[ad_1]

Key points

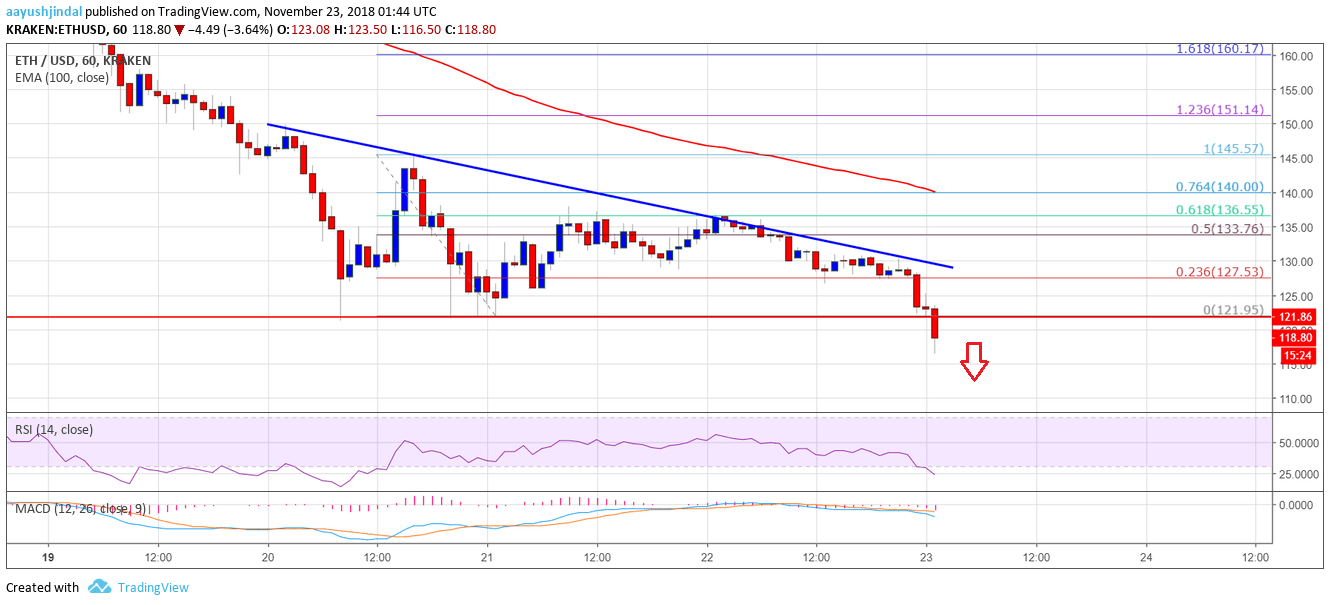

- The ETH price failed to exceed $ 135 and $ 136 against the US dollar.

- C & # 39; is a new bearish trend line based on the resistance to $ 127 on the hourly chart of Eth / USD (data feed via Kraken).

- The pair is currently under pressure and could accelerate falls below the $ 120 level.

The price of Ethereum is faced with a new round of sales against the US dollar and bitcoin. The ETH / USD broke the minimum of $ 120 and could accelerate further losses.

Price analysis of Ethereum

Yesterday we saw a slight upward correction in the ETH price from the support of $ 122 against the US dollar. The ETH / USD pair was adjusted above $ 130 and $ 132. The price also moved above the fiber retracement level of 50% of the last slide from the minimum of $ 145 to the minimum of $ 121. However, the upside, the move was limited by $ 135 and $ 136 resistance levels.

The buyers also failed to break the fiber retracement level by 61.8% in the last slide from the low of $ 145 to the minimum of $ 121. In addition, there is a new bearish trend line based on the resistance to $ 127 on the hourly chart of Eth / USD. Clearly, the pair failed to gain momentum above the $ 136 level and refused. The recent downtrend has been such that the price has broken support levels of $ 124 and $ 122. More importantly, the price is trading at an annual low of less than $ 120. It seems that sellers are back and that they could push the price further towards the levels of $ 115 or $ 110 in the short term.

Looking at the chart, the ETH price probably completed a short-term correction from the $ 122 support. It failed to increase the pace above the key resistance near $ 136 and $ 140, resulting in a new decline. Buyers need to be careful considering the current market sentiment and breaking under $ 120.

MACD time – The MACD is back in the bearish zone.

RSI timetable – The RSI is currently moving lower towards level 20.

Main support level: $ 110

Main resistance level: $ 130

Source link