[ad_1]

[ad_1]

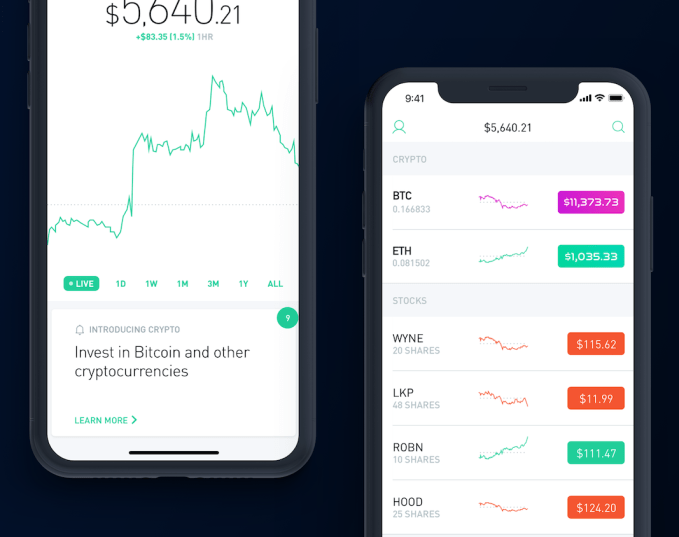

Robinhood Securities-Free Selling App allows you to buy and sell Bitcoin and Ethereum without additional transaction costs starting in February, compared to 1.5% -4% Coinbase fees in the United States. And from today Robinhood will allow all users to track price, news and set up alerts on those and other 14 major cryptographic coins, including Litecoin and Ripple.

"We are planning to run this business in a draw and do not expect to profit from it in the near future," says Robinhood co-founder Vlad Tenev. "Robinhood Crypto's value lies in growing our customer base and serving better our existing customers. "

By essentially using cryptography as a loss leader instead of its core business like Coinbase and other apps, Robinhood could substantially expand beyond the 3 million users it already owns. Simplifying trading and tracking could strengthen Bitcoin and Ethereum. Combining it with traditional stocks, ETFs and options trading in a single app, Robinhood could further legitimize the cryptocurrency craze. The two commercial worlds could cross ideas, dragging even more people into the cryptic scene.

The founders of Robinhood Baiju Bhatt (left) and Vladamir Tenev (right)

Many of the startups dealing with crypto have been created with questionable track records. But five-year-old Robinhood raised $ 176 million from major investors, including Andreessen Horowitz, Index and NEA, which now rate the company at $ 1.3 billion. There is a clear long-term advantage in breaking down crypto traders and using the feature like a wedge to get them to keep the money with Robinhood where they earn interest and pay for Robinhood Gold's premium level for $ 6 to $ 200 per month allowing you to borrow between $ 1,000 and $ 50,000.

Here's how Robinhood Crypto works. You can instantly transfer up to $ 1000 from your linked bank account (more if you have a Gold membership), with additional funds arriving over the slower ACH transfer. For smaller traders, this could eliminate annoying delays on other platforms that can make you lose a low price you want to buy. The entire Crypto section of Robinhood is paired with a Tron design of 80 years to indicate the 24-hour trading window, compared to the day and night themes for when traditional stock markets are open or closed.

When making a purchase or sale order, Robinhood provides an estimated price, connects to a number of trading venues, exchanges and market centers to find the lowest price and uses its economies of scale to improve prices over time . To counteract the volatility of the market, Robinhood puts a "collar" around your trade so if you can not do it at a price close to the estimated price, wait for the price to come back or let you know.

And in the event that the price of a coin skyrockets or precipitations, you can place limited orders to set a price where you buy or sell automatically. The complete list of coins you can draw is Bitcoin, Ethereum, Bitcoin Cash, Litecoin, Ripple, Ethereum Classic, Zcash, Monero, Dash, Stellar, Qtum, Bitcoin Gold, OmiseGo, NEO, Lisk and Dogecoin.

Only BTC and ETH will be available for trading when they present themselves to the waves of users starting in California, Massachusetts, Missouri, Montana and New Hampshire in February, although others will be added. "We are extremely selective about the cryptos we are making available on the platform," says Tenev. "We are introducing them first because they are the most mature currencies that people trade in these days, many times people have declared them dead and have come back stronger than ever."

To back up the new Robinhood Crypto feature, the company is adding new two-factor authentication options, including integrations with authentication apps, to ensure people are not stolen and downloaded their wallets. "There are several senior world-class people we recently hired who are building the system internally," says Tenev. However, the move paints a giant target on Robinhood's back. If the company is violated or deprived of individual users, the reputation of the fintech startup may become blurred.

The question for the product was clear, though. 100,000 Robinhood users were regularly attending for price cryptography and trade in their app, and 95% of respondents said they would invest in cryptids if the product had supported it. Robinhood also had to send a cease-and-desist to "Cobinhood", a competitive encryption app that encrypted its name and raised $ 10 million in an ICO.

Judging by the choices of two best startups, this week you might see a sign of the cryptocurrency shift. Yesterday, Stripe removed Bitcoin as a payment option on its platform, and now Robinhood is trading. "People think of encryption less from the point of view of payments and more from the point of view of investment in activity," explains Tenev.

Robinhood Crypto presents a Tron-style design motif of 80s

Regarding the fact that he is personally invested in the scene of the crypt, Tenev admits "I'm an amateur, certainly, but I would not say it's all so significant." But it's a good idea for your business, which used a lean engineering team to drop stock buying and selling commissions, while competitors like the Scottish and E * trade can charge over $ 6 per trade to cover their commercial and expansive space with huge overheads. Robinhood has now managed $ 100 billion transactions, saving users over $ 1 billion in fees.

"[Cryptocurrency] puts the power that is historically held by financial institutions in the hands of people. I think it is directly aligned with Robinhood's mission to democratize the financial system, "Tenev tells me, concluding" We are a well-established company and we can manage it. "The security of exploding in the wild west of crypto could swallow its startup with a massive security failure or greatly increase its traction by aligning itself with what has become a cultural phenomenon.

Disclosures: The author of this article has small positions in Bitcoin and Ethereum and knows the founders of Robinhood from college.