[ad_1]

[ad_1]

Bitcoin could be sold, according to estimates provided by coinfairvalue.com, a website that estimates "fair value", a metric that takes into account the supply of money, the amount of money lost and the speed of money, a indicator for how much value has been exchanged. It is a rather different way of considering the value of cryptocurrencies compared to that offered by websites such as coinmarketcap.com, as there is no distinction between the circulation of supply and offer.

The currency fair value model used by coinfairvalue to estimate a price of $ 7.415 per bitcoin uses several variables derived from the Austrian economy to approximate a price per currency that is about twice the current Bitcoin market price. This model, which does not use any market data, has been proposed on a Steemit post by the pablomp user about 2 years ago. Since then, he has been selected by relevant members of the cryptographic space as Tom Lee, head of research at Fundstrat Global Advisors.

Read more: The price of Bitcoin (BTC) should be $ 14,800, according to Tom Lee's "fair value" metric

With their way of accounting for supply data, Coinfairvalue.com could be a great way to take into account the effects of whales and in general a large concentration of capital on the market. As their website mentions in the methodology section:

"Pay attention in cases where a low speed of money is a consequence of the issuer of a token or of the company that holds most of the currency offering. In these cases, a single person can change the overall speed of the currency in an unpredictable instant".

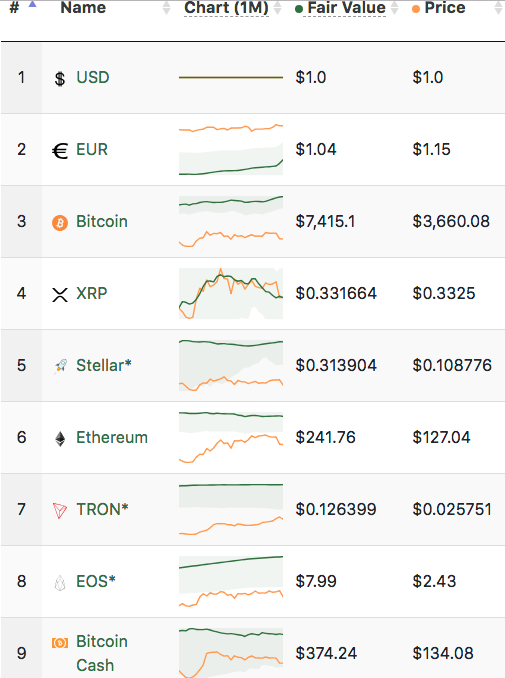

The model shows similar results for other cryptocurrencies, Ethereum price at $ 241.76, Stellar at $ 0.31, TRON at $ 0.12, or EOS at $ 7.99:

The XRP is the famous exception (along with the euro, which is also considered overvalued against the dollar) when it comes to estimating higher prices than current trading values, since its "fair value" in USD for token it is only 0.331, compared to 0.332 reported by normal means.

Reddit received the proposal with mixed feelings, including some confused members of subreddit r / CryptoCurrency who tried their luck to sell with a bonus:

Paper

Paper

It seems that market capitalization will remain for a while as a reference metric when it comes to evaluating cryptocurrencies. However, the fair value proposal could just be an interesting way to get a new price-independent sneak peek behind Bitcoin.

Read more: Are we measuring the wrong market capitalization? The actively developed crypts do not always translate into better market capitalization

Follow Chepicap now chirping, YouTube, Telegram and Facebook!

[ad_2]Source link