[ad_1]

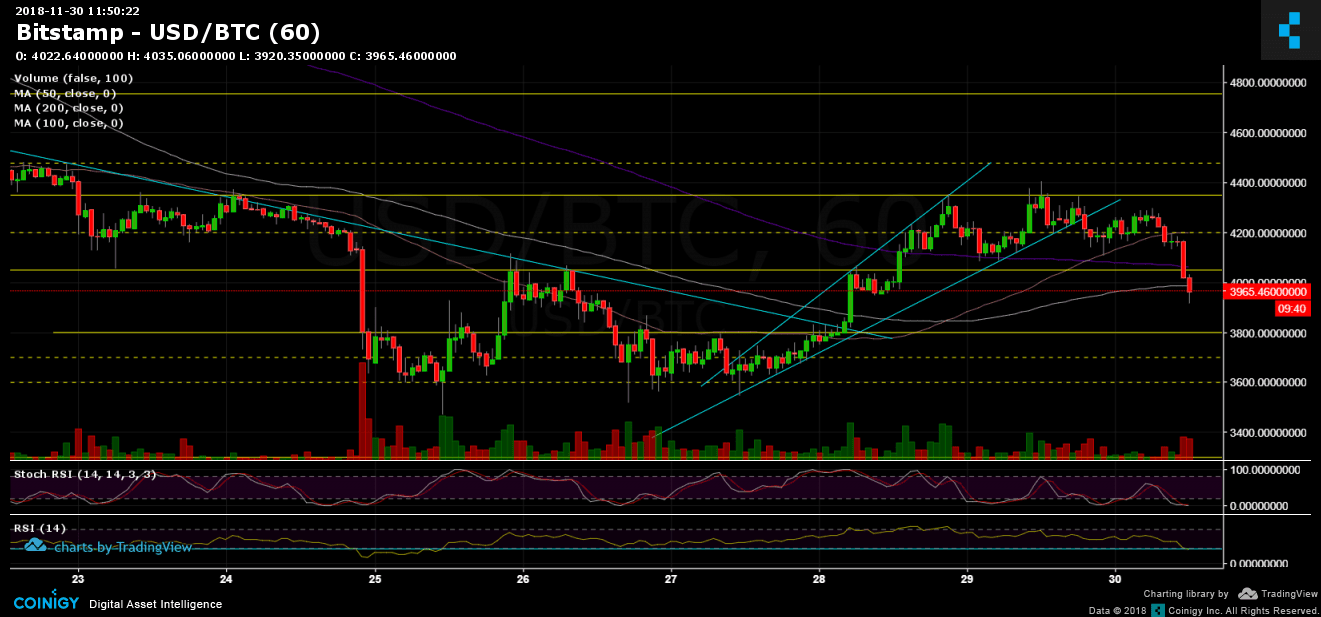

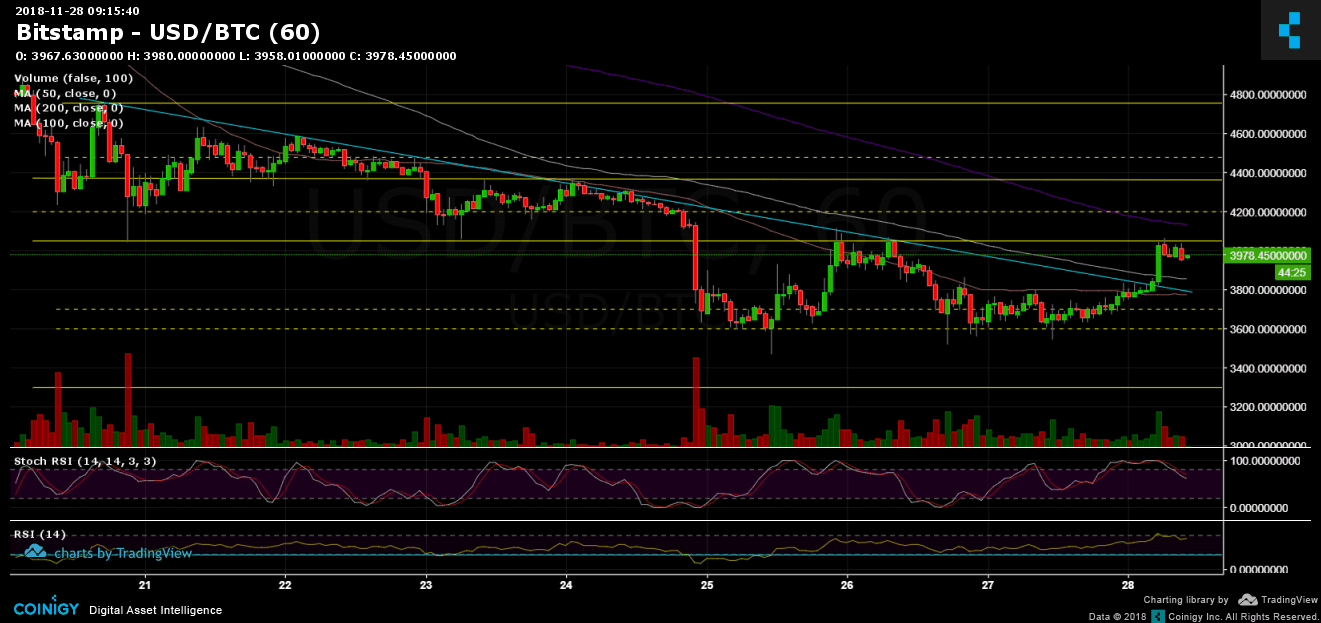

During the last week, we noticed an upward correction in the price of Bitcoin and the main altcoins. This strange move developed into a symmetrical triangular formation.

In case the above triangular formation breaks, it could send Bitcoin to the $ 4600 – $ 4800 range. On the other hand, if the symmetrical triangle breaks, then bitcoin will probably test the last lows around $ 3700.

There is also a possible model of reverse head and shoulders in development (graph at 1 hour and above). If this formation is resolved, then the market may have already found a short-term fund.

Return to Ethereum

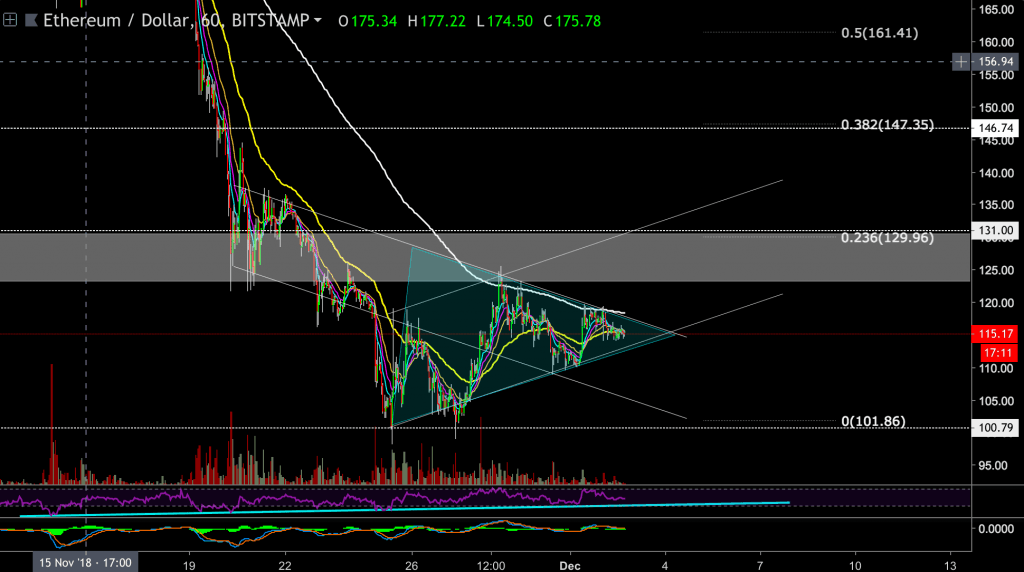

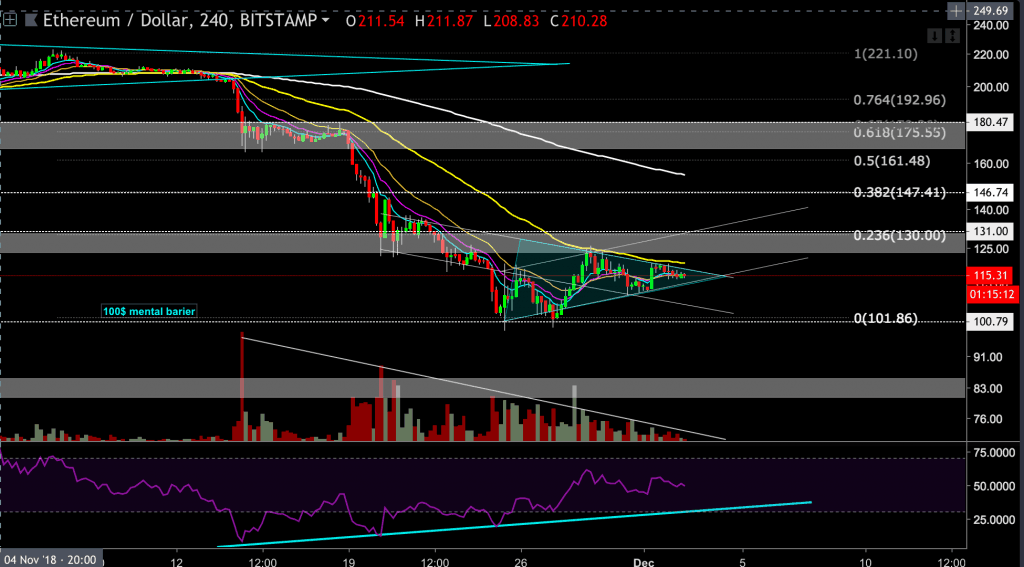

The Ethereum table follows the Bitcoin chart as expected. The current lateral motion could be seen as a symmetrical triangle, as well as the formation of inverted H & S.

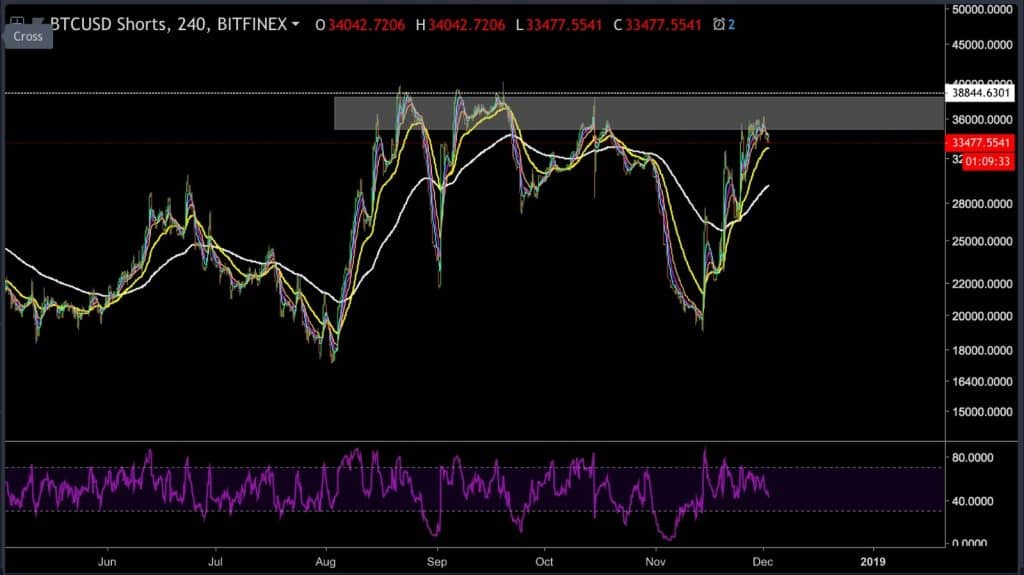

At the time of writing this, the short open positions on Bitfinex are in the area of 34,000. If we look at the history of recent months, this level of 35,000 – 40,000 was a typical level for short squeezing maneuvers.

In a scenario where there will be a short compression, the price of Bitcoin should increase dramatically. This move could reach the above goals or even higher.

Just like a reminder, a short squeeze refers to a situation where a price is pushed up intentionally to trigger stop-loss orders for bear short positions. To close these short orders, the bears need to reacquire the good that creates a rotating event that increases the price.

Looking at the 4-hour ETH chart

- Ethereum is currently trading at the price level of $ 115 and is consolidating below the resistance level $ 122- $ 130.

- If this type of triangular consolidation breaks and manages to overcome the resistance level of $ 122- $ 130, then ETH could try to reach the Fibonacci retracement level at 0.382 at the price level of $ 146.

- To achieve this goal, ETH will need a lot of volume and quantity of buyers, an impulse that is currently lacking in the market.

- On the other hand, if the bears regain control and the formation of the triangle breaks down, then the $ 100 level is probably the first short-term stage.

- The RSI indicator is still creating higher lows and is currently not within the oversold range.

Remember: these types of symmetrical consolidation formations can easily break on either side of the equation. So traders should be patient, protect their funds and always use stop-loss controls.

BitStamp ETH / USD 1 hour chart

BitStamp ETH / USD 4-hour chart

BitFinex BTC / USD Borts

TradingView cryptocurrency charts. Coinigy technical analysis tools.

CryptoPotato video channel

More news for you:

[ad_2]

Source link