[ad_1]

[ad_1]

The emergence of cryptocurrencies in recent years has been a roller coaster ride. During 2017, Bitcoin increased in value from $ 900 to nearly $ 20,000 before collapsing dramatically. Today, at the beginning of December 2018, a single bitcoin is worth just under $ 4000.

All this has encouraged the rapid development of other cryptocurrencies – well over 1,000 of them according to most estimates. The dream is that these can reproduce the success of Bitcoin. But the reality is that few are traded in large volumes or are worth something.

The spectacular rise and fall of cryptocurrencies, along with the alleged anonymity they offer, has surprisingly attracted criminals. The history of cryptocurrencies is littered with thefts, Ponzi schemes and other illicit activities.

But in recent months, a type of fraud has come to the fore: pump-and-dump schemes. In February, the Commission for Commodity Trading on the US market issued a specific consumer warning about these scams and regulators started actively pursuing foremen.

Little is known about these schemes, how they are managed and how they work in detail.

Today this changes thanks to the work of Jiahua Xu and Benjamin Livshits at the Imperial College of London. These guys have studied pump-and-dump schemes in cryptocurrency markets and now publish the first detailed account of how they work. Researchers have even developed an algorithm that can predict when they are about to occur, which offers a promising way to subvert or prevent.

First a bit of history. Pump-and-dump schemes are a well known trick in conventional commodity markets, but only recently have they become commonplace in cryptocurrencies. The organizer starts by selecting an obscure cryptocurrency and quietly accumulating it.

The organizer then announces that a pumping operation is about to start and that a randomly chosen cryptocurrency will be announced at a specific time. These announcements take place on anonymous channels, such as Telegram, to which interested parties can register.

At the specified time, the organizer reveals the chosen cryptocurrency, which seems to be the one that they have accumulated. This is the starting point for interested parties to start buying. The sudden activity then triggers a sharp increase in the price of the currency.

When the price reaches its peak, a sell-off begins when the participants try to get a quick profit at the expense of anyone who has been unlucky to have participated in the fun unknowingly or too slowly. All this activity takes place in a few minutes.

Obviously, the organizer is in a clear position to get maximum profit. But a significant number of others are participating in the hope of cashing out early enough to make a profit. In fact, part of the trick is that the "pump" is entirely automated and random, so that nobody can take advantage of privileged information and that only quick reactions and judgment determine who wins.

A sufficient number of people have been fooled by this trick to make pump-and-dump patterns more and more common. Xu and Livshits say that on average there are two pump-and-dump scams every day and that these generate around $ 7 million in monthly trading volume. So someone is doing a significant amount.

To study the details, the researchers focused on a single pump-and-dump scam that took place on November 14, 2018, exactly at 7:30 pm GMT. They collected details by recording announcements on several Telegram channels, the largest of which is official McAfee Pump Signals, which has over 12,000 members. They then recorded the price changes and trading volumes of the selected currency

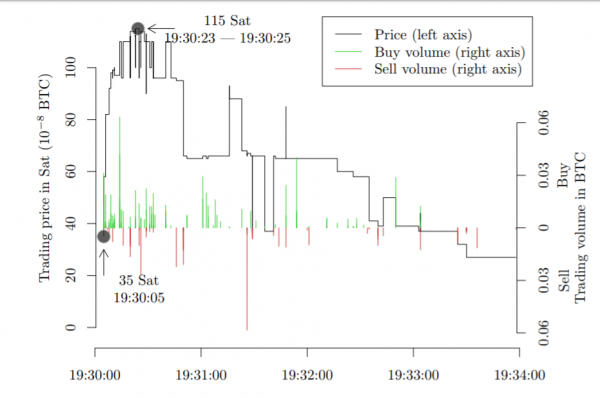

At 19:30:04, official McAfee Pump Signals revealed the chosen currency, a little known cryptocurrency called BVB, created in 2016 by supporters of the German football team Borussia Dortmund. However, the coin had been dormant for over a year, with little commercial activity and a value of about 35 sat (1 sat = 10-8 bitcoin).

Then things started to happen quickly. "We noticed that the first purchase order was placed and completed within 1 second after the first coin announcement," say Xu and Livshits. "After only 18 seconds of a wave of maniacal purchase, the price of coins has skyrocketed." It was then that he reached 115 sat.

Not all Telegram channels reacted so quickly. Anyone who follows Bitcoin Bomba "criptopia" was at a significant disadvantage, since this channel announced the pump at 19:30:23. "Note that Bitcoin bomb & # 39; criptopia & # 39; " announced the currency only when the price of coins was already at its peak, making it impossible for investors who relied solely on their announcement to make money, "say Xu and Livshits.

Then, as the participants took their profits, the price collapsed. "Three and a half minutes after the pump-and-dump began, the price of coins had fallen below its open price," the researchers say. Subsequently, the volume of trade decreased significantly.

The analysis of Xu and Livshits reveals some interesting details about the event. First of all, anyone who joined the business more than 18 seconds after the start had little hope of making a profit.

Secondly, the participants bought around twice the BVB coins sold. This suggests that many participants are sitting on unsold coins. "Those coin holders can only expect to reverse the position in the next pump, which may never come," say the researchers.

Xu and Livshits studied 236 other pump-and-dump events that took place between July 21st and November 18th. They say that many of them were preceded by unusual buying activity in the target currency. This would be consistent with insiders who accumulate the currency before the pump. "The study reveals that pump-and-dump organizers can easily use their insider information to make extra money for the sacrifice of other gunners," say Xu and Livshits.

But the study also suggests a way to identify target currencies before they are revealed: simply search for unexpected transactions in dark currencies. To find out if this works, Xu and Livshits used historical data from known pump-and-dump schemes to train an automatic learning algorithm to detect the telltale signs of a scam.

Then they let him loose on data in real time, where he found this activity on six occasions between October 30th and November 6th. Five of these warnings were revealed to announce real pump-and-dump schemes.

This work suggests a path to weaken or prevent scams, but it is likely to be only a move in the traditional game of cat and mouse that security experts employ against malicious actors. Presumably, the organizers of these scams will quickly change their activities to make them more difficult to identify for this type of machine learning algorithm. And so on.

Cryptocurrency scams are not likely to disappear very soon. But this kind of detailed understanding of how they work can only have an important value in preventing them from spreading more widely.

Ref: arxiv.org/abs/1811.10109: Anatomy of a Cryptocurrency Pump-and-Dump Scheme