[ad_1]

Navigator is up more than 5% on the stock market in its first session since it presented its third quarter results, which analysts at Caixabank BPI consider “comforting”. Although the financial sign released is considerably lower than the previous year, the company managed to recover compared to the second quarter, and decided to surprise its workers with bonuses and with the advance of some benefits.

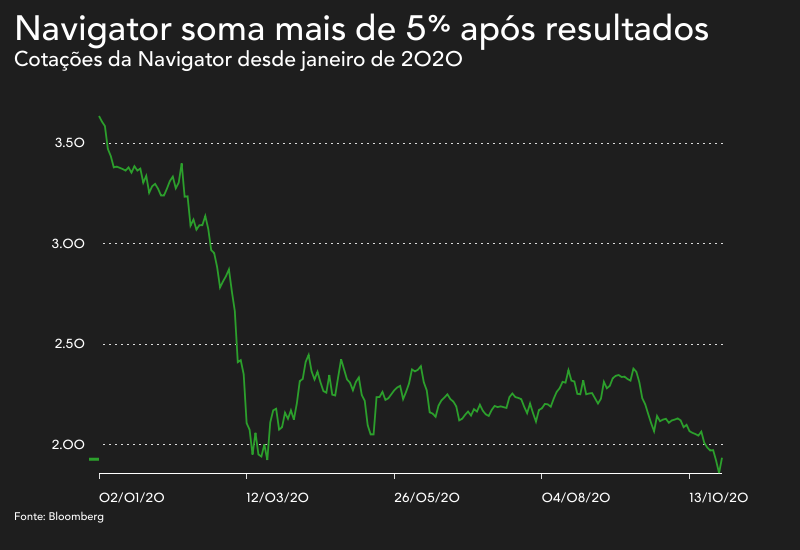

Navigator continues with a 4.52% rise to € 1,942, but has already added 5.49% to € 1.96. The rise allows the company to move away from the low of 2012 reached in the last session, following a long series of pauses. The appreciation gains more significance due to a session of steep declines in European markets and the Portuguese market, which trades in a five-month low.

The Navigator Company recorded a net profit of 75.2 million euros in the first nine months of this year, which shows a decrease of 49% compared to the 147.5 million presented in the same period in 2019. However, from the second to the Nel in the third quarter, the group recorded a recovery in business, with sales growth of 20% to 348 million euros and a net result of 31 million euros, up 133% compared to the previous quarter. A figure that far exceeds the estimates of CaixaBank BPI, which in the third quarter was aiming for 21 million in profits.

According to the note issued by the same investment house after the disclosure of the results, the surprising numbers derive from “margins higher than expected”, combined with the umpteenth “strong debt reduction”. The increase in margins is related to a reduction in fixed costs of 30 million euros, which is part of the company’s promise to cut these costs by 46 million by the end of the year.

Against this backdrop, “we see value in this stock and a comforting presentation of the results can support the share price,” analysts say. However, they point out that UWF paper prices “remain in a negative trend and uncertainty remains high, which should lead to volatility in the share price.” The investment firm itself therefore defends “a bit of caution” taking into account the uncertainties raised by the evolution of the covid-19 pandemic, but signals a “propensity for positive ground in this phase”.

Parallel to the showdown to the investors, the trash can also find “space” to address the workers, and on the same day announced that they will receive the Christmas bonus upfront, as well as other benefits that include unpaid vacation payments, accumulated leave, and an “extraordinary bonus,” in an operation whose total amount exceeds € 10 million, according to the company.

This Wednesday, the paper holder stands out in the green, taking the lead in the climbs and accompanied by peers in the sector, Others and Semapa, who add 0.68% and 1.98% respectively. This, on a day when negative sentiment reigns among European markets, accusing concern over the growing restrictions that the second wave of the pandemic is imposing.

.

[ad_2]

Source link