[ad_1]

Key points

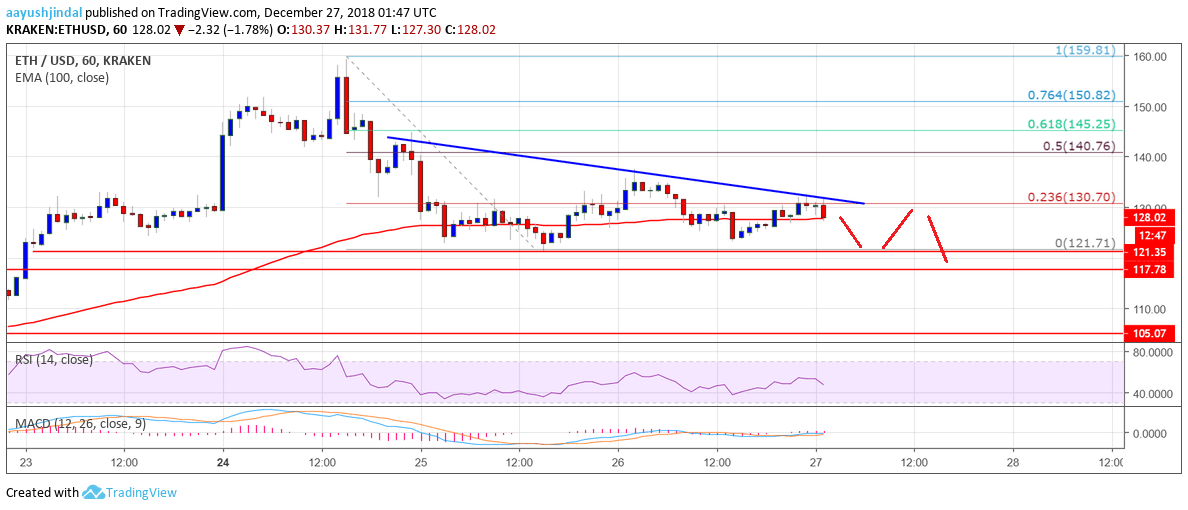

- The ETH price has recovered some points, but failed to cancel the resistances from $ 130 and $ 131 against the US dollar.

- There is a downtrend line in place with resistance to $ 130 on the hourly chart of ETH / USD (data feed via Kraken).

- The pair is likely to be close to $ 130 and may fall further in the short term.

The price of Ethereum is facing an uphill challenge against the US dollar and bitcoin. The ETH / USD could continue to face strong resistance near the $ 130 zone.

Price analysis of Ethereum

Recently, we have seen a minor upward correction above $ 130 in the ETH price compared to the US dollar. The ETH / USD pair also moved above the $ 134 level, but gains were limited. There was even a push above the Fib retracement level of 23.6% from the recent fall from the low of $ 160 to $ 121 low. However, the price struggled to overcome the resistance of $ 135 and subsequently decreased.

There was an interruption below the $ 126 level and the simple 100-hour moving average. However, the price remained above the $ 121 support and is currently consolidating losses. More importantly, there is a bearish trend line in place with resistance to $ 130 on the ETH / USD time chart. A break above the trendline and then $ 131 can push the price towards the resistance of $ 135. The main resistance is close to $ 140 and the Fibra retracement level to 50% of the recent decline from the $ 160 swing to $ 121. downs. On the downside, the $ 121 support area is very important. If there is a break below $ 121, the price could extend the downturns.

Looking at the chart, the ETH price seems to struggle to recover bullish momentum above $ 130 and $ 135. Therefore, there is a risk of a bearish break below $ 121.

MACD time – The MACD is slightly positioned in the bullish zone.

RSI timetable – The RSI is slowly moving towards level 50.

Main support level: $ 121

Main resistance level: $ 135

Source link