[ad_1]

Key points

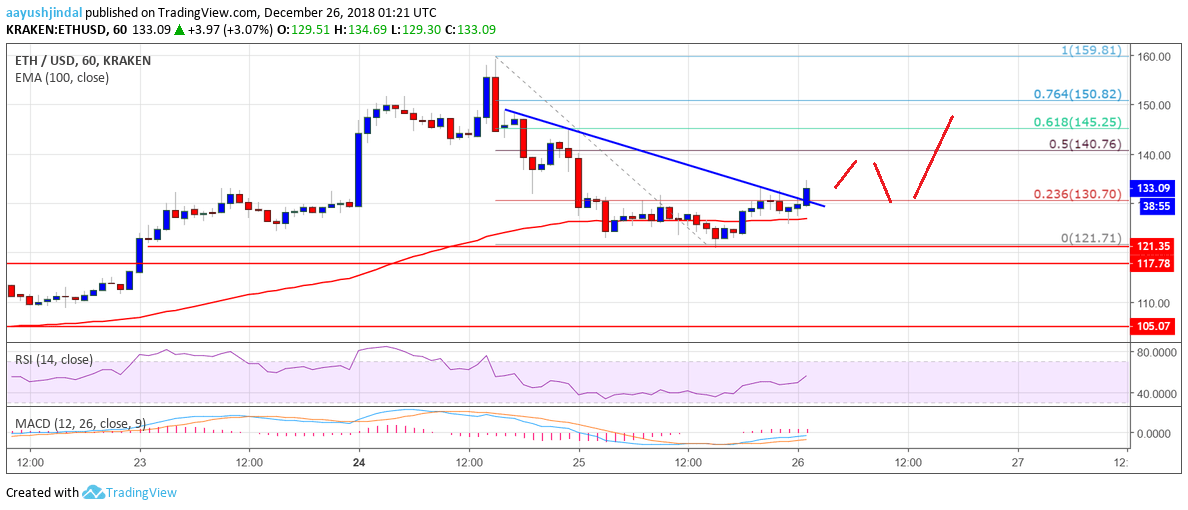

- The ETH price tested the $ 120-121 support area and began to consolidate against the US dollar.

- There was a break above a short-term bearish trend line with resistance to $ 130 on the hourly chart of Eth / USD (data feed via Kraken).

- The pair can trade in an interval for some time before a new raise to the $ 140 level.

The price of Ethereum holds important supports against the US dollar and bitcoin. The ETH / USD could resume its move upwards towards $ 140 or $ 142 in the short term.

Price analysis of Ethereum

Yesterday we discussed the possibilities of the ETH price to keep the average moving average of 100 hours compared to the US dollar. The ETH / USD pair corrected further down and tested the $ 120-121 support area. However, buyers were able to prevent losses of less than $ 121 and a simple 100-hour moving average. Low was formed at $ 121.71 and subsequently the price started trading in a range.

The price has dropped above the $ 130 level, with a positive angle. There was a break above the Fib retracement level of 23.6% from the last decline from $ 159 up to $ 121 down. Furthermore, there was a break above a short-term bearish trend line with resistance to $ 130 on the hourly chart of Eth / USD. It opened the door for further gains and the price could now trade towards $ 138 or $ 140. In addition, the 50% Fibra retracement level of the last decline from the $ 159 up to $ 121 is close to the level of $ 140. Therefore, if the price continues to rise, it could face a resistance near the levels of $ 140 or $ 142.

Looking at the chart, the ETH price holds the support of $ 121 and the 100-hour SMA. Therefore, there could be a decent upward move towards $ 140. The downside, if there is a downside break below $ 121, the price could fall to $ 112.

MACD time – The MACD is slowly moving into the bullish zone.

RSI timetable – The RSI is now placed above level 50.

Main support level: $ 121

Main resistance level: $ 140

Source link