[ad_1]

Key points

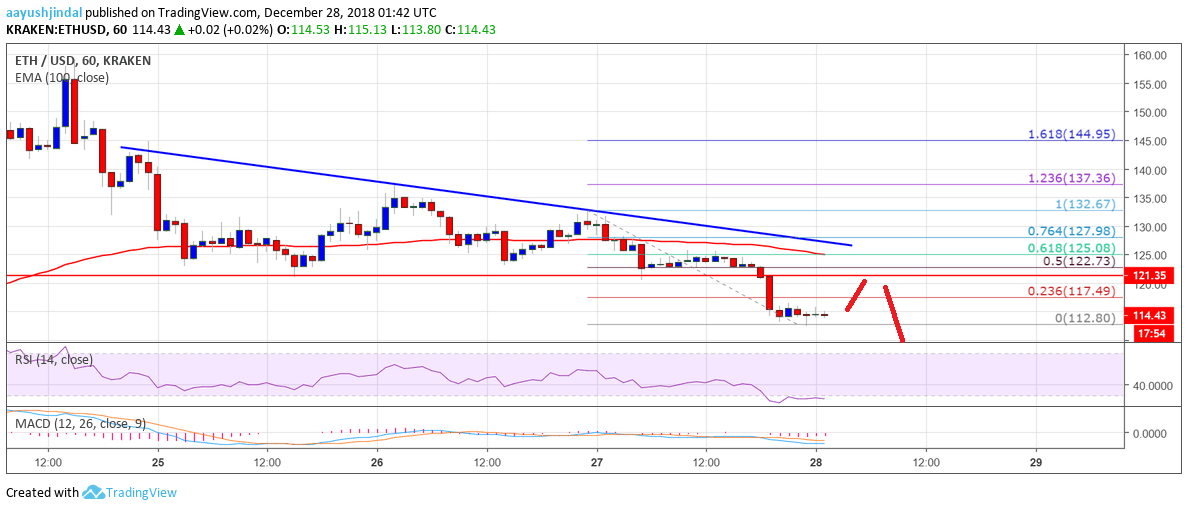

- The ETH price failed to remain above the support of $ 121 and was further reduced against the US dollar.

- Yesterday's downtrend line is intact with resistance to $ 128 on the hourly chart of Eth / USD (data feed via Kraken).

- The pair could correct higher in the short term, but it is likely that sellers close to $ 128 and $ 130.

The price of Ethereum further extended losses against the US dollar and bitcoin. ETH / USD is now at risk of further reductions below the $ 110 level in the short term.

Price analysis of Ethereum

Yesterday we discussed a possible downside break below $ 121 and $ 118 in the ETH price compared to the US dollar. The ETH / USD pair failed to break the $ 130-132 resistance zone and started a bearish move. There was a break under the key support $ 121, opening the door to further losses in the short term. The price has broken support levels $ 118 and $ 116, and has stabilized below the simple 100-hour moving average.

A minimum has formed close to $ 112 and the price is currently consolidating losses. An initial resistance is close to $ 117 and the Fib retracement level is 23.6% of the recent decline from the high oscillating $ 132 to the low $ 112. More importantly, yesterday's main trend line is intact with resistance to $ 128 on the hourly chart of Eth / USD. If the price corrects higher in the short term, it may face sellers close to resistance levels of $ 118 and $ 121. The next resistance is Fibra's 50% retracement level of the recent decline from the $ 132 high to $ 112 swing. bass. To recover, the price must break $ 128, 100 SMA and the downtrend line.

Looking at the chart, the ETH price has moved into a bearish zone below $ 126 and $ 121 levels. There may be a short-term correction, but the price may meet sellers close to $ 121 and $ 128. On the flip side, the next key support is $ 106.

MACD time – The MACD is gaining ground in the bearish zone.

RSI timetable – The RSI is now positioned well below the level 40.

Main support level: $ 106

Main resistance level: $ 128

Source link