[ad_1]

[ad_1]

CCN is expanding. Are you our next full-time journalist from the West Coast USA? Send us your CV and examples here.

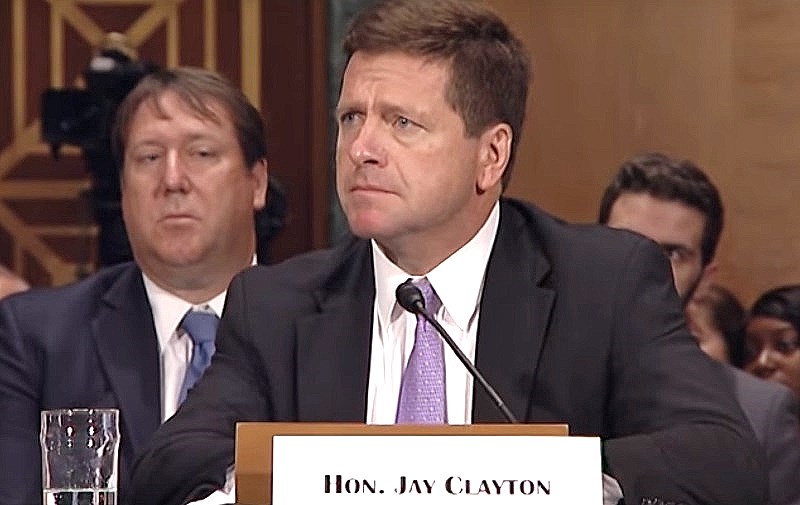

SEC Chairman Jay Clayton has claimed that bitcoin exchanges lack sufficient transparency and monitoring for the Bitcoin Exchange Traded Funds (ETFs).

According to CNBC, at the Consensus Invest Conference in New York City recently, Clayton said:

What investors expect to be trading in the commodity that underlies that ETF makes sense and is free from the risk of manipulation. I would be comfortable.

Clayton primarily feels that at Bitcoin ETF would be easily manipulated and that not enough safeguards are in place to prevent as much. Bitcoin as a whole.

Overall, the Bitcoin market is too much to be the object of the ETC, which would be a method of investing in the entire Bitcoin market without holding Bitcoin . After the Winklevii were denied their application for an ETF, they enlisted the help of Nasdaq to use its monitoring software on their own exchange.

Bitcoin ETFs, but for now there will not be any. Push push push regulated exchan exchan exchan exchan exchan exchan exchan exchan exchan exchan exchan them them them them them them them them them them them them them them them will will will will will will will will will will will will will will will will will will will will will will will will will will will vulnerable to mass manipulation.

The other issue is safe guardians of Bitcoin, which are seen as lacking as well. There are only a few actually regulated custodians on the market. Coinbase's recent launch of Coinbase Custody is an example, and it has been highly respected for its regulatory approvals. Clayton attributed his further unease to Bitcoin heists past and present:

We've seen some thefts around digital assets that make you scratch your head. We care that the underlying assets that ETF have good custody, and that they're not going to disappear.

In short, Bitcoin markets have to go before the SEC is going to allow anyone to offer Bitcoin ETF. Bitcoin market or simply adding Bitcoin to one's portfolio is a way off. There is still the option of the Bitcoin Investment Trust (GBTC), which enters a small amount of Bitcoin per share.

Featured image from Youtube.

Get Exclusive Crypto Analysis by Professional Traders and Investors on Hacked.com. Sign up now and get the first month for free. Click here.