[ad_1]

Key points

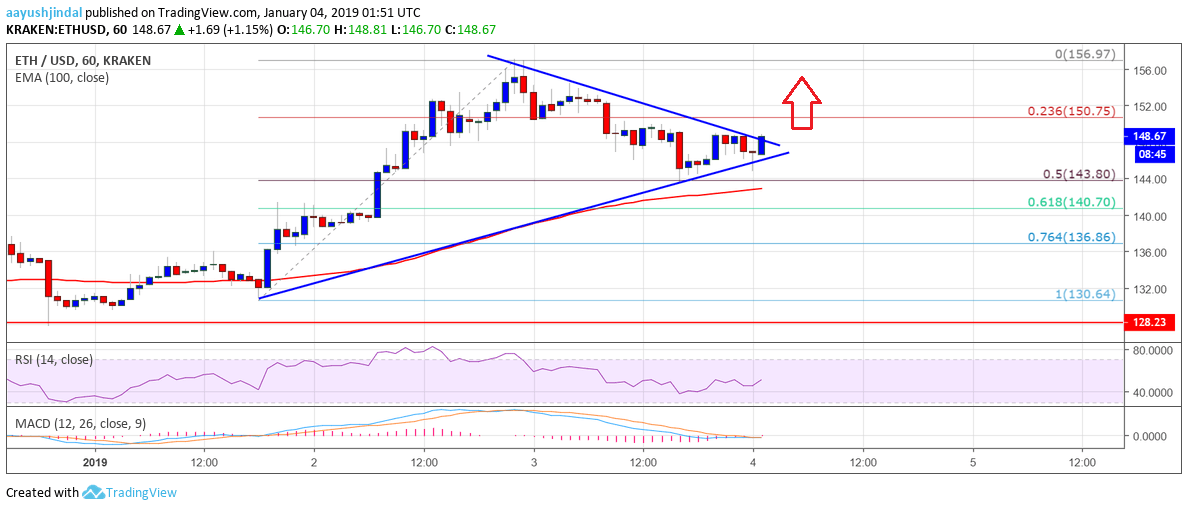

- The price of the ETH was recently corrected lower and traded below the $ 150 support against the US dollar.

- C & # 39; is a bullish trend line formed with support for $ 145 on the hourly table of ETH / USD (data feed via Kraken).

- The pair seems to be preparing for a bullish move above $ 152 and $ 156 in the near term.

The price of Ethereum holds key supports against the US dollar and bitcoin. The ETH / USD is likely to rebound above $ 155 as long as it is more than $ 140.

Price analysis of Ethereum

Yesterday, the ETH price was trading close to the $ 157 level against the US dollar. The ETH / USD pair traded at $ 156.97 and subsequently started a downward correction. It fell below the $ 154 and $ 150 support. There was also a break below the Fib retracement level at 23.6% of the recent leg, from $ 130 low to $ 157 high. However, the price found strong support near the $ 144 level.

In addition, there is an uptrend line formed with support for $ 145 on the hourly chart of Eth / USD. The pair also tested the 50% fiber retracement level of the recent leg from the low of $ 130 to the $ 157 one. Currently it is consolidating above the $ 144 level and the trend line. The price action is positive and it seems that the price may soon break the $ 150 and $ 154 levels. A break above the $ 154-155 zone could clear the path for further gains. On the downside, the support of the trend line, $ 144 and the simple 100-hour moving average, hold the key. As long as the price is higher than $ 144 and $ 140, it could recover in the short term.

Looking at the chart, the ETH price is ready for further gains over $ 150 and $ 154 levels. However, a proper break above the recent high near $ 157 is necessary for a solid bullish wave.

MACD time – The MACD is returning to the bullish zone.

RSI timetable – The RSI is just above level 50.

Main support level: $ 144

Main resistance level: $ 155

Source link