[ad_1]

[ad_1]

<! –

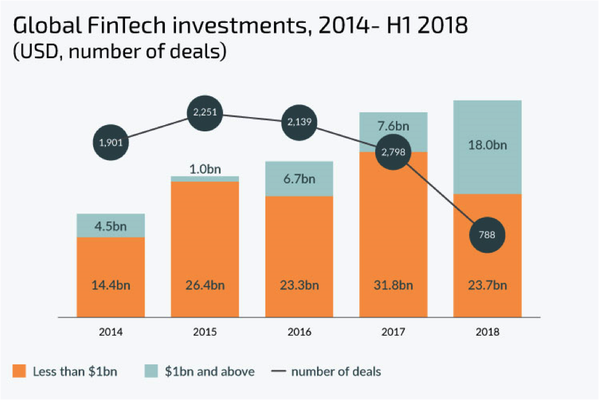

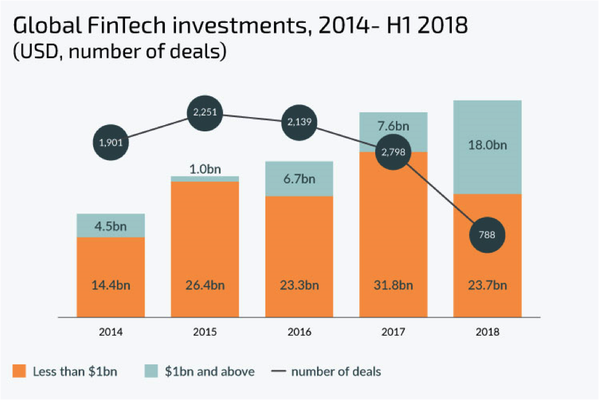

Fintech's global investments have increased in recent years and 2018 was no exception. The global FinTech sector raised $ 41.7 billion in the first half of 2018, exceeding the record total of last year.

We researched the fintech market, analyzed sources like Forbes, CBInsights and more, and found out which fintech apps attract the lion's share of investments. For the sake of clarity, we divided the fintech apps into 4 key areas of fintech development:

Investing, Wall Street

23 of the 50 best fintech startups on the Forbes Fintech 50 2018 list are investment platforms.

Investment platforms help their users manage and allocate their financial assets (stocks, stocks, mutual funds) and make well-founded investment decisions. In addition, they allow their users to verify the value of their resources in a convenient place and time. These platforms often use Data Science and Machine Learning algorithms to make better business decisions. A statistical model observes the news and translates the results into real-time models and dots that can drive up or down stock prices. Based on forecasts, it can sell, hold or buy shares.

Here are the top 3 investment platforms, according to Forbes:

1) Addepar

| categories | financing | Position |

|

Investing, data and analysis, Wall Street and Enterprise |

$ 215 m |

Mountain View, California

|

Cloud-based software that enables financial advisors to track and analyze all of a customer's assets and help them make more informed and informed investment decisions. Addepar has opened its own API and integrated its data mining software into Citco Fund Services, Salesforce, RedBlack Software and others. It is one of the leading investment platforms that allows gathering and aggregating data from different resources.

2) Symphony

| categories | financing | Position |

|

Investing, data and analysis, Wall Street and Enterprise |

$ 234 m | Palo Alto, California |

The investment platform allows traders and portfolio managers to exchange messages securely, share screens and conduct meetings without violating compliance rules. Provides secure access to over 100 financial applications.

3) kensho

| categories | financing | Position |

|

Investing, data and analysis, Wall Street and Enterprise |

$ 150 m | Cambridge, Massachusetts |

The platform exploits machine learning algorithms and a large database of historical records to analyze and predict how a given event, from a natural disaster to a political event, could increase or decrease the market price. Its mapping technology is now the foundation of over a dozen unique index products.

Loan platforms

Digital loan is one of the key directions for the development of fintech software.

P2P lending platforms enable fintech companies to automate and speed loan decision making and reduce costs. Machine learning is used to find subservient borrowers and provide more accurate credit scores, particularly for users with a limited credit history. The machine learning algorithms allow us to predict the reliability of a user. Banks and insurance companies have a large number of historical consumer data, so they can use these items to form models. In addition, they can use data sets produced by large public service or telecommunications companies.

4) Kabbage

| categories | financing | Position |

|

Loan, small business, data and analysis |

$ 500 M | Atlanta, Georgia |

The company provides financing directly to small businesses and consumers through an automated lending platform. If the loans are approved, many candidates receive money in as little as five minutes.

5) RateSetter

| categories | financing | Position |

|

Loan, consumers, small businesses |

$ 63.52 |

UK |

Ratesetter is a peer-to-peer loan service that allows its users to lend and borrow money directly from each other based on their interest rates. Since 2010, it has reached over 1.6 billion pounds in P2P loans and now has over 250,000 active customers.

The website allows you to invest a minimum amount of £ 10 and get loans up to £ 35,000 for individuals and up to £ 2 million for businesses.

6) Credit karma

| categories | financing | Position |

|

Investing, data and analysis, Wall Street and Enterprise |

$ 215 m |

Mountain View, California

|

The loan platform offers consumers free credit scores and credit monitoring, as well as, from 2017, free tax software and archiving. Use data on a consumer's finances to make personalized recommendations for credit cards and loans for which a candidate is likely to be approved by collecting reference commissions from the lenders.

Blockchain platforms

7) Coinbase

| categories | financing | Position |

|

Blockchain and Bitcoin, Investments, Consumers |

$ 217 m |

San Francisco, California

|

Coinbase is a digital currency exchange based in San Francisco, California. Trade in Bitcoin, Bitcoin Cash, Ethereum, Ethereum Classic and Litecoin with fiat currencies in around 32 countries and bitcoin and storage transactions in 190 countries around the world.

Payment platforms

8) Adyen

| categories | financing | Position |

| Payments, small businesses, consumers | $ 266 m |

Amsterdam

|

Adyen is a global payment company that allows companies to accept payments via mobile devices, e-commerce and points of sale. Adyen has over 3,500 customers. Adyen acts as a mediator with its payment processing platform, used by almost all Internet giants, including Facebook, Uber, Netflix and Spotify. He worked out $ 90 billion of transactions last year.

9) of the band

| categories | financing | Position |

| Payments, consumers, small businesses, Wall Street and Enterprise | $ 450 m |

San Francisco, California

|

Stripe allows users to receive payments over the Internet. Stripe provides the technical, anti-fraud and banking infrastructure necessary for the execution of online payment systems.

10) Transferwise

| categories | financing | Position |

|

Payments, consumers, small businesses |

$ 397 m |

London

|

TransferWise is a money transfer service. It allows you to send money abroad easily and quickly reducing costs. TransferWise estimates help users save $ 50 million in commissions on the $ 2 billion transfers made on its platform on a monthly basis. Last year he made international transfers available via Facebook Messenger.

11) Currencycloud

| categories | financing | Position |

|

Payments, remittances, small businesses |

$ 61 m |

London

|

Currencycloud is a cloud-based B2B platform that allows companies to make remittances, convert currencies, set beneficiaries and track reports in real time using the innovative Payment Engine. In 2017, GV, formerly Google Ventures, participated in a $ 25 million investment in Currencycloud.

Summary

Fintech is one of the hottest investment points. We selected 11 fintech apps (and divided them into categories, such as investments, payments, loans, blockchain and others) that attracted most of the investments and are the most popular among users. Most of them use data and analysis to make accurate forecasts, increase customer satisfaction and reduce costs.

Tetiana Boichenko, marketing manager at N-iX LLC. He worked for three years in technology companies writing about emerging technologies such as blockchain, AI / Machine Learning and their implications for the business, in particular focusing on the fintech domain.

->

Fintech's global investments have increased in recent years and 2018 was no exception. The global FinTech sector raised $ 41.7 billion in the first half of 2018, exceeding the record total of last year.

We researched the fintech market, analyzed sources like Forbes, CBInsights and more, and found out which fintech apps attract the lion's share of investments. For the sake of clarity, we divided the fintech apps into 4 key areas of fintech development:

Investing, Wall Street

23 of the 50 best fintech startups on the Forbes Fintech 50 2018 list are investment platforms.

Investment platforms help their users manage and allocate their financial assets (stocks, stocks, mutual funds) and make well-founded investment decisions. In addition, they allow their users to verify the value of their resources in a convenient place and time. These platforms often use Data Science and Machine Learning algorithms to make better business decisions. A statistical model observes the news and translates the results into real-time models and dots that can drive up or down stock prices. Based on forecasts, it can sell, hold or buy shares.

Source: Fintech Global

Here are the top 3 investment platforms, according to Forbes:

1) Addepar

| categories | financing | Position |

|

Investing, data and analysis, Wall Street and Enterprise |

$ 215 m |

Mountain View, California

|

Cloud-based software that enables financial advisors to track and analyze all of a customer's assets and help them make more informed and informed investment decisions. Addepar has opened its own API and integrated its data mining software into Citco Fund Services, Salesforce, RedBlack Software and others. It is one of the leading investment platforms that allows gathering and aggregating data from different resources.

2) Symphony

| categories | financing | Position |

|

Investing, data and analysis, Wall Street and Enterprise |

$ 234 m | Palo Alto, California |

The investment platform allows traders and portfolio managers to exchange messages securely, share screens and conduct meetings without violating compliance rules. Provides secure access to over 100 financial applications.

3) kensho

| categories | financing | Position |

|

Investing, data and analysis, Wall Street and Enterprise |

$ 150 m | Cambridge, Massachusetts |

The platform exploits machine learning algorithms and a large database of historical records to analyze and predict how a given event, from a natural disaster to a political event, could increase or decrease the market price. Its mapping technology is now the foundation of over a dozen unique index products.

Loan platforms

Digital loan is one of the key directions for the development of fintech software.

P2P lending platforms enable fintech companies to automate and speed loan decision making and reduce costs. Machine learning is used to find subservient borrowers and provide more accurate credit scores, particularly for users with a limited credit history. The machine learning algorithms allow us to predict the reliability of a user. Banks and insurance companies have a large number of historical consumer data, so they can use these items to form models. In addition, they can use data sets produced by large public service or telecommunications companies.

4) Kabbage

| categories | financing | Position |

|

Loan, small business, data and analysis |

$ 500 M | Atlanta, Georgia |

The company provides financing directly to small businesses and consumers through an automated lending platform. If the loans are approved, many candidates receive money in as little as five minutes.

5) RateSetter

| categories | financing | Position |

|

Loan, consumers, small businesses |

$ 63.52 |

UK |

Ratesetter is a peer-to-peer loan service that allows its users to lend and borrow money directly from each other based on their interest rates. Since 2010, it has reached over 1.6 billion pounds in P2P loans and now has over 250,000 active customers.

The website allows you to invest a minimum amount of £ 10 and get loans up to £ 35,000 for individuals and up to £ 2 million for businesses.

6) Credit karma

| categories | financing | Position |

|

Investing, data and analysis, Wall Street and Enterprise |

$ 215 m |

Mountain View, California

|

The loan platform offers consumers free credit scores and credit monitoring, as well as, from 2017, free tax software and archiving. Use data on a consumer's finances to make personalized recommendations for credit cards and loans for which a candidate is likely to be approved by collecting reference commissions from the lenders.

Blockchain platforms

7) Coinbase

| categories | financing | Position |

|

Blockchain and Bitcoin, Investments, Consumers |

$ 217 m |

San Francisco, California

|

Coinbase is a digital currency exchange based in San Francisco, California. Trade in Bitcoin, Bitcoin Cash, Ethereum, Ethereum Classic and Litecoin with fiat currencies in around 32 countries and bitcoin and storage transactions in 190 countries around the world.

Payment platforms

8) Adyen

| categories | financing | Position |

| Payments, small businesses, consumers | $ 266 m |

Amsterdam

|

Adyen is a global payment company that allows companies to accept payments via mobile devices, e-commerce and points of sale. Adyen has over 3,500 customers. Adyen acts as a mediator with its payment processing platform, used by almost all Internet giants, including Facebook, Uber, Netflix and Spotify. He worked out $ 90 billion of transactions last year.

9) of the band

| categories | financing | Position |

| Payments, consumers, small businesses, Wall Street and Enterprise | $ 450 m |

San Francisco, California

|

Stripe allows users to receive payments over the Internet. Stripe provides the technical, anti-fraud and banking infrastructure necessary for the execution of online payment systems.

10) Transferwise

| categories | financing | Position |

|

Payments, consumers, small businesses |

$ 397 m |

London

|

TransferWise is a money transfer service. It allows you to send money abroad easily and quickly reducing costs. TransferWise estimates help users save $ 50 million in commissions on the $ 2 billion transfers made on its platform on a monthly basis. Last year he made international transfers available via Facebook Messenger.

11) Currencycloud

| categories | financing | Position |

|

Payments, remittances, small businesses |

$ 61 m |

London

|

Currencycloud is a cloud-based B2B platform that allows companies to make remittances, convert currencies, set beneficiaries and track reports in real time using the innovative Payment Engine. In 2017, GV, formerly Google Ventures, participated in a $ 25 million investment in Currencycloud.

Summary

Fintech is one of the hottest investment points. We selected 11 fintech apps (and divided them into categories, such as investments, payments, loans, blockchain and others) that attracted most of the investments and are the most popular among users. Most of them use data and analysis to make accurate forecasts, increase customer satisfaction and reduce costs.

Tetiana Boichenko, marketing manager at N-iX LLC. He worked for three years in technology companies writing about emerging technologies such as blockchain, AI / Machine Learning and their implications for the business, in particular focusing on the fintech domain.

<! –

Bankers – Subscribe for free to the bank exchange!

->

[ad_2]Source link