs and services in exchange for bitcoins

4/8 The first bitcoin ATM will appear

On October 29, 2013 the first bitcoin ATM was installed in a coffee shop in Vancouver, Canada. The machine allowed people to exchange bitcoins in cash

REUTERS / Dimitris Michalakis

5/8 The fall of MtGox

The world's largest bitcoin exchange, MtGox, filed for bankruptcy in February 2014 after losing nearly 750,000 of its bitcoin customers. At the time, it was about 7% of all bitcoins and the market inevitably crashed

Getty Images

6/8 The real Satoshi Nakamoto would get up, please

In 2015, Australian police broke into Craig Wright's home after the businessman claimed to be Satoshi Nakamoto. Then terminate the complaint

Getty Images

7/8 The great division of Bitcoin

On 1 August 2017, an unsolvable dispute within the bitcoin community saw the division of the network. The fork of bitcoin's underlying blockchain technology has generated a new cryptocurrency: Bitcoin money

REUTERS

8/8 Bitcoin price sky rockets

Towards the end of 2017, the price of bitcoin rose to almost $ 20,000. This represented an increase of 1,300% compared to its price at the beginning of the year

Reuters

1/8 Satoshi Nakamoto creates the first bitcoin block in 2009

On January 3, 2009 the bitcoin genesis block appeared. It was less than a year after the pseudonym creator Satoshi Nakamoto described the cryptocurrency in a document titled "Bitcoin: a peer-to-peer electronic payment system"

Reuters

2/8 Bitcoin is used as currency for the first time

On May 22, 2010 the first bitcoin transaction took place in the real world. Lazlo Hanyecz bought two pizzas for 10,000 bitcoins – the equivalent of $ 90 million at today's prices

Lazlo Hanyecz

3/8 Silk Road opens to business

Bitcoin soon gained notoriety for its use on the obscure web. The Silk Road market, established in 2011, was the first of hundreds of sites to offer illegal drugs and services in exchange for bitcoins

4/8 The first bitcoin ATM will appear

On October 29, 2013 the first bitcoin ATM was installed in a coffee shop in Vancouver, Canada. The machine allowed people to exchange bitcoins in cash

REUTERS / Dimitris Michalakis

5/8 The fall of MtGox

The world's largest bitcoin exchange, MtGox, filed for bankruptcy in February 2014 after losing nearly 750,000 of its bitcoin customers. At the time, it was about 7% of all bitcoins and the market inevitably crashed

Getty Images

6/8 The real Satoshi Nakamoto would get up, please

In 2015, Australian police broke into Craig Wright's home after the businessman claimed to be Satoshi Nakamoto. Then terminate the complaint

Getty Images

7/8 The great division of Bitcoin

On 1 August 2017, an unsolvable dispute within the bitcoin community saw the division of the network. The fork of bitcoin's underlying blockchain technology has generated a new cryptocurrency: Bitcoin money

REUTERS

8/8 Bitcoin price sky rockets

Towards the end of 2017, the price of bitcoin rose to almost $ 20,000. This represented an increase of 1,300% compared to its price at the beginning of the year

Reuters

The biggest victim so far has been the US-based mining company Giga Watt, which was forced to apply for Chapter 11 of bankruptcy this week after it was unable to pay debts of about $ 7 million.

"The company is insolvent and is not able to pay debts when it is due," said the deposit, according to CoinDesk.

"The company and its creditors would be better served by the reorganization of the company pursuant to Chapter 11 of the Bankruptcy Code."

Bitcoin suffered two major price drops in less than a week, after months of market stability (CoinMarketCap)

Most bitcoin mining operations are based in China, where electricity costs are among the lowest in the world.

Yet, despite low-cost electricity, images and videos of mining operations that have broken down in the country have spread among social media.

Suanlitou, a mining platform based in Hong Kong, announced this week that it has not been able to cover electricity tariffs for a period of 10 days in November, according to the South China Morning Post.

Another group of Chinese miners of Chinese cryptocurrencies has also arrested 20,000 mining drilling rigs due to declining profitability.

It is not clear what the future will be for the price of bitcoin, with some analysts predicting more falls, while others expect the market to experience a reversal of trend by the end of the year.