[ad_1]

- Ethereum exceeded $ 81.50 before starting the recovery in mid-December.

- It is not expected that the update of the rigid fork will introduce a new resource.

- The path of least resistance is to the north.

Ethereum started the new year at a relatively high level compared to the beginning of December 2018. The crypt had begun a trimming exercise in November amid market instability. In addition to falling below $ 100, Ethereum exceeded $ 81.50 before beginning the recovery in mid-December.

In other news, the network is preparing for the update scheduled for January 2019. The update of the hard fork should not introduce a new resource. However, you will see that the capacity of the Ethereum network has increased significantly. There are a number of other essential improvements, including the laying of other future updates such as sharing technology and the transition from the demonstration of the work to the demonstration of the stake consensus algorithm.

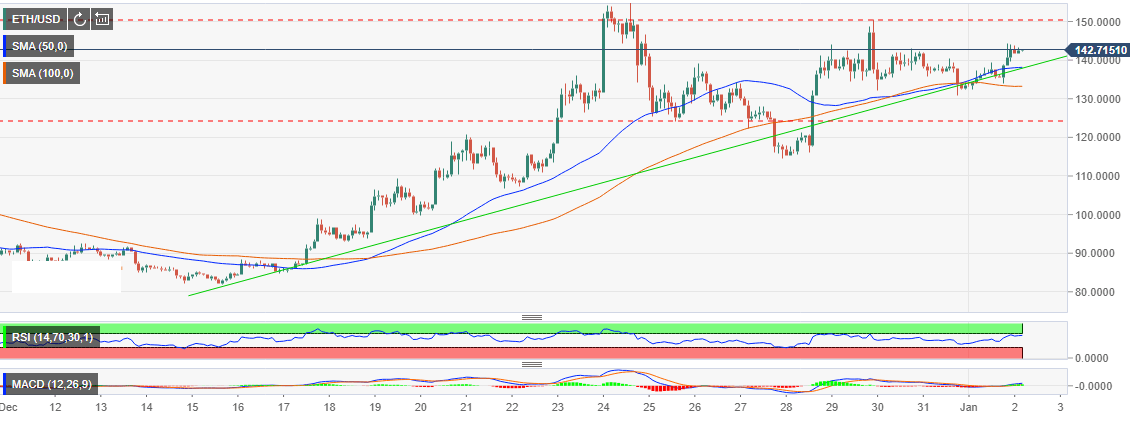

Meanwhile, Ethereum is currently stuck after the price could not sustain growth of more than $ 150. A correction from above marginally above this level has explored levels towards $ 110. However, a rebound has checked before the new year, while ETH / USD recovered slightly above the trend line. The range resistance at $ 150 is still the key obstacle for Ethereum buyers.

However, it is likely that a planned update over two weeks' planned advertising campaign will support a new test and exceed the $ 150 resistance. Currently, Ethereum is exchanging hands at $ 142. The price is higher moving averages to show that purchasing activity has not diminished despite bears increasing grip. Likewise, the RSI on the 1 hour chart is almost touching the overbought for the first time in 2019. The MACD on the same chart maintains its position above the average level to indicate that the path of least resistance it's north.

ETH / USD 1 hour chart

Receive Crypto updates 24 hours a day on our social media channels: give a follow-up to @FXSCrypto and our Telegram channel of Trading Crypto FXStreet

[ad_2]

Source link