[ad_1]

Photo: QuoteInspector

Key points:

- The bearish trend could continue in the Ethereum market;

- the bears had control;

- the ETH price may change in an uptrend at any time.

ETH / USD long-term trend: bearish

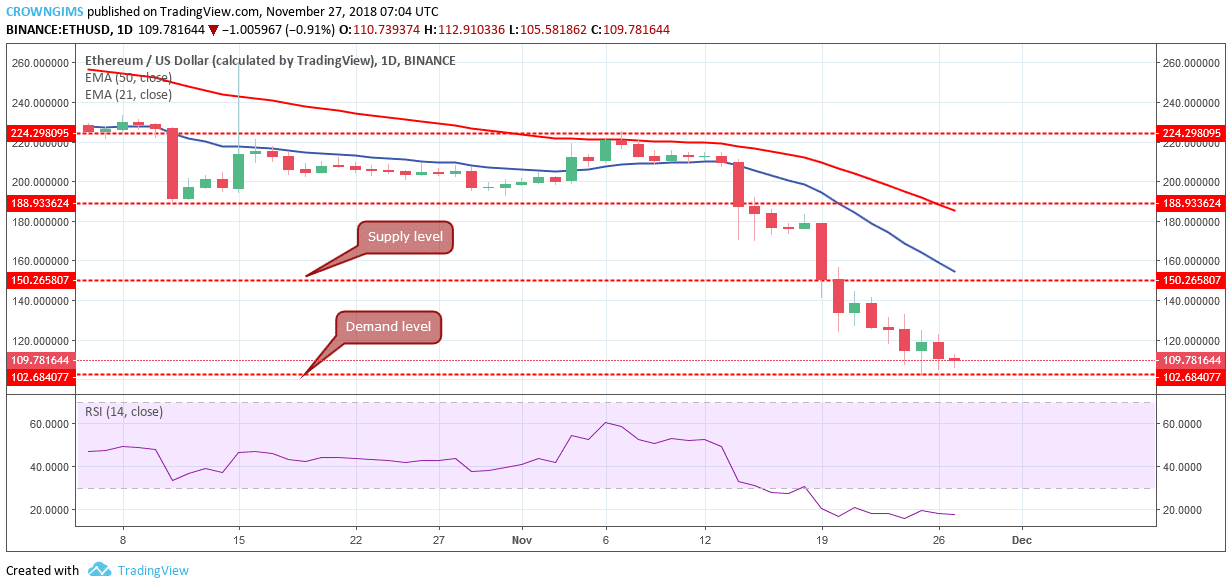

Offer levels: $ 150, $ 190, $ 224

Demand levels: $ 102, $ 90, $ 75 The price of Ethereum is falling on long-term prospects. The cryptocurrency has been under the pressure of bears for more than a week. Since November 14, after the currency has broken out of the consolidation phase, the bulls have lost total control over the ETH market and the ETH price has reached lower levels.

The price of Ethereum is falling on long-term prospects. The cryptocurrency has been under the pressure of bears for more than a week. Since November 14, after the currency has broken out of the consolidation phase, the bulls have lost total control over the ETH market and the ETH price has reached lower levels.

The price of Ethereum was at $ 140 last week and refused to meet this historic level, it fell below the demand level of $ 102. From the daily chart, the relative strength index is included in the 39, interval below 20. This implies that the ETH price is in the oversold level of the market and the price should decrease.

The 50-day EMA still remains above the 21-day EMA and the ETH price is lower than the 21-day EMA with the two separate EMAs indicating that downward pressure is rising .

The currency will continue its bearish trend until the relative strength index remains in the oversold level. The price of the ETH will probably reach $ 90 as long as the bears keep their pressure.

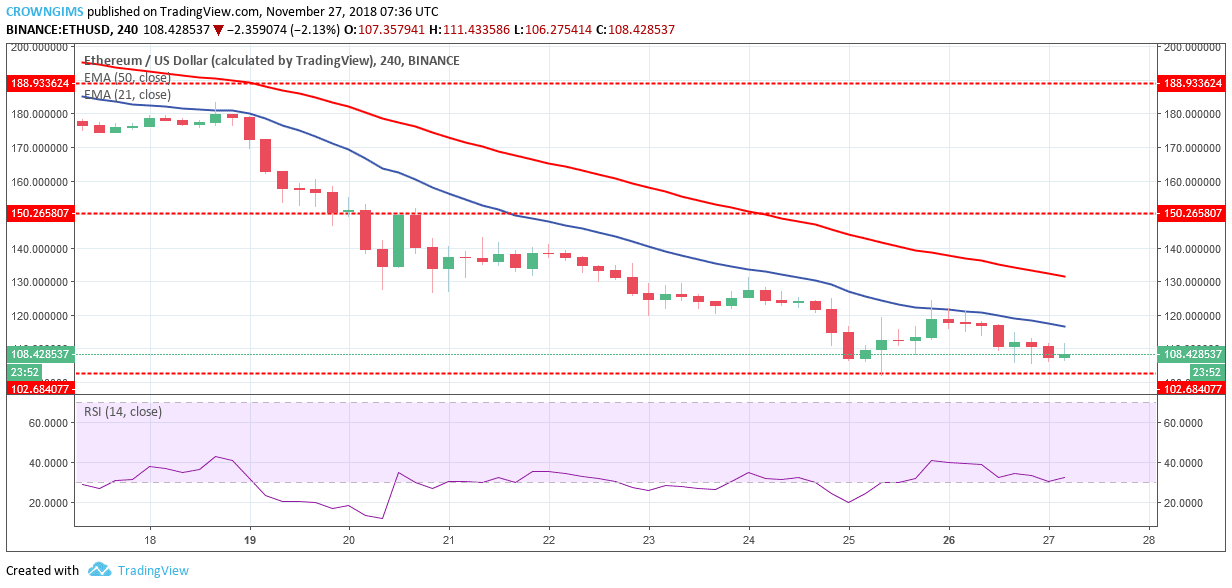

Medium-term trend ETH / USD: bearish

In the 4-hour chart, the ETH / USD is in a bearish trend. The bulls pushed up the price of Ethereum on November 25, but resisted the dynamic resistance (21-day EMA) and the price has risen to $ 102. Although the relative strength index is above 20 levels with the signal line point rise could be a pullback signal but the ETH price is less than 21 days EMA and the 50-day EMA indicates that the downward trend may continue.

In the 4-hour chart, the ETH / USD is in a bearish trend. The bulls pushed up the price of Ethereum on November 25, but resisted the dynamic resistance (21-day EMA) and the price has risen to $ 102. Although the relative strength index is above 20 levels with the signal line point rise could be a pullback signal but the ETH price is less than 21 days EMA and the 50-day EMA indicates that the downward trend may continue.

Source link