[ad_1]

[ad_1]

Latest news about Litecoin

Inspired by the events that led to the launch of the Crypto Rally in December 2017, the Litecoin development team plans to implement the 0.17 litecoin core, in which the network tariffs will be reduced by a factor of 10. During the big Q3 race 2017, it was not unusual for network users to pay high commissions that at some point reached a peak of $ 1.

In theory, network commissions should be established by market participants and at the moment the cost set manually at 0.001LTC / kb, but this intervention by the development team is a sort of plan to counter the odds of increases in network once increases have increased and Litecoin uses tips.

In a network without adequate mitigation, congestion will lead to high commissions as miners become selective, accepting high tariffs from those who prefer quick transaction settlement.

At the same time, Litecoin plans to abandon the tariffs to remain competitive as a medium of exchange as they anticipate the downward market. As prices rise, the foundation will have a solid base for a tariff "with which they can grow proactively".

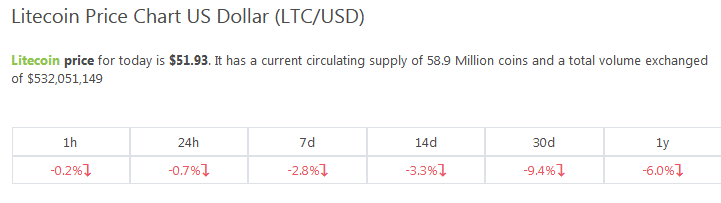

Litecoin LTC / USD price analysis

From coin pursuers, Litecoin is down 2.5% in the last week and flat in the daily chart.

Too much, there is not much we can draw from the LTC / USD price chart due to inactivity. Prices are literally going inside a $ 5 with caps at $ 55 and main support at $ 50.

Trend: bearish

A simple trend line linking the monthly highs reveals what is obvious: Litecoin is fighting bears. But even if the market is optimistic about earnings, it's a high order for the bulls because they not only need to cancel on October 11 but they also need to break and close the main resistance line at $ 70. $ 70 is an important resistance, a previous support line that marks the bear abatement model of early August. On the other hand, bears will probably confirm their presence if there is a merger of less than $ 50. In order for this to be true, we have to see an entire candle carrying volume with a volume of less than $ 50.

Volumes: Volumes Big Bear – exceeds that of the bulls of October 15th

Of concern is the relatively high market participation in October. While the outflow of the USD triggered a high market share on October 15, volumes were lower. In particular, the bulls have not gathered enough momentum to cancel the losses of October 11, which means that the bears have control from the point of view of the effort with respect to the result.

Candelabra formation: remote market

The LTC / USD chart was inactive due to a changing market. As mentioned above, the LTC / USD is moving within a range of $ 5 with minor caps at $ 55 and principal support at $ 50. As has been the case, the longer the consolidation, the stronger it is the breakout. After 10 months of lower lows, the market expects a revival, but could confirm the confirmation of the bears of October 11. This scenario will open the way for sellers who aim for $ 30 or less.

Conclusion

Trading with feelings will make you burn. This is the reason why despite all the hype and expectations, a contrarian move could be printed by lowering the LTC / USD pair. Therefore, as the market consolidates above $ 50, we suggest adopting a neutral approach and pending the trend that defines break outs above $ 55- $ 60 or below $ 50.

Graphs from the Trading view

This is not the investment advice and the opinions are those of the author. Do your research