[ad_1]

[ad_1]

What is Tether?

Tether (USDT-USD) is the largest and best known stablecoin; or a cryptocurrency anchored to the value of a large legal currency, in this case the US dollar. While it is true that Tether operates on the Omni chain, which is built on the Bitcoin blockchain (BTC-USD) (COIN) (OTCQX: GBTC), this does not mean that you can trust it. So, how does Tether keep the value of a USDT for $ 1?

- Tether claims that all USDTs are supported 1: 1 by US Dollars.

- Tether uses arbitrage through exchanges to make it happen.

Number 1 is the main source of concern, as many have called into question.

What is the purpose of Tether?

According to the Tether homepage, Tether is "Digital money for digital age". But we are serious; people only use Tether because they want to avoid using US dollars. You see, some trades are too shady to deal in USD because they should meet the annoying standards of FINCen like KYC / AML and, if they did, people would have to pay taxes. Legitimate exchanges allow customers to trade directly in USD, and why not?

Stablecoins in general

If you want a quick primer, this video explains what a stablecoin is.

Source: Jackson Palmer – YouTube

A brief history of Tether

Tether was created in 2014 by Brock Pierce. Yes, the same guy in the John Oliver segment who was involved in the foundation of EOS (EOS-USD).

For fun, Google (GOOGL) "Brock Pierce Scandal" and see what happens. Going forward …

The official white paper uses the term "audit" 30 times. Unfortunately, they have never had a complete official audit by an accounting company.

In 2017, they lost their banking relationship with Wells Fargo. The Paradise Papers leak showed that Tether shared several founders from Bitfinex's dubious Bitcoin exchange.

In 2018 Tether broke up with their auditor, Friedman LLP. A "non-financial" audit was completed by a law firm, but this effort was misleading at best.

First of all, the relationship is not a control. It was prepared by a law firm – Freeh Sporkin & Sullivan, LLP – not an accounting firm.

It is not by lack of attempts, according to Stu Hoegner, general councilor of Tether.

"The bottom line is that you can not get an audit," Hoegner told CoinDesk, arguing that this problem is not unique to his company, but to the entire cryptocurrency industry.

He continued:

"The obstacles to be controlled are simply too big to be overcome at this time, and not just for us". – Coindesk

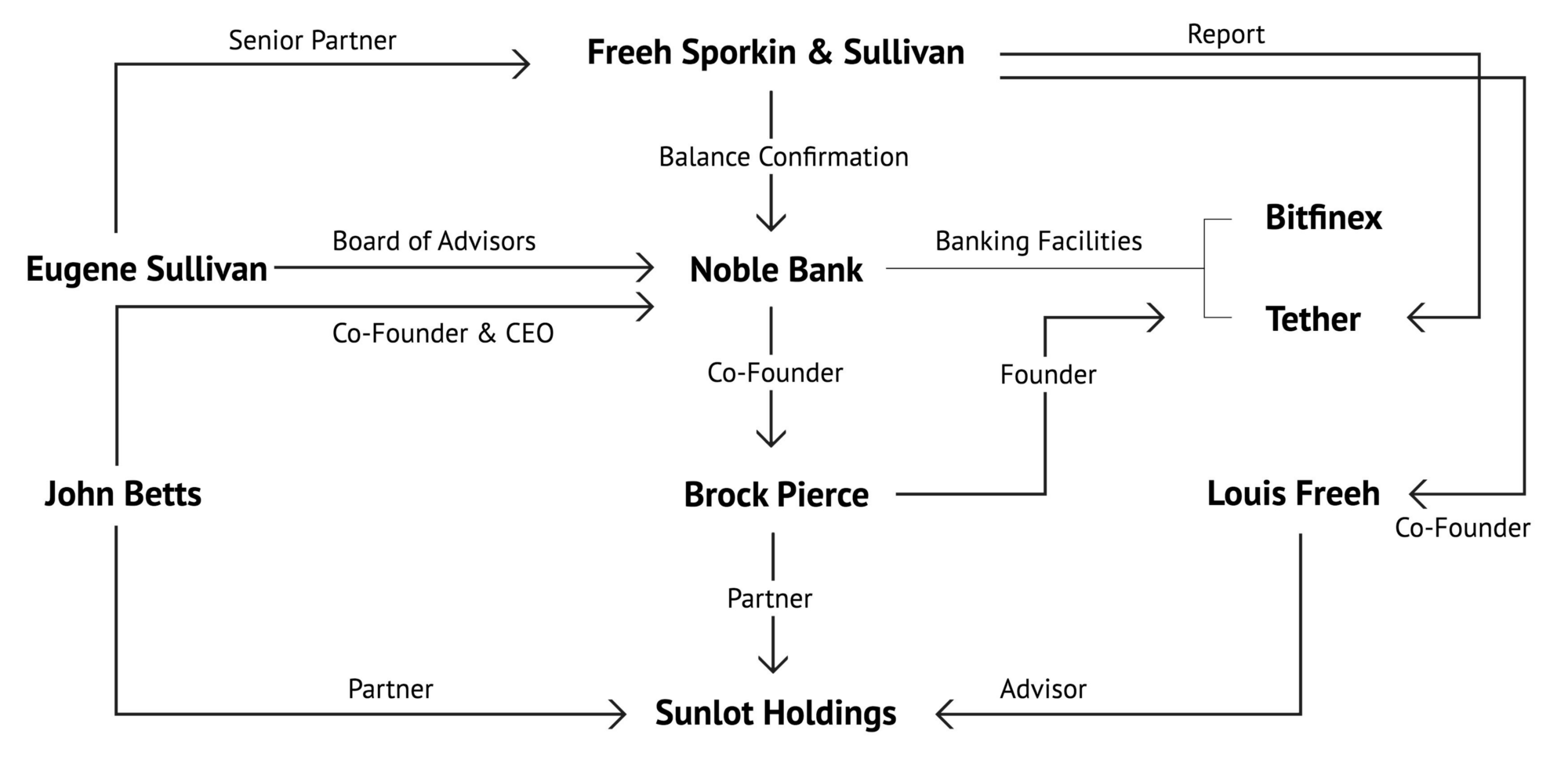

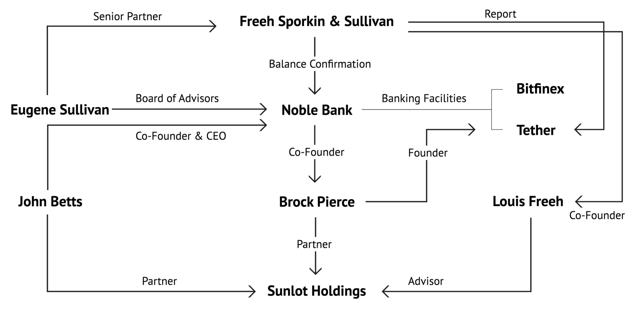

Worse, some have suggested that the owners of Noble Bank are also the owners of Tether.

Image source: medium Bitfinex & # 39; ed

Image source: medium Bitfinex & # 39; ed

Just this week began the news that Tether & # 39; s Bank, Noble Bank was desperate for money and another Bloomberg report said that Noble was looking for a buyer.

To date there are 2.8 billion Tether in circulation, a time bomb.

The false trading volume is led by Tether

Some cryptocurrency exchanges do not require time or effort to separate their volume in USD from their USDT volume. This is terribly misleading. The reason it's happening is that if you're trading and want more visibility, just allow free trading, connect to Tether and then swap "Billions" with yourself to increase your rankings. Soon change-o, now you're the best exchange!

So, how much volume is simulated in this way? According to Bitfinex this year is more than 83%.

Image source: Bitfinex & ed

Image source: Bitfinex & ed

Others have placed the fake volume even higher. Sylvain Ribes has shown that up to 93% of trading volume could be false in exchanges like OKex.

How to play the next Tether Collapse

When Tether is finally closed, or when the coin loses its peg, it will be a real chaos on the surface. You should prepare yourself for the tsunami of articles stating that Bitcoin is toast and all cryptocurrencies are made for.

In reality, the on-chain activity of many cryptocurrencies touched the bottom months ago. The activity that takes place on these exchanges is simply white noise compared to the underlying protocols.

On the day Tether unravels, a huge and volatile cryptocurrency sale will begin. Do not panic, and maybe do not even make a move. Remember, looking back, the market funds are generally long and silent. You will have many opportunities to enter, be patient.

The halter is a plague of the cryptosphere and, once the plague has passed, a new era of cooperation between big investors and the cryptocurrency space will begin. Remember that Bakkt will be launched next month. The reason why we have not yet had an ETF is because of scams like Tether and the tangle of frauds and scams that make it easier.

As the saying goes, "This is good for Bitcoin". Just remember that I told you it was coming. Finally, remember that if you want to know if Bitcoin is actually dead, you should read this article.

Conclusion

Pointless stablecoins such as Tether, zero-rate trading and 100x leverage form the trifecta of the false volume. To ensure that cryptocurrencies achieve traditional adoption, we must eliminate these scams from the ecosystem. Fortunately, if you're looking for an entry point into the market, Tether's collapse could give you this opportunity.

This article was first published in Crypto Blue Chips.

Revelation: I am / we are long BTC-USD.

I wrote this article alone, and expresses my opinions. I'm not getting any compensation for this (other than Seeking Alpha). I have no business relationship with any company whose actions are mentioned in this article.

Additional disclosure: I do not own the Tether and I will not keep Tether.

[ad_2]Source link