[ad_1]

- ETH / USD is rangebound close to recent lows.

- The downside is the path of least resistance

ETH / USD is around $ 86.00, below the Asian minimum of $ 84.95. The third largest cryptocurrency remained relatively stable during the last hours of trading, while the market sought support after a long-term decline. Ethereum has lost more than 50% of its value in a recent month due to a combination of technical and speculative factors including the imminent update of Constantinopole and the huge sale of ETH by ICO projects.

Technically looking, ETH / USD is close to an unexplored territory. The only valid support was created from the minimum of the previous week to $ 82.15. Once broken, there will be little to stop the price up to $ 75.00 (Pivot Point 1 month Support 1) and to the long-term congestion zone at $ 60.00 which served as launch pad for the price in April 2017

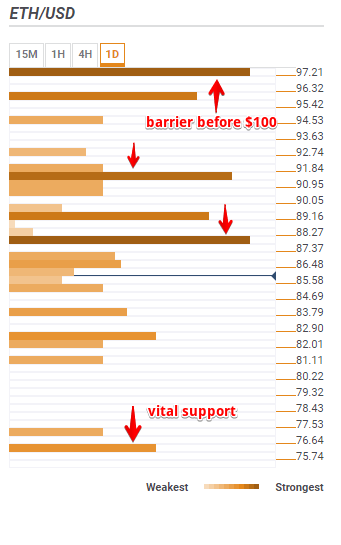

Immediately above the current price, the resistance area is created by the confluence of the technical indicators, which include the 38.2% retracement of Fibo Daily and SMA5, of 4 hours. Once deleted, the recovery can be extended to $ 90.00 charged with SMA10 at 4 hours, Bollinger Band at 4 hours on average and Fibo retracement at 61.8% per day. Another strong resistance is in the $ $ psychological approach $ 91.00 with SMA200 1 hour, SMA50 4 hours and 23.6% of weekly Fibo retracement.

However, the last barrier is seen above $ 97.20. It is created by 23.6% of Fibo retracement on a weekly basis and by a resistance Pivot Point of a day 3. This area separates us from the $ 100.00 hinge and represents the upper margin of a medium term channel.

ETH / USD 1D

Source link