[ad_1]

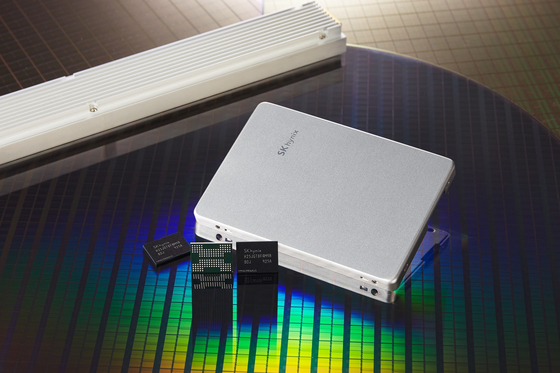

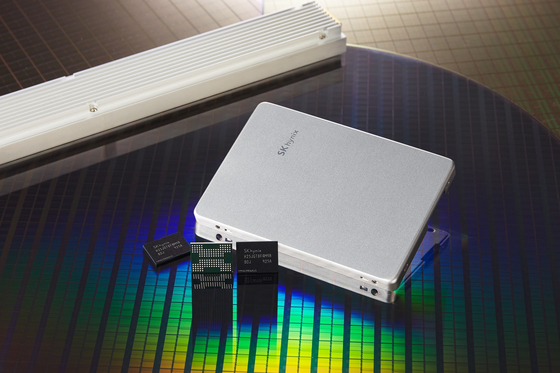

128-layer NAND flash memory developed by SK hynix

The sales and market share of Intel’s NAND flash division in the third quarter, which SK Hynix decided to take over at a cost of KRW 1.03 trillion, plummeted. As SK Hynix’s share declined slightly, the combined share of both companies fell below Japan’s Kioxia, which is the second largest in the market.

3Q NAND market stopped growing by 0.3%

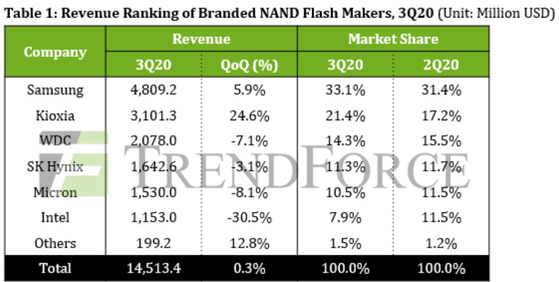

According to Trend Force, a market research firm on the 29th, global NAND flash market sales in the third quarter of this year were $ 14.5 billion (about 16 trillion won), up 0.3. % compared to the previous quarter. Compared to the first quarter (8.3%) and the second quarter (6.5%), the growth trend was strongly weakened. Trend Force analyzed that “demand for consumer electronics and smartphones picked up in the third quarter, but NAND flash consumption did not increase as server and data center customer inventory reached a fairly high level.”

NAND flash market share and sales in Q3 of this year 〈Trend Force〉

Intel sales fell 30% from the previous quarter

Intel has been particularly slow. In the third quarter, Intel’s NAND flash sales fell 30.5% from the previous quarter to $ 1.15 billion (about 1.27 trillion won). In the same period, the market share fell from 11.5% to 7.9%. Trend Force said, “With increasing pressure on inventory from server customers, Intel’s shipments and average selling prices (ASPs), which have a high share of enterprise solid state drives, have decreased “.

It firmly ranked # 1 by increasing Samsung Electronics’ share

Samsung Electronics maintained its No. 1 with 33.1%, a slight increase (1.7% p). In the same period, sales increased 5.9% from the previous quarter to $ 4.81 billion (about 5.3 trillion won). Before the tightening of US sanctions in September, Huawei, which bought parts in large quantities, and Apple, which launched the new iPhone 12, in October, were largely hit by the surge in demand.

SK Hynix’s NAND flash sales in the third quarter decreased 3.1% from the previous quarter to $ 1.64 billion (approximately 1.81 trillion won). Trend Force explained: “SK Hynix was also affected by the pressure to reduce inventory in the server market.”

Intel’s Chinese NAND Flash factory in Dalian

Kioxia 21.4%〉 Hynix + Intel 19.2%

Japan’s Kioxia recorded $ 3.1 billion (roughly 3.4 trillion won) in the third quarter of this year due to the influence of Huawei’s inventory building, iPhone 12 series release and release of new console games. This is a 24.6% increase over the previous quarter. In the same period, the market share increased from 17.2% to 21.4%. Kioxia’s market share in the third quarter was higher than the combined share of SK Hynix and Intel (19.2%). However, Trend Force noted that “Intel plans to begin expanding its Dalian China plant next year” and that “most of the long-term profits from further expansion will go to SK Hynix.”

The NAND oversupply and falling prices will continue through the 4th quarter

Meanwhile, Trend Force has predicted that the oversupply and price drop in the NAND flash market will continue throughout the fourth quarter. Trend Force said, “Huawei’s mass procurement of parts has been completed and server customer efforts to reduce inventory will continue.” Analyzed.

Reporter Kim Tae-yoon [email protected]

[ad_2]

Source link