[ad_1]

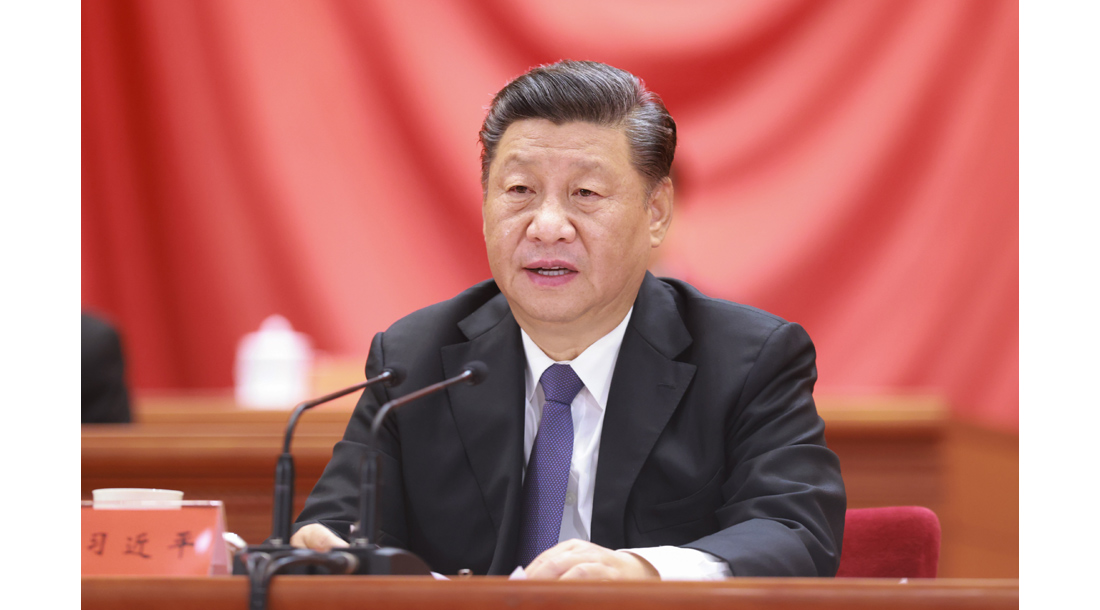

Ant Group’s listing was suddenly called a paper.Image: Republished by Beijing News

Ant Group was originally scheduled to go public on the Hong Kong and Shanghai stock exchanges on November 5th, but was suddenly called for a board two days before listing. Many senior executives, including Jack Ma, have been interviewed by the Chinese government. The outside world speculated that Ant’s postponement of the company’s listing was suppressed by the CCP. The Wall Street Journal reported on the 13th that it was Chinese President Xi Jinping who ordered the revocation of Ant’s listing; however, this is only one of the cases in which the Chinese government controls private companies. The news revealed today (14) that around 100 private companies in China have been “nationalized” since 2018.

According to the Nikkei report, the number of private companies “nationalized” by the Chinese government has risen from around 20 in 2018, around 30 in 2019, to 51 in 2020 this year, and around 100 private companies in three years. Companies have been brutally attacked by the government. The CCP’s crackdown on private companies in recent years has had an impact. In 2010, the return on equity (ROE) of listed companies in China was 13%, but in 2019 it remained only 7%. ROE was named by the CCP by Xi Jinping The recession after the general secretary is particularly evident.

One of the ways the Chinese government has extended its hands to private companies is by strengthening its control over private companies by investing capital. Some companies were exploited when the business was hit by the epidemic; some strategically important companies have been controlled by the government, such as semiconductors, wind power, pharmaceuticals and other fields, such as “SMIC” (SMIC), More than 60% of the capital is in the hands of a fund supported by the Chinese government.

Even if the Chinese government does not control a majority stake in a private company, government-backed capital can still control the company if it has a large percentage of voting rights. For example, in mid-September, 20% of the shares of the Chinese technology company “Simo Smart” was bought by the “Luoyang Guohong” fund backed by the city of Luoyang, Henan Province, but “Luoyang Guohong” owns 30% of the rights voting, which is equivalent to the real situation of Saimo. The controller effectively became the Henan Provincial SASAC (State Asset Supervision and Administration Commission).

However, if the Chinese government is unable to take control of a company with larger capital like Ant Group, it will go the other way.The countermeasures it adopts are tougher, including strengthening oversight, or simply blocking in this way. Listing plan.

Initially, Ant Group was supposed to go public on the Hong Kong and Shanghai stock exchanges on November 5th, but was suddenly called for a listing two days before listing. Many senior executives, including Jack Ma, have been interviewed by the Chinese government.

It is speculated that the postponement of Ant’s listing was due to the suppression by the CCP. The Wall Street Journal reported on the 13th that it was Chinese President Xi Jinping who ordered the suspension of Ant’s listing.

However, this is only one of the cases where the Chinese government controls private companies. Today’s Nikkei (14th) revealed that as of 2018 about 100 private companies in China are “state-owned”.

The Chinese government is increasingly suppressing private companies. (Schematic diagram) Image: Recovered from the Chinese government network

.

[ad_2]

Source link