[ad_1]

Tether is the project you love, hate or know nothing. For individuals who fall into this last category, here is a quick overview of this often controversial topic.

Tether Remains A Controversy

Tether is a stablecoin that is intrinsically linked to the value of a US dollar and is supported by legitimate reserves. Many use the USDT as a method to find comfort in a bear market, since you can exchange your altcoins / bitcoins in Tether, in an act called "tethering", to maintain the dollar value of your holdings.

Despite the fact that the USDT has quickly become the ninth most valuable project in the industry, many remain skeptical about the funds behind the project, as Tether's organization has been slow in getting the documents showing that it holds 2.5 billion dollars in its reserves. While the Tether organization, which has been linked to the Bitfenix management team, has fired its auditors at the start of this year, since then it has shown some evidence to suggest that there are funds that return the 100% of USDT tokens.

Although fears around its USD reserves may have declined, the USDT has still remained a prime subject of litigation within the cryptocurrency community.

As reported by Ethereum World News, the researchers claim that the USDT was used to raise the price of Bitcoin throughout 2017. According to the research paper, which was accepted by the University of Texas, the stablecoin was used to artificially inflate the price of Bitcoin after (or during) a sharp decline

Not only the fears of manipulation surround the project, but also the technical problems. According to SlowMIst, a cyber-centric cyber-centric Chinese cyber-centric team, an unnamed exchange has falsely accepted the tokens of 694 USDT in a "double expense" attempt. Following this revelation, the community panicked, believing that the entire Tether ecosystem would collapse. However, as faced by well-known exchanges and an Omni developer, this problem should not affect all USDT tokens, as it was only "poor exchange integration".

While the aforementioned fears were subsequently treated in some way, the project remains one of the most contested topics in the cryptosphere.

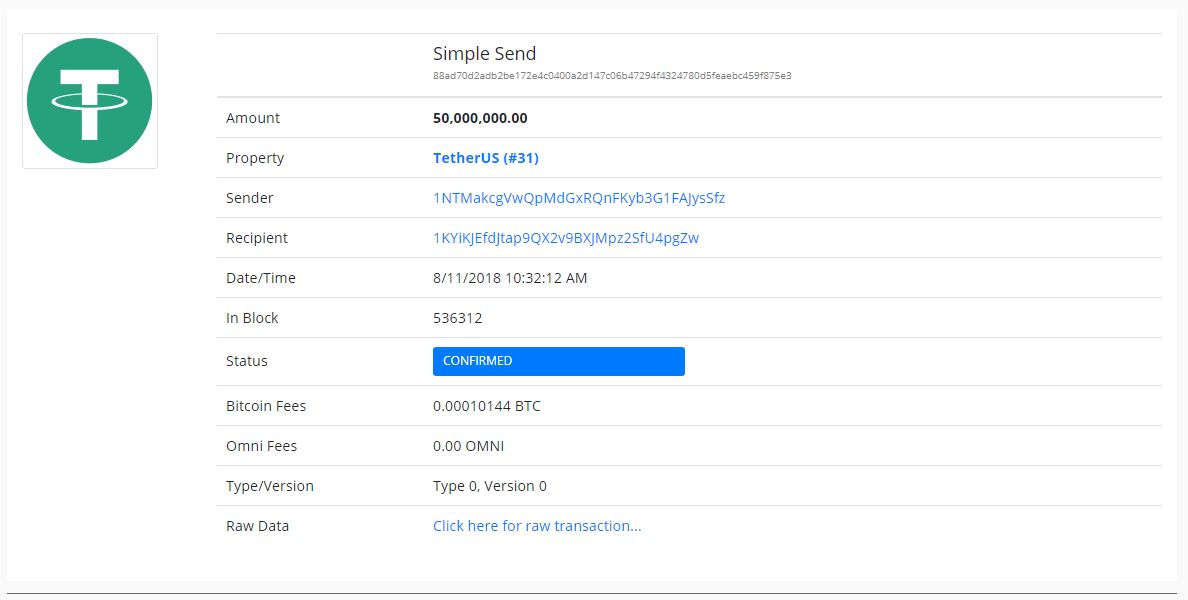

Kaching! Tether prints USD 50 million

On Saturday morning, the Tether organization issued $ 50 million of new USDT tokens in a bear market. This information comes from Omni Block Explorer (Omniexplorer), which traces Omni-based resources such as USDT tokens. With this move, Tether now has a market capitalization of $ 2.4 billion, which has led it to become the ninth most valuable cryptocurrency.

During a previous Tether release, Charlie Lee, a well-known cryptocurrency personality and founder of the Litecoin project, stressed that the USDT press is likely to be a bullish signal.

In general, this was a precursor of the rising price. The Tether is printed when people deposit USD and return USDT. This USDT will then be used to purchase Crypto. This is similar to someone who deposits $ 250 million on exchanges. Obviously, this does not mean that they will buy right away. DYOR https://t.co/zg2PEjGohv

– Charlie Lee [LTC⚡] (@SatoshiLite) 25 June 2018

But this time, the market continued to fall instead of seeing a 2-3 in good health The% moves upward as prices normally do, which surprises more than a few investors.

Photo by Jeremy Paige on Unsplash

[ad_2]

Source link