[ad_1]

Photo: Shutterstock

Key points:

- The price of Ethereum is consolidating;

- The ETH price can reach the price level of $ 131 as a maximum;

- the downward trend could continue in the ETH market.

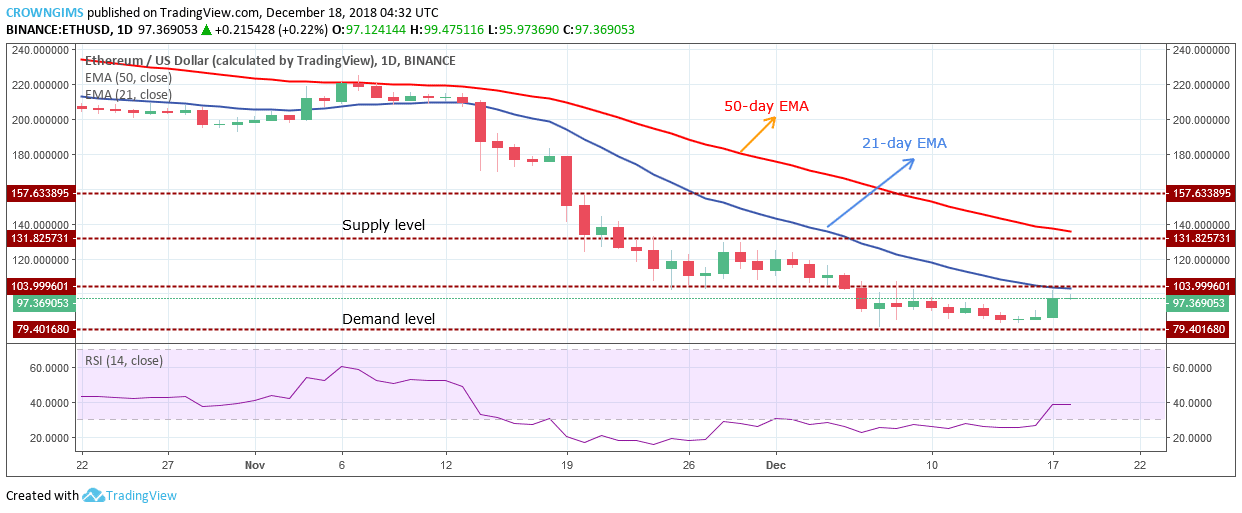

ETH / USD long-term trend: bearish

Offer levels: $ 103, $ 131, $ 157

Demand levels: $ 79, $ 60, $ 47

ETH remains in its bearish trend on long-term prospects. The bears are still close to the Ethereum market without giving space to the bulls. On November 28, the bulls attempted and pushed the coin to the supply level of $ 131, but were unable to burst due to pressure from the Bears. The price of Ethereum has touched the minimum at $ 79 on 7 December. Over the past week the ETH price has consolidated in the range of $ 103 and demand level of $ 79.

Strong bullish candles are currently emerging, pushing the ETH price down to the $ 103 bid level indicating that the bulls are gradually gaining ground. If the bulls manage to break the bid level of $ 103, they will gather north and aim for a strong bid level of $ 131. In case the bears defend the price level of $ 103 and the price rebounds to break the level of demand of $ 79 on the downside, the price of Ethereum will have its minimum at $ 60 in demand.

The 50-day EMA remains above the 20-day EMA while the ETH price is lower than the two EMAs distant from each other indicating that the crypt is under strong downward pressure. The period 14 of the relative resistance index is at 40 levels parallel to the non-directional level indicating that consolidation is underway. Traders should be patient and be careful so that the breakout can take place.

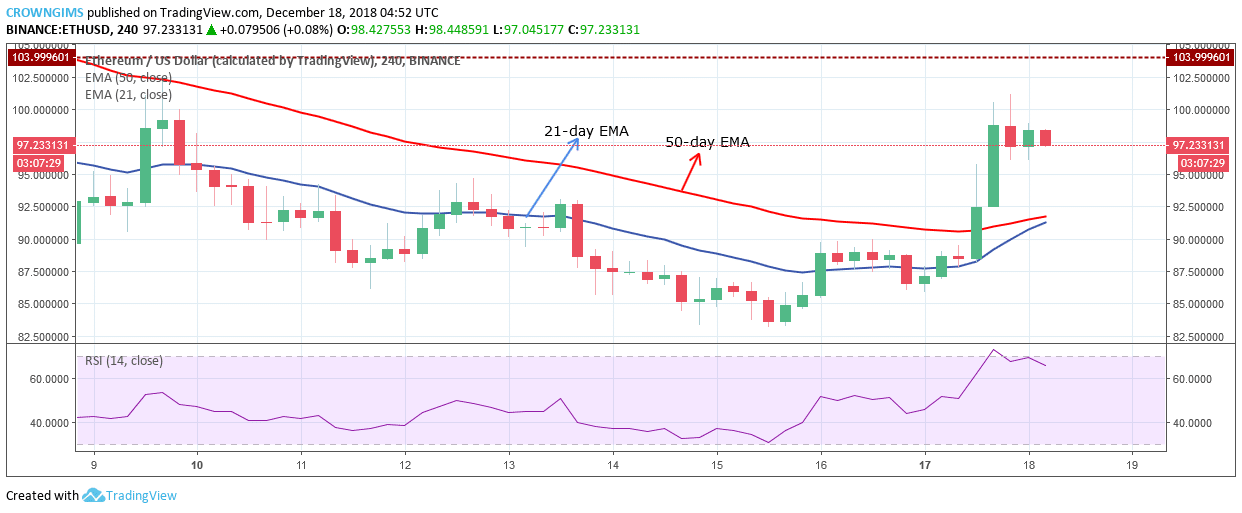

ETH / USD Medium-term trend: bullish

In the medium term, ETH / USD is in an uptrend. Bears lose the pressure on December 15 at the level near the $ 79 demand level; this is clearly seen as the candle pattern of the inner bar formed to reverse the trend on the 4-hour chart. The reorganized ETH price in the north broke the two dynamic supports and resistance.

The price of Ethereum is currently higher than the 50-day EMA, while the 21-day EMA is below an attempt to exceed the 50-day EMA indicating that the bulls are gaining momentum to change the tendency to an uptrend. However, the Relative Strength Index is higher than 60 levels of decline indicates the sales signal that could be a pullback after which the uptrend could continue.

Source link