[ad_1]

[ad_1]

Introduction

In order to understand why people are excited about blockchain technology and cryptocurrencies, it is useful to take a step back and understand some of the limitations of our current way of organizing the world. We are becoming a world society; reorganizing it to be more efficient.

One of the breakthroughs of Bitcoin (BTC-USD) (COIN) (OTCQX: GBTC) The blockchain was a way of achieving a distributed consensus without a central authority. The first one was coming from the pipe.

Before we begin; a word of caution. Not all blockchain projects are a good idea. Be wary of people using blockchain as a buzzword, which is what it has become.

Let's start with some applied science.

The Speed of Light Problem

One of the limitations we are on a planetary scale is how to synchronize computer systems. The way the GPS system works with a bunch of clocks orbiting the earth. Depending on your position, we can calculate the difference between how many satellites. With a high level of accuracy.

Without the speed of light limitation, the GPS systems would not work. However, this also presents us with the problem of knowing the order in which events occurred when synchronizing computer systems in different locations.

In order to solve the problem of the problem, the solution will be a centralized system. This enables high frequency trading, in which the cables from the central server are measured down to the nearest millimeter and connected via fiber optics. If my cable is fractionally shorter than yours, I can execute a trade faster than you.

Limitations of the Current System

Now, since trading on the FOREX markets, or stock market, or any market is done in this way; you might be wondering what the problem is. Why do we need a solution to this approach?

Well, it comes down to trust and control. If the central exchange is in New York, then what happens when the US and China escalate? Who is going to arbitrate disputes? Would you trust another country to have this kind of control if there was an alternative?

This problem goes much deeper than tension between the US and China. Think about all the geopolitical turmoil going on today. We had the Arab Spring, look at the situation with the WTO, look at the situation with Russia and the Crimean peninsula, disputes over the islands near Taiwan, NAFTA … the list goes on.

This tension results in lost opportunities, and world leaders have been looking for alternatives. Further issues are complicating the US dollar as a centerpiece of global trade. Do you think the whole world trusts the USA to deal fairly with them? They accept the current state of affairs because right now, what's the alternative?

How Blockchains Handle the Speed of Light Issue

The approach of Bitcoin and Ethereum (ETH-USD) is a blockchain to address the speed of light issue. "Stop time" every ounce in a while; reach consensus on what happened in the time frame, write these transactions to the block and then continue on. With Bitcoin, you get a block every ten minutes or so, and with Ethereum it's every 15 seconds on average.

What this does not mean to a central authority. Bitcoin has been doing this since 2009, and Ethereum since 2015.

Bitcoin back and forth? Decentralization on a number of levels. If you keep a blockchain in a central repository, what has been gained? If there's someone who can edit, approve, or change to record by force; then why would anyone trust the new system?

People who do not want to let go of control. But, that's exactly what needs to happen if we're going to be a source of truth without a single person sitting behind the kill switch.

Friction in the Current System

Have you had to ship something internationally recently? What was that experience like?

It has been estimated that when we started shipping things in containers; there was a boost of perhaps 7% to global GDP. The net effect is positive, which can be standardized, automate, and agree on the common protocols (the standard effect of shipping containers).

Paper bills of lading are obviously not the future. What is the opportunity cost that we are paying for? Why have we switched to something else by now?

I think the reason we are a digital bill of lading system is because we are in the hands of a central digital authority. It's too hard to reach agreement about what standards are going to run the thing.

How many assets are underutilized today because we are stuck in our old modalities? Is there another way?

Think about the value that was unlocked by AirBNB (AIRB) and Uber (UBER) for example. Houses, cars and people were being underutilized!

Blockchain – the Long Term Solution

It is possible to automate global supply chains and trade. The puzzle has many parts, and we are clearly not there yet. But, if we can chip away at digital identity, automating ports and logistics, and creating digital bills of lading; then we will approach future that is richer in opportunity simply by activating underutilized assets and removing friction.

Smart computer systems that know the rules of each jurisdiction could automatically and faithfully execute their code and calculate the optimal route, determine price and all global rates, and allow full auditability and visibility.

Moving day around and right now. Projects like Bitcoin and Ethereum are proof that such a system can work. What we need is a reliable way to connect physical objects to digital systems.

Criticism and Skepticism

Only people can claim that it is organizing the world's value and information on a blockchain is patently absurd because it can only process so many transactions per second. However, to those people I would like to introduce two concepts. These concepts are that of the hashing function, and the Merkle Tree.

It does not matter what kind of function it does, it takes a certain length of time.

What a Merkle Tree does (from other things).

Taken together, this means that you could condense down to almost infinite amount of data into a single output; only a single transaction to the blockchain. Then, someone could verify a shipment easily using that one hash that was written to the blockchain. How's that for efficiency?

Store of Value

Some people think that Bitcoin is failing because it does not store value. If Bitcoin is failing, then maybe there is so much to this whole blockchain thing, or so the thinking goes. Or, maybe the blockchain is a good thing but Bitcoin, not so much.

Well, I'd like to refute this misunderstanding from the Keynesian Economists once again. First, Bitcoin was not designed to "store value." Are you shocked and surprised by this? Go read the Bitcoin white paper and search for "store of value."

Bitcoin was designed in that way, and the number of users would increase over time. This creates more demand, which pushes up the price over time.

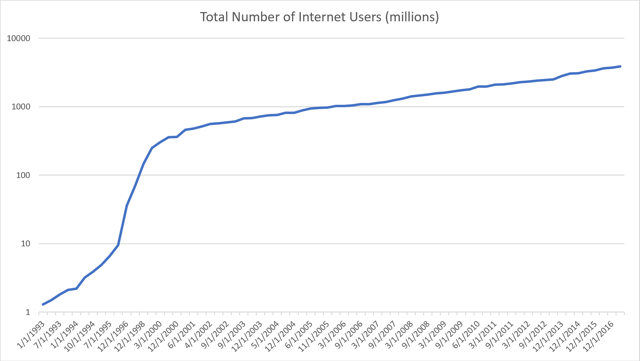

Do not believe me? Let's look at a chart. After all, data is king.

Source: blockchain.com and author's charts

Source: blockchain.com and author's charts

See how Bitcoin has increased in price by a factor of 10, five times now? Can you also see that it's time for another factor of ten, people panic and price goes down for a bit? Can you see that after the dip, the price goes up again?

Bitcoin is working just fine. I apologize to the economists in the room who can not accept reality. It's time to wake up and smell the Bitcoin, folks.

How to Position Your Portfolio

It was the emergence of the internet. It was a general sense that something big was happening, but it was difficult to know what to do about it.

We have this exponential growth of the new technology, which we have seen as the potential for change, but we have a lot of confusion about what is meant to be a big deal.

Source data: InternetWorldStats

Here's a Nobel prize winning Keynesian Economist on the subject:

The growth of the Internet will be drastically, as the flaw in 'Metcalfe's law'-which states that the number of potential connections is becoming more common. each other! By 2005 or so, it will be clear that the Internet has been no longer than the fax machine's. – Paul Krugman, 1998

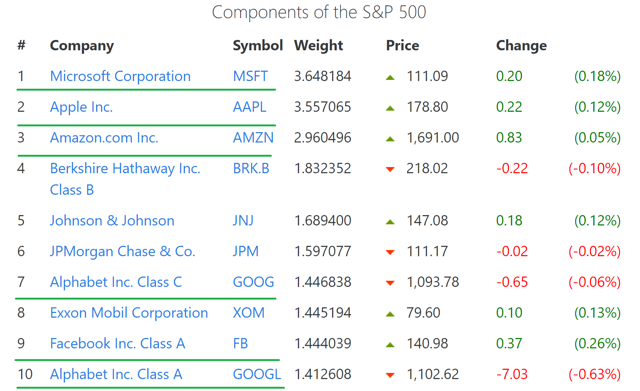

We saw the emergence of the tech companies. The dotcom bubble is still talked about like a running joke. But, have you seen which companies are the most valuable today?

Source: Slickcharts.com

Source: Slickcharts.com

Will the blockchain revolution play out like the internet revolution? I think the answer is "partly." But, there is one key distinction that we need to discuss.

Blockchain flips the value capture to the network itself

With the internet, it was not a good way to "own" the infrastructure. You could invest in telecom companies, with the idea that everyone has to pay online in some way or another. But, this strategy hardly seems like it was the best. AOLs have been trying to capture people and actually become their platformer. But, that did not work out.

Fast forward to now, and look at what happened with the ICO craze. One of the reasons that the last cryptocurrency bubble was made in a single stroke, Ethereum made it possible for their own project and their own digital currency.

Fundraising for these ICO projects was done with Bitcoin and Ethereum, which put a massive upside pressure on the price. However, when it became clear that the blockchain networks were not ready to handle the amount of traffic they were getting bombarded with; the whole game started to unravel. After that, the SEC started to get more active in regulating these offerings as securities, and the bubble was popped.

Ethereum Close Price data by YCharts

Ethereum Close Price data by YCharts

You can see from the chart above, that the price of ETH was impacted to a much greater degree than the price of BTC. Also, much like the dotcom bubble, this is not the end of the line for these new technologies.

What happens next?

I see two key trends emerging in the next few years.

- We will see expanding use cases for blockchain technology, like logistics, supply chain and automation. These use cases will be synergistic with the IoT and the emergence of machine learning systems. These technologies will be smarter and get simply woven into the fabric of daily life in the same way that smart phones and social media have done already.

- Platforms like Bitcoin and Ethereum will implement the following wave of adoption. In fact, this is already happening now. People said they would not come. We're going to see the same thing with blockchain technology.

As blockchain technology gets adopted, holders of these cryptoassets will be the primary beneficiaries. But, eventually the benefits of hyper-liquid physical and digital assets will benefit everyone. I think this technology is going to change the world in ways we can not even imagine right now.

At the very least, investors need to be aware of what's going on in this asset class.

Not so long ago, some experts would be used, and that tablets would only be used as expensive coffee trays. I know I think it may be wise to dismiss virtual currencies. – Christine Lagarde, IMF Managing Director

Investors need to understand the risks and opportunities posed by new technology. Getting informed and ultimately involved with Bitcoin or Ethereum is a great place to start, even if these crypto assets only end up being the tip of the iceberg.

Conclusion

As Vinay Gupta says:

First we organized information, matter is next.

We do not know exactly what the world will look like in the future. But I believe we will see more blockchain-like systems and not less.

I think Bitcoin paved the way for this revolution. But in the long term, we'll see that when we become one of the primary ways that we organize our world, that the value of Bitcoin (and Ethereum) is only reinforced.

If you have the time, I recommend watching this video.

This article was published first in Crypto Blue Chips.

disclosure: I am / we are long BTC-USD, ETH-USD.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

[ad_2]Source link