[ad_1]

Photo: QuoteInspector

Key points:

- Bears hold on to the Ethereum market;

- the downward trend could continue in the ETH market;

- the ETH price could have a limit of $ 145 as a barrier.

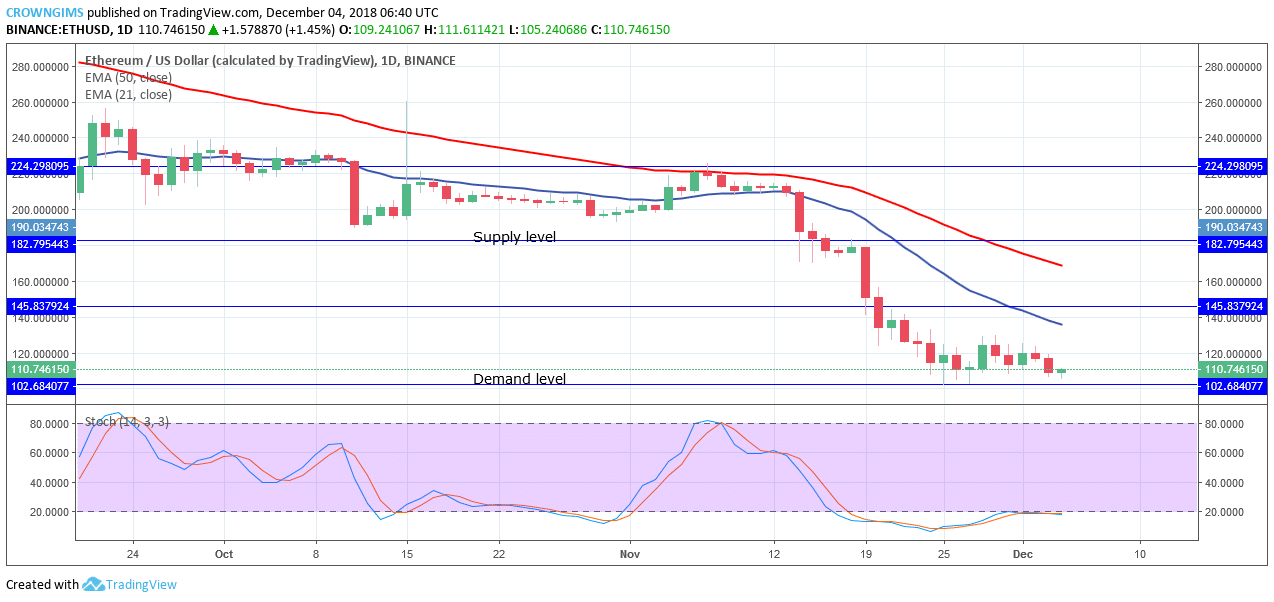

ETH / USD long-term trend: bearish

Offer levels: $ 145, $ 182, $ 224

Demand levels: $ 102, $ 90, $ 75

On the long-term perspective, Ethereum is bearish. It was in a bearish trend last week and found its minimum demand level of $ 102. It formed an indecisive Japanese candle (doji candle) that pushed the bulls to push the price with the expectation of retesting the level broken but the bears stopped and then the consolidation started.

The currency is exchanged under the EMA of 20 days and the 50-day EMA which indicates that the currency is still in bearish trend. The stochastic period of oscillator 14 is immersed in an oversold region (below 20 levels) indicating that the bulls could soon conquer the market.

Ethereum could find its minimum at the $ 90 demand level in case the bears were able to break the demand level of $ 102 on the downside. In case the bulls conquer the market and the demand level of $ 102 is defended, the ETH price will have a bid level of $ 145 as the first barrier.

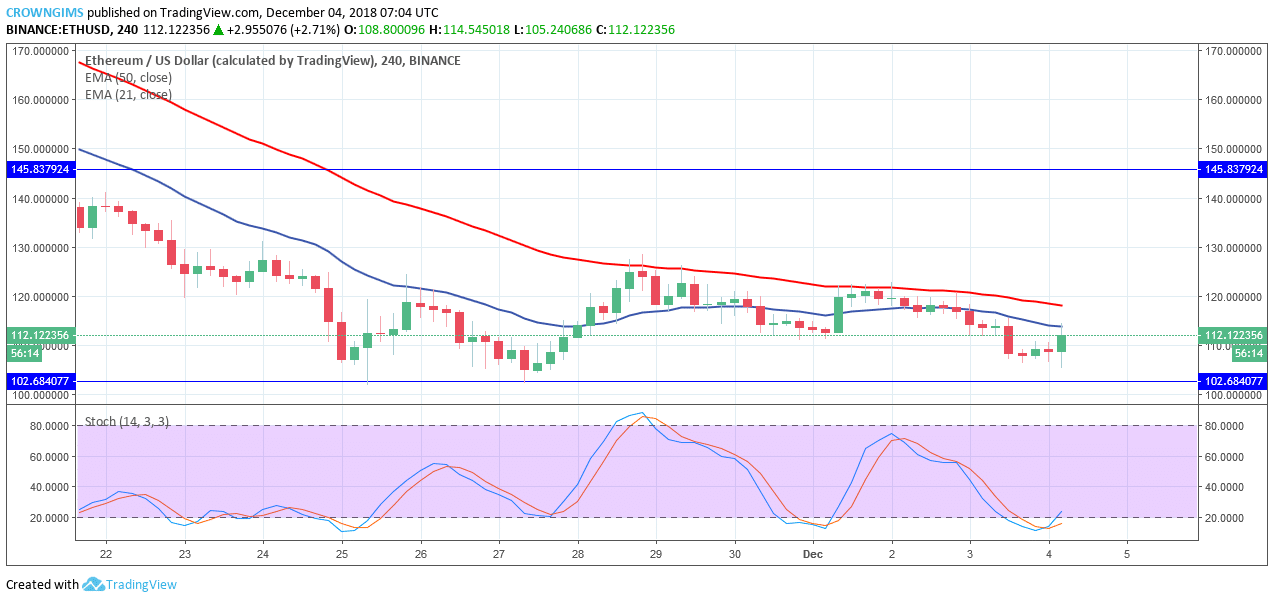

Medium-term trend ETH / USD: bearish

ETH / USD is in its bearish trend on the 4-hour chart. On 1 November, the currency broke the 21-day EMA dynamic resistance level, but resisted with the 50-day EMA and the ETH price was brought back to its previous low.

Currently, ETH is under the two EMAs that are testing the broken level. Furthermore, the period 14 of the stochastic oscillator is in the oversold region with the signal lines pointing north that indicate the purchase signal that could be a pullback before continuing the downward trend.

Source link