[ad_1]

Latest news on Ethereum

The evolution of Ethereum as a decentralized and open source platform for an efficient global computer capable of securely storing and processing information requires sacrifice and participation by all stakeholders. Behind there is the need to address scalability and of course manage the possibilities of centralization through ProgPow. Ethereum 2.0 or Serenity is the place where the platform is dragged until the users of the network are back in the best way to progress.

While Ropsten did not force the team to postpone the launch of the Constantinople test network, a provisional date of January 16, 2019 was set. It will remain so, but developers may still postpone the launch until there is a guarantee of a transition. smoothly.

Remember, the goal is to ensure that Serenity-o Ethereum 2.0 is backwards compatible with Ethereum 1.0. This delay is simply because developers are trying to integrate scalability options into the legacy chain.

Similar readings: CEO of Binance: Sooner or later, a run to the crypt will take place

In all of these, it will be a step-by-step procedure before Serenity and the switch to PoS is active. First of all, assuming that everything works as expected, we expect to see the implementation of Beacon Chain in the first quarter. Then we will see Sharding by 2020 and then the activation of Ethereum 2.0. Serenity guarantees scalability: up to 1000X with synchronous claims averaging 10 seconds.

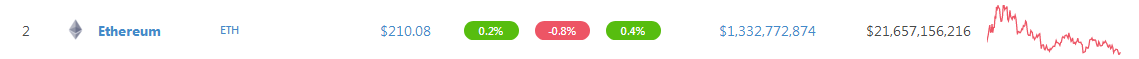

Analysis of ETH / USD prices

The fact is that traders are struggling to make a profit.

Earnings are tight and although the ETH / USD pair has increased by 0.4 percent in the last week, the same margin is declining on the last day indicative of a going market.

As in our previous ETH / USD business plans, Ethereum is moving into a tight consolidation and fight against sellers who have so far been successful in confining prices within a commercial range of $ 30.

Trend: bearish

Our commercial position finds good support from September 5 bar. Not only the press bar in a bloody market, but it is wide and accompanied by high commercial volumes.

Therefore, considering that it broke under the previous support now resistance to $ 250, the subsequent price accumulation and price failure to overstep that bear liquidation suggestion.

Everything else is constant, it will be ideal if the buyers of the Ethics / USD will build momentum to push prices over $ 250- $ 300. However, this seems unlikely by the arrangement of the candles.

Trading volumes: flat but low

Before the 5 September release bar, average volumes were around 200k. By September 5, with the 544k press and the closing below $ 300 complete with wide commercial ranges, the bears were in charge. Since then showy candlesticks with high volumes are Sep 17-968k (bearish) and Oct 15-964k (bullish).

However, these bars are still moving within a range of $ 110 with supports at $ 160. To confirm the bear breakout bar, you need to see a high volume print bar below $ 160.

On the back, the bull's launch bar should be on the back of strong volumes that exceed the average of the last 10 days of 130k.

Candlestick training: Bear Break Out and Ranging

As already mentioned, ETH / USD is traded within a bear breakout model with clear supports at $ 160 and $ 300. Unless this accumulation / distribution leads to higher earnings at $ 250- $ 300 of resistance or decreases below $ 160, bears are in charge but traders should take a neutral position.

Conclusion

The fundamentals support the price and with the activation of Constantinople, network users would be a step forward towards the enjoyment of a scalable network and unrivaled transaction speed. In the meantime, we should see that optimism translates into a price. From the graph it is clear that ETH / USD has a range range and if there are no trends defining breakouts, we suggest taking a neutral position.

All graphics courtesy of Trading View

This is not an investment tip. Do your research.

Source link