[ad_1]

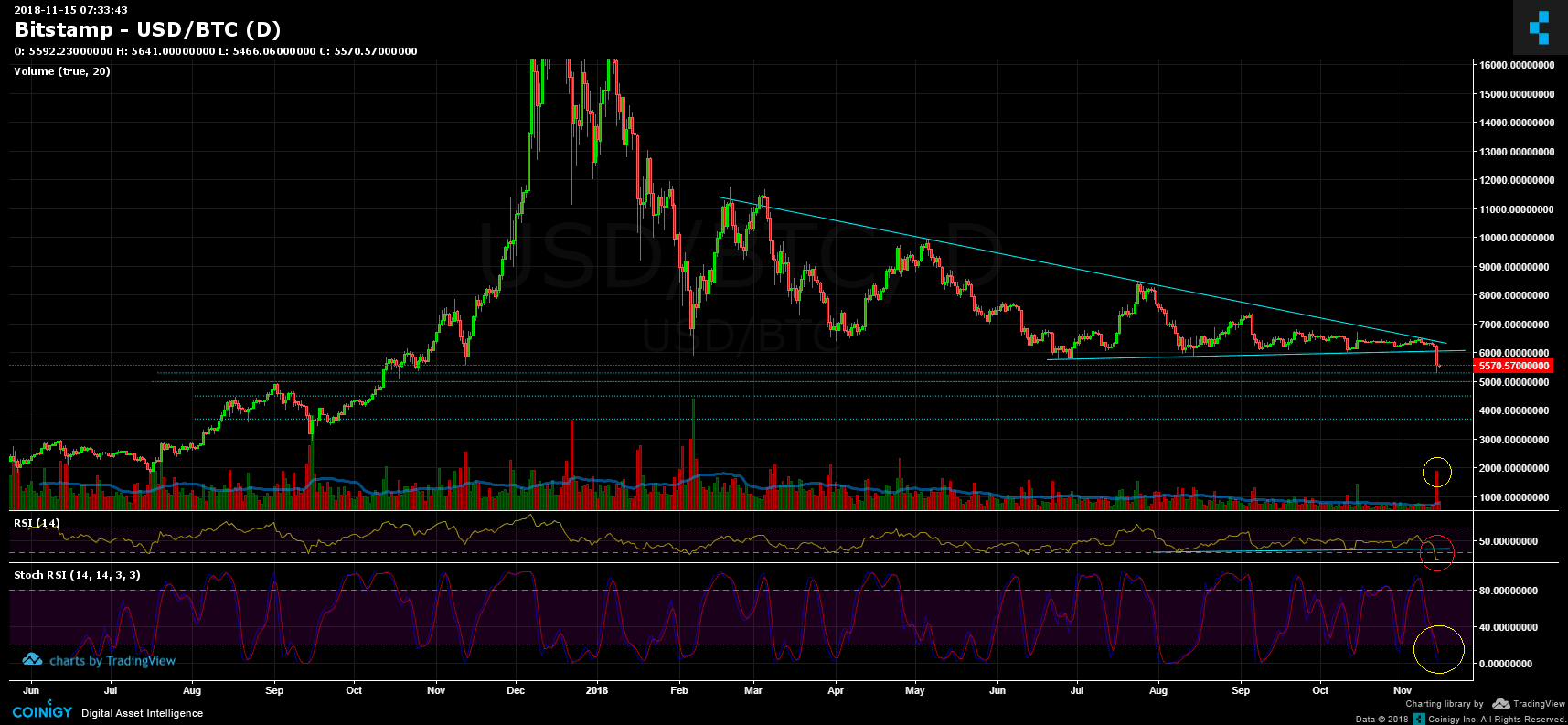

After long months of lateral consolidation, the market has finally chosen a direction and, as it seems, the bears have won the battle.

BTC has lost more than 14% in the last two days, and all the other altcoins are following in even worse drops. The total market capitalization of the encrypted market has fallen to $ 176 B.

Pay attention to the 12-hour RSI indicator, which has fallen to its lowest level since July 2016 and is currently at 6 … Note that the range of RSI movement is between 0 and 100, which should give some indication of the immediate market sentiment.

Traders have waited for the long formation of the triangle from the daily chart to break on one of the sides, and eventually it is broken, so what happens now?

For BTC the next reasonable level of support could be found at $ 5,000 and below $ 4,000 and even $ 3,000 if this gathering of blood continues.

Return to Ethereum: the ETH price is currently around the $ 168 level (according to Bitstamp) and drops rapidly.

Looking at the 4-hour chart

- As we mentioned in our previous analysis, if the bears manage to break the support level of $ 206 that was held good in the last week or so, then we could see a quick move down, and that's exactly what it happened.

- Ethereum broke all of its support levels with a high volume in a single red candle. Ethereum is currently maintaining support at the price level of $ 167, the lowest level of support in the following 4-hour chart.

- At the time of writing, there is intense combat around this level of support, and bears seem to currently have the strongest hand.

- The next level of support is at the level of $ 126 – $ 130 or even lower – at the price level area of $ 80 (in case the round number of $ 100 does not trigger an action of the bull).

- The RSI of the 4-hour chart is currently at 25 in the oversold areas and, it seems, could continue to fall much lower.

Please pay close attention these days and protect your funds.

BitStamp ETH / USD 4-hour chart

1-day chart Coinbase ETH / USD

TradingView cryptocurrency charts. Coinigy technical analysis tools.

Be the first to know about our price analysis, crypto news and trading tips: follow us on Telegram or subscribe to our weekly newsletter.

More news for you:

[ad_2]

Source link